Why Sunshine Coast Buyer Demand Is Holding Firm After the Rate Rise

By Leigh Martinuzzi | Martinuzzi Property Group – eXp Australia

If you only followed the headlines after the latest rate rise, you’d think the market should be falling everywhere, all at once. But the data and what we’re seeing on the ground point to something more nuanced.

Demand hasn’t disappeared at all. It has lifted again, and it is being fuelled by record levels of borrowing and demand boosting policy, at the exact same time supply is still constrained. That combination is why prices can remain supported even when rates rise, and why different markets can behave very differently under the same interest rate settings.

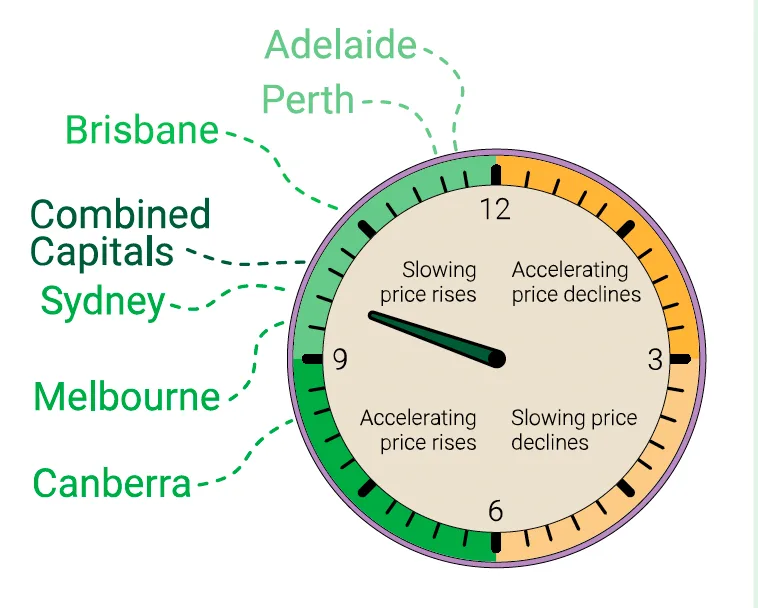

Same rates, different outcomes

One of the most persistent myths in property is that interest rates set prices nationally. They influence borrowing capacity and confidence, but they do not dictate outcomes suburb by suburb. Housing markets are structural, local and fragmented. That’s why smaller capitals have been outperforming the bigger ones at different points, and why “one Australia” forecasts usually miss what matters most.

The markets that keep performing tend to have multiple fundamentals moving together. Population growth matters, but it has to be meaningful in real numbers. Employment growth matters too, but it’s the creation of durable local jobs, not just a short tourism pop or a one off project. Real wages matter once inflation is stripped out, because rising incomes are what allow buyers to absorb higher prices without stalling.

Supply is the other side of the equation, and it shows up everywhere. Tight resale stock, low vacancy rates, and limited new housing coming out of the ground all support pricing. Approvals matter, but commencements matter more, because what gets built is what changes supply. Construction costs and feasibility issues also matter, because even when approvals exist, projects don’t always stack up.

On top of that, demographics shape demand quality. Downsizers can lift prices, but sustained growth needs younger buyers, upgraders, and ongoing churn. Even things like school catchments can create micro markets that outperform the suburb around them.

That’s the structural lens I look through first, because it explains why the Sunshine Coast moves the way it does.

