Why We Shouldn’t Panic about the Changing Market

Weekly Real Estate Market Update with Leigh Martinuzzi MPG

The property market has been impacted by the recent interest rate hikes! Prices have dropped -7.2% in the last 12 months. The total value of Australian property has dipped from close to $10 trillion last year, down to about $9.2 trillion. The RBA has now raised the cash rate at 3.35%, which means the average mortgage repayments have increased again. For a mortgage of $500,000, the impact of the last nine rate rises looks like this: $943 in additional monthly repayments of $11,556 in additional annual repayments. We know that while inflation appears to be easing, it’s still a long way from RBA’s target of 2% to 3%, which is why they are suggesting it will rise a few more times and sit around 4%. For the 2023 financial year, experts predict prices will drop by 13% over that period and a further 7% to 10% by the end of this year. This means if you bought a property for $1M last June, by mid-2023, it may be worth $870,000. Of course, these are averages across the country, and there are a few why we shouldn’t panic.

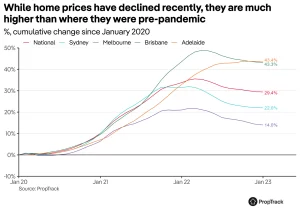

My first thought is one of the total property values to total debt. With Australia’s property values to have a said worth of $9.2 trillion and debt of $2.2 trillion, we have a 24% loan-to-value ratio. This is, on all accounts, relatively safe. Although this is based on averages it still shows us that there is a great deal of wealth in property and the Aussie economy. I believe property wealth stimulates future property wealth. We also can see that prices in Australia rose dramatically since the onset of the pandemic and have only fallen marginally in comparison (see chart below). Anyone that purchased within the peak of the market, i.e., late 2021 or early 2022, will have likely seen their property value fallen below their purchase price. To put this in perspective, there were approximately 140,000 homes sold in the period of Jan to March 2022, which represents a small, 1.3% of Australia’s 10.7 million homes. If the cash rate doesn’t rise above 4%, I don’t envision there will be too many distressed sales in which case this means prices will likely remain firm. Also, most people who bought at the peak of the market are likely holding for the long term, so by the time they do sell, prices would have likely risen again.

Over the last six months, we’ve experienced fewer homes coming to the market for sale and a great deal fewer homes transacting. There were 500,550 homes sold over the 12 months to January 2023, which is down -19.1% on the previous year. New listings over the last four weeks were -22% below the five-year average. During periods of economic uncertainty, many people hold off on the major financial decision, i.e., buying or selling property. However, the world doesn’t stop! People still need a place to live and people will still make moves due to a change in circumstances. Therefore, while there have been many holding back from buying and selling, I believe, this pent-up demand will pop soon, and we will see a flurry of activity. And, if this aligns with easing interest rate rises, we may see prices even climb slightly. On top of this, demand from international migration is sure to increase as the gates into Australia are now well and truly open.

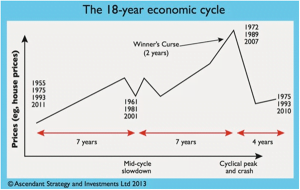

And for those who like a little optimism, we can also raise the conversation about the 18.6 property cycles (see chart below). This theory states that property prices move in waves of 18.6 years with an average of 14 years of growth, with slight corrections in the middle 7 years, and then 4 years down. Some suggest that these charts are a guide at best and that we are already at the start of our 4-year downward trend. Those who are convinced that these historic trends will continue, suggest we still have a few more years of growth yet. We may see property prices rise even further all the way up until 2025/2026 before we reach our next recession. If this is the case, now is a fantastic opportunity to put our money into assets and invest in property.

The risk of a recession is a true reason to worry about further property price falls and distressed sales. This happened overnight back in 2008 when the GFC was announced. This time around, while a recession may be on the cards, most economic signs aren’t supporting this. Unemployment is at a record low and staff across most industries are hard to find, which means job security is high. There seems to still be a great deal of inflation despite recent rate rises, and on all accounts the economy remains strong. In the short-term, we may experience more property market corrections and stabilisation, but in the medium, to long-term the outlook from my perspective doesn’t seem so bad.

AUCTION CLEARANCE RATES

- Queensland – 50% (177/977)

- NSW – 62% (674/1386)

- Victoria – 60% (548/949)

- ACT – 56% (85/75)

- South Australia – 76% (80/328)

- Tasmania – 50% (2/165)

- Western Australia – 21% (14/631)

- Northern Territory – NA (1/24)

*(Auctions/Private Sales)

REVIEW(S) OF THE WEEK

We couldn’t be happier with our experience and the outcome of selling our place. Leigh has such vast local knowledge and is truly invested in the local area, his track record speaks for itself, so choosing him was a no-brainer. He set clear expectations from the start, which were also in line with our selling goal. The whole process, including communication, marketing, inspections etc was straightforward and stress-free. Overall, we were thrilled with a quick sale at the price we wanted. – Seller