Why There Won’t Be a Market Crash

Weekly Real Estate Market Update with Leigh Martinuzzi MPG

There are some headlines and experts talking of a massive market crash. Prices will drop by up to and maybe beyond 30%, at least this is what they’re telling us. On top of this, there are fears of rising inflation and the incredibly fast increase in the Australian cash rate. Something must be done to slow the economy and the rapid increase of dwelling prices across Australia that marked 2021. The RBA has now acted, perhaps a little late, and combined with the fear-mongering, consumer sentiment is at an all-time low. However, I for one, Mr Optimistic, don’t believe there will be a massive market crash. Yes, the booming market that was 2021 has passed, and the market needs correcting, but there won’t be a “crash.”

Firstly, the cash rate is now 1.85% and it’s expected to see the likes of 2.5% to 3.5% by mid-next year. When the inflation starts to slow it will likely see the RBA pull back on further rate rise and maybe even see them reverse it slightly. We might see a cash rate at the end of 2023 somewhere around 3%. The pre-covid cash rate decade average sits at 2.56%, and the property market cruised along quite comfortably back then. Therefore, I think households will be able to handle the similar cash rate moving forward without the need for property prices to fall off the cliff.

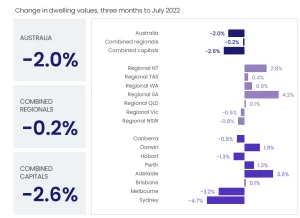

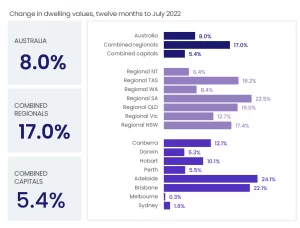

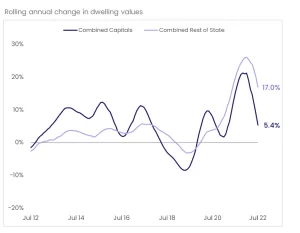

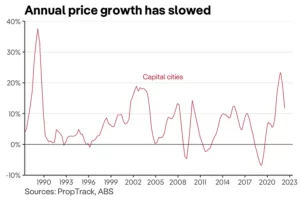

Nationally, since around February 2022, we have seen dwelling prices fall, and in some areas, falls have been sharper and quick. Sydney prices were down by -4.7% in the 3 months to July however at their peak in 2021 prices rose by upwards of 30%. Also, noticed more so in Sydney, new properties listed for sale are well up compared to most other areas. This will naturally have a lowering effect on prices, giving buyers more choice and more room to negotiate. In other areas, prices haven’t fallen so dramatically (see charts below). In the 12 months to July regional prices are still up 17% compared to combined capital prices, up by 8%. The optimistic forecast suggests a -6% correction for Sydney prices, while Brisbane may see prices finish the year up 11%.

Locally, we’ve seen buyer numbers ease and the time that it’s taking to sell homes longer, however, this is not unusual. During the booming market, the average time on the market in Palmwoods, for example, was as low as 11 days, this is now up to approximately 23 days and climbing. I remember a few years ago the average time was closer to 60 days. Across Australia, the average time on the market has risen to 32 days (see chart below). And although properties are sitting on the market for longer, there is still a shortage of good properties for buyers to choose from.

The property market just doesn’t stop. For a crash to happen, more people need to be forced to sell and there needs to be little to no buyers in the market. This is unlikely. Firstly, international immigration is picking up pace, which will improve buyers’ demand. Secondly, there are more properties coming up for sale in our southern markets, so naturally, sellers become buyers, which should also stimulate demand. And finally, new dwelling approvals are low, with fewer properties being built in the next couple of years. Yes, buyers are holding back right now with all this uncertainty, but soon, I expect by Spring, we will see market conditions return to a pre-covid pace.

The government, politicians and the RBA don’t want the economy to stop. The reason being is that 57% of Australia’s wealth is tied up in the property sector. If the property market stops, the economy stops! More reason why the RBA needs to be careful about how the tackle cash rate rises and inflation moving forward. Have a look at the chart below. Australian real estate is worth $9.8 trillion, and of that, 21% is tied up in debt. Property values grew by a bit over $2 trillion in 2021. I think it’s safe to say that we can handle a slight interest rate rise. Household wealth remains strong, and I don’t think many people will be forced to sell. There would have to be a lack of job opportunities for that to happen and right now Australia and record low unemployment rates and a lack of workers.

Prices rise and fall, and markets move through cycles. We’ve come out of a booming market and now hitting stagnation; however, nothing is permanent. Auction clearance rates improved last week despite the increased number of properties for sale. This may be an indication that we are nearing the bottom of the market before activities start to pump along like it was pre-covid. Making it a more pleasing market for buyers while good opportunities still remain for sellers.

AUCTION CLEARANCE RATES – WEEK ENDING 14TH OF AUGUST 2022

- Queensland – 33% (232/1083)

- NSW – 50% (770/1389)

- Victoria – 57% (608/1096)

- ACT – 56% (82/86)

- South Australia – 62% (112/320)

- Tasmania – 100% (1/131)

- Western Australia – 30% (10/726)

- Northern Territory – 100% (1/32)

*(Auctions/Private Sales)

REVIEW(s) OF THE WEEK

Easy to talk to

Leigh was very knowledgeable about the median pricing in our area and got us a very good result. – Woombye Seller

Professional, Helpful and Supportive

I found Leigh to be very professional and efficient. I was very nervous selling my house as I am 84 years old and not really expecting to move, but Leigh was most helpful and supportive through the whole process. I cannot recommend his services highly enough. – Palmwoods Seller