The shock stat is the debt, not the demand

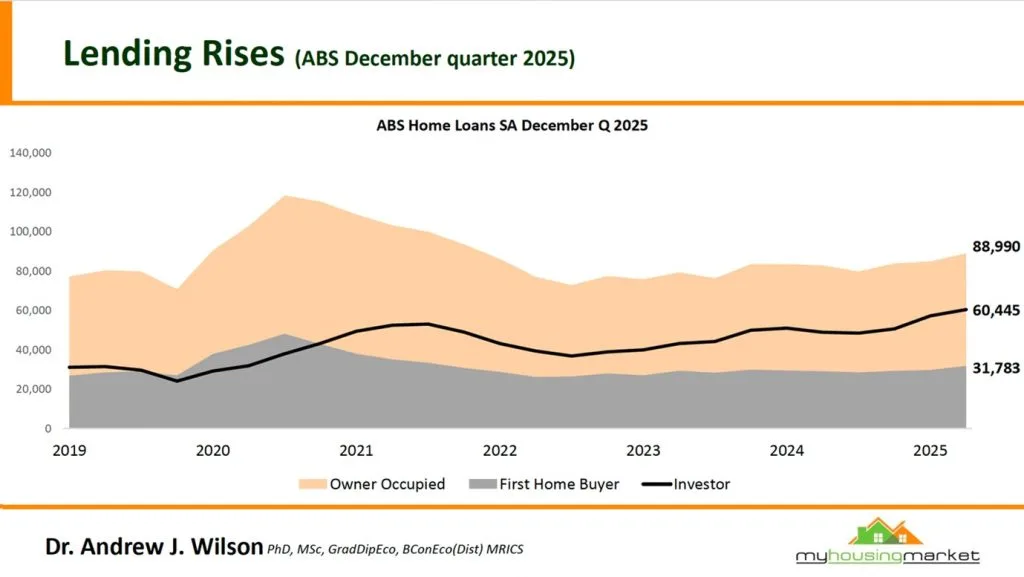

The lending figures paint a clear picture. Buyers were leaning back in late last year. Total home loan commitments rose strongly, and both first home buyers and investors increased activity. First home buyer numbers lifted by 6.8% in the quarter, and the value of first home buyer lending jumped 15.5% to $19.3 billion, with 31,783 loans written. Across the wider market, total home loan commitments rose 5.1% in the quarter and were up 13.4% over the year.

But the standout detail is what it’s costing to compete.

The average new owner occupier loan size has hit a record around $736,000, and it jumped about $42,000 in a single quarter. That’s not the property price. That’s the debt people are agreeing to carry.

This is the “wait what?” moment because it reframes the conversation. It’s not simply “rates up, prices down.” It becomes “buyers are back, but they’re borrowing more than ever to compete for limited stock.”

Government backed entry settings are part of this story. Incentives and guarantees improve access for first home buyers, but they do not add supply. When more buyers enter a constrained market, the pressure usually shows up in prices and loan sizes, especially in the entry and mid tier segments.

Investors are lifting, refinancing is booming, supply is still tight

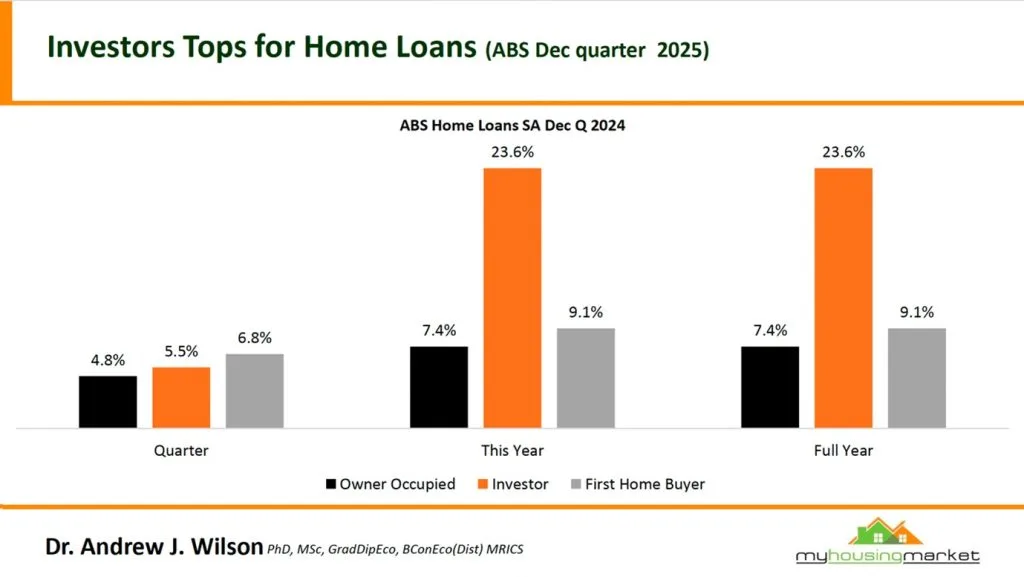

Investor lending has lifted again, and it’s a meaningful signal. Investors tend to move when they believe the long term drivers outweigh short term noise. In the data you shared, investor lending hit a record around $43 billion in the quarter, up 7.9%. Total new mortgage commitments hit a record $108.3 billion.

Refinancing also surged to record highs, around $68.4 billion in the quarter. That tells you households are actively managing debt. In a higher rate environment, that often looks like switching lenders, restructuring, and hunting for sharper pricing. It’s one reason markets often slow down through behaviour first, not through an instant collapse in values.

On the supply side, the pressure remains obvious. Building approvals have been volatile, and the more recent numbers point to ongoing weakness where we need new homes most. In December, approvals fell 13.8% after a rise in November. Apartment approvals fell 29.8%, while house approvals were only up 0.4%. Longer term, approvals are well below their previous highs, with house approvals down 26% since the 2016 peak and apartment approvals down 41% from the 2016 boom. That keeps the future pipeline tight, and that supports both rents and prices.

Even the more “in time” market indicators aren’t screaming panic. Auction conditions have been holding up, with a national clearance rate around 69% for the week mentioned, above the same period last year. Sydney was around 73.9% on heavy volume, and Melbourne around 69.5%. That’s not a market falling apart. That’s a market with buyer depth, even as costs rise.

What the forecasts are really saying for 2026

The most realistic outlook for 2026 is not a uniform boom or a uniform bust. It’s solid but uneven growth, with widening gaps between top performing and underperforming suburbs and property types.

The thinking behind that is straightforward. Interest rates may stay higher for longer, which caps borrowing power and changes buyer behaviour. But demand drivers remain strong. Population growth is still doing heavy lifting. More first home buyers are entering via incentives. Equity rich downsizers remain active. Investor appetite is rebuilding as rents keep pushing higher and vacancy stays tight. Meanwhile the supply shortage hasn’t been resolved and the new build pipeline remains constrained by costs, labour, and feasibility.

National indices are still reporting growth. One index reported national values up 0.8% in January after 0.6% in December. Another reported national home prices up 8.8% over 2025, pushing values to new records, even as growth cooled in December.

There’s also a clear shift happening within markets as affordability bites. Units performed better through parts of 2025, and the logic is simple. When borrowing capacity is capped, more buyers trade backyards for balconies and courtyards. That doesn’t make units “the answer” everywhere, but it does mean well located, family friendly apartments in lifestyle areas can become more attractive, especially when they’re priced below replacement cost.

The common thread through all of this is fragmentation. Quality and location matter more, not less, in this kind of cycle.

What this means on the Sunshine Coast

On the Sunshine Coast, these themes play out in a very local way. We are a set of micro markets, and not every pocket behaves the same.

What I’m consistently seeing is buyers becoming more deliberate, not disappearing. They’re comparing more, negotiating more, and being less forgiving on compromises. Entry level demand remains very strong, and investor enquiry has picked up noticeably.

Rates rising tends to pause behaviour, but it pauses sellers too. When some owners hold off listing, the pool of available stock can tighten quickly, and that’s one reason prices can stay firm even after a rate rise, especially for well located, well presented homes with strong owner occupier appeal.

If you take one message from this update, it’s this. The market is being driven less by the cash rate and more by the collision of demand and limited supply, with record debt levels now doing a lot of the heavy lifting. That’s why outcomes will stay fragmented, and why strategy and property selection matter more than trying to time the next headline.

What this means for buyers, sellers, and investors

If you’re a buyer, the big takeaway is that demand hasn’t vanished, but behaviour has changed. Buyers are more budget conscious, more selective, and more likely to negotiate harder. The opportunity is that some competitors sit on the sidelines after a rate move, so if you’re finance ready and clear on your numbers, you can sometimes buy well. The trap is stretching too far because the new “normal” loan sizes are huge, and small rate changes hurt more when the debt is larger.

If you’re a seller, this market still rewards quality and clarity. Buyers are active, but they’re less forgiving. Presentation matters more, pricing strategy matters more, and the campaign has to create confidence. If a home is well positioned, well marketed, and priced correctly, it can still attract strong competition. If it’s overpriced or under presented, it will sit and invite negotiation.

If you’re an investor, the story is still supply and rents. Investor lending lifting again suggests many are positioning for continued undersupply and rental pressure. But selection matters more than ever. Not every pocket performs the same, and not every property will attract the same tenant demand. The safer approach in this environment is focusing on scarce, well located assets with strong owner occupier appeal, because those tend to hold up best across cycles.

Final Thoughts

If you’re waiting for a neat, simple market signal, you might be waiting a while. The most practical way to read the current cycle is to focus on what actually moves prices: buyer capacity, buyer confidence, and available stock.

Right now, demand is still present, loan sizes are doing more of the heavy lifting than many realise, and supply remains the pressure point. That’s why good homes in good pockets can still attract strong competition, and why the “best and rest” gap keeps widening.

If you’re thinking of making a move this year, the winners won’t be the people who predict the next rate decision perfectly. It’ll be the people who plan clearly, price correctly, and act with confidence when the right opportunity shows up.

At Martinuzzi Property Group, we’re here to make property decisions feel clear, calm, and well informed, even when the market is noisy. You’ll get honest advice, exceptional communication, and a stress free selling experience, delivered through proactive service and outstanding results. It’s what we’re known for, and it’s how we operate every week with our clients across the Sunshine Coast.

If you’d like a clear plan for your next move, reach out anytime!

Request Your Free Market Appraisal Today! 👉 Click here to book your appraisal

SUBSCRIBE to stay updated with all latest property insights and news 👉 Click Here to Subscribe

The Sunshine Coast Seller’s Guide to Choosing the Right Agent 👉 Get Your Free Guide Here

Preparing for Settlement: A Seller’s Guide to a Smooth Handover 👉 Download the Guide Here