What We Can Expect in The First Half of 2023

Weekly Real Estate Market Update with Leigh Martinuzzi MPG

The property market here on the Sunshine Coast and across Australia is expected to remain slow for the first few months of the year. The main reason is the remaining uncertainty of where the cash rate will peak. While currently at 3.1% currently, we do expect a few more rises early this year. The market expectations for the peak rate are somewhere from 3.6% to 4%. For a mortgage of $750,000, owners are already paying $1,135 more than they were at the start of the year when the cash rate was 0.1%.

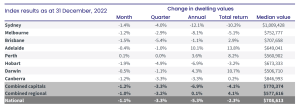

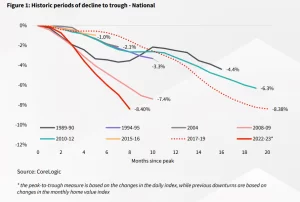

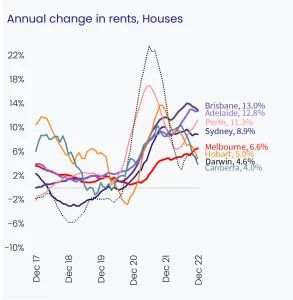

The sharp decline in national property prices of -8.4% annually to January 2023 can be attributed to the rapid cash rate rise that occurred throughout 2023. If you look at the increase in mortgage rates most people that are seeking to purchase have a now reduced borrowing capacity and property prices remain high, which puts purchasing out of reach for many. This will place further pressure on the rental market and may see asking rents increase some more.

The other concern that we expect to see happen this year is that many people who bought and fixed their interest rates at the lower rate will come out of their fixed rate period this year. The RBA noted that approximately 35% of all home loans are on fixed terms, and two-thirds of these are set to expire this year. This means they can expect their home loan rate to suddenly increase from 3% to 4% and may push some homeowners into mortgage stress. APPRA introduced a mortgage buffer of 3%, which will protect most but further increases in the cash rate won’t help. It is expected that consumer spending will worsen, and inflation will slow, which is what the RBA is hopeful for happening.

We also know that the house debt to income ratio is the highest it’s ever been, currently at 188.5%. A decade ago, this was 162%, and in 2002 it was at 130.2%. This gives further reason to expect many property owners will have to tighten their spending and consequently slow economic growth further. During the booming market of 2021, there were a massive 619,531 transactions encouraged by incredibly low-interest rates. This was the highest volume of sales in 18 years. Naturally, this can’t last forever, and we can expect the market to balance out.

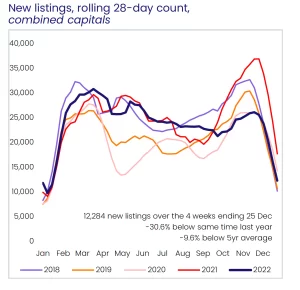

It may sound all doom and gloom, but I think it’s far from it. Yes, we can expect a slowing pace and lowering prices, however, prices are still well above where they were two years ago. We have also seen a huge reduction in the number of properties for sale that will mean less choices for buyers. Of course, this could change in the lead up to Easter as typically at this time of year we see an influx of properties coming up for sale. For A-grade properties, we are still experiencing good sale prices and quick timeframes. For all your property needs, please call me if I can assist.

AUCTION CLEARANCE RATES

- Queensland – 25% (4/640)

- NSW – 50% (6/191)

- Victoria – 25% (4/386)

- ACT – NA (0/3)

- South Australia – 40% (5/163)

- Tasmania – NA (0/66)

- Western Australia – NA (1/464)

- Northern Territory – NA (0/9)

*(Auctions/Private Sales)

REVIEW(S) OF THE WEEK

Great communication throughout the whole process.

Leigh was honest and open about our home’s potential and didn’t give us any unrealistic expectations or the usual ‘sales pitch’. He stayed in touch with us throughout the whole process and gave us very regular updates. He did all the leg work, calling, following up, and asking the right questions to potential buyers until he found us the right buyer. He made sure we were never out of the loop and kept all parties communicating effectively. Very happy. – Seller