Unravelling the Property Cycles: Why I Expect Prices on the Sunshine Coast to Continue to Grow

Weekly Real Estate Market Update with Leigh Martinuzzi MPG

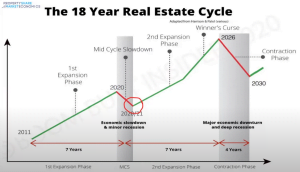

Market dynamics are often dictated by the ebb and flow of supply and demand, intertwined with the prevailing economic conditions. However, external factors also exert their influence on market trends. Specifically, I’m referring to the property market and the cyclical nature of prices, which not only mirror those experienced globally in both stocks and property but also follow a predictable pattern, such as the 18.6-year market cycle, a topic I’ve previously explored. Today, I aim to delve into this cycle and shed light on the so-called property clock, which serves to pinpoint the current phase of the market.

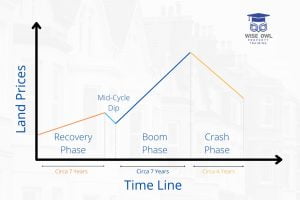

Let’s begin with the property clock, a familiar concept to many. It delineates various stages such as peak, decline, bottom, and rising markets, also known as recovery, upswing, downswing, and stagnation respectively. In Australia, the property market transitions through these stages cyclically throughout the year. Traditionally, as we approach spring, the market gains momentum, peaks during summer, experiences a downturn in autumn, and enters a phase of stagnation in winter. While this seasonal perspective holds merit, my observations on the Sunshine Coast have shown that winters can sometimes be unexpectedly buoyant.

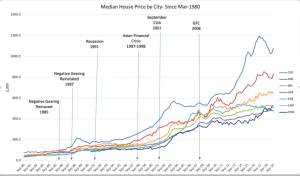

Nonetheless, in isolation, it provides a useful framework for assessing the state of Australia’s property market. Moreover, owing to the region’s relatively stable weather, the Sunshine Coast experiences fewer fluctuations based on seasonal variations compared to its southern counterparts. Regardless, any significant developments in Sydney often foreshadow similar movements here, albeit with a slight lag.

Central to understanding these market phases is the interplay between supply and demand. Despite the traditional view of autumn as a declining market phase, why then do we currently find most Australian markets in a “recovery” stage? The answer lies in the dynamics of supply and demand. When supply surpasses demand, we witness a decline and stagnation in the market. Conversely, when demand outweighs supply, we observe a resurgence, propelling the market towards its peak. Presently, this imbalance favours a market on the upswing in Australia. Factors such as robust population growth, a resilient economy, and a severe shortage of available properties have contributed to this scenario. While I initially speculated that we had reached the peak in May 2022, subsequent events proved otherwise. Despite anticipations of a crash, we merely experienced a temporary dip lasting approximately 12-15 months, marking the conclusion of the initial 7-year segment of the 18.6-year market cycle.

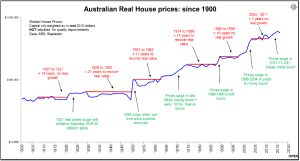

Now, the trajectory becomes intriguing, especially considering the current balance between supply and demand. The historical charts may indeed manifest their predictions accurately. The previous cycle’s peak around 2008 ushered in a tumultuous period for the housing market, characterised by plummeting prices and subdued activity. Subsequently, a gentle recovery phase ensued until roughly 2018, followed by a brief dip spanning a couple of years. The subsequent 7-year growth phase commenced vigorously, spurred by the COVID-19 boom, which saw prices surge by approximately 40 to 60%. Looking ahead, the prevailing imbalance suggests that prices will likely continue their upward trajectory, with the growth phase projected to persist for several more years. While historical patterns indicate growth until 2026, adjustments may be necessary given the unique nuances of the Australian market, possibly extending the timeline by 6 to 12 months. However, this doesn’t imply a resurgence in prices akin to the recent boom.

Reflecting on the 2011 growth phase, