Weekly Market Update: Key Insights & Trends with Leigh Martinuzzi MPG

REA Group recently conducted a survey to shed light on the factors that have held homeowners back from selling their properties in recent months. The findings offer valuable insights into the current real estate market trends.

At the forefront of these reasons is market uncertainty, which was cited by 36% of homeowners as the primary cause for their hesitancy to sell. Following closely behind, 25% of respondents expressed a simple lack of desire to move, and 24% attributed to price expectations not aligning with the current market. It’s noteworthy that despite approximately 1 million property owners expressing the desire to sell, only 1 in 4 have proceeded with a sale.

The prevailing sentiment among experts is that interest rates have either reached their peak or are very near it. This newfound confidence in the market has prompted many homeowners to finally list their homes for sale. However, it’s important to note that this surge in listings is not uniform across the country. Cities like Sydney, Canberra, Melbourne, and Hobart have reported an unexpectedly high number of new properties hitting the market. On the contrary, areas like the Sunshine Coast have not yet witnessed this trend, while Perth grapples with record-low stock levels.

To provide you with a glimpse of future prospects, we’ve included a dwelling price forecast from PropTrack. Predicting market behaviour for the remainder of this year and the next is indeed challenging. However, industry insiders largely anticipate a robust spring selling season with a substantial increase in homes being listed. While this might put downward pressure on prices due to increased buyer choice and negotiation room, it could also spark a competitive frenzy among buyers. With interest rates stabilising and prices on an upward trajectory, buyers are likely to act promptly to avoid missing out on future appreciation.

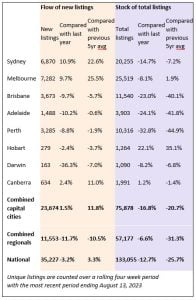

Tim Lawless of CoreLogic recently analysed new listings and total listings compared to historical averages. Typically, new listings dip during the autumn to winter season by an average of 5.2%, followed by a 9.8% rise between winter and spring. This year, however, new listings have defied the norm, surging by an impressive 13.2%, largely attributed to rising property values and growing seller confidence. It’s worth noting that these figures are based on pre-COVID five-year averages. And this trend is not consistent nationwide. New listings in our combined capital cities have risen by a modest 1.5% year-on-year, which may seem insufficient given the increasing demand for properties.

For instance, in Brisbane, new listings have seen a decline of -5.7% compared to the previous five-year average and -9.7% compared to the same period last year. Total listings paint an even more concerning picture, with a -40% drop compared to the five-year average and a -23% decrease compared to the same time last year. Interestingly, it’s primarily in Sydney and Melbourne where more sellers are entering the market before spring. However, this trend has yet to materialise on the Sunshine Coast.

As new listings continue to emerge, it’s crucial to recognise that this may not be sufficient to meet the current demand. While we anticipate a slight uptick in the total number of listings, this could be primarily due to some vendors having overly optimistic price expectations. Although prices are expected to remain stable with slight increases, overpricing properties may deter potential buyers, given the ongoing caution related to interest rate movements. We do not foresee prices plummeting further than they have over the past year unless there is a substantial surge in homes for sale coupled with distress sales triggered by the so-called “fixed price rate cliff,” a scenario that remains uncertain.

Additionally, buyer demand is on the rise, and properties offering good value are likely to be snapped up quickly. In conclusion, the real estate market presents a complex landscape with regional variations, but the overall outlook suggests an active and dynamic environment in the coming months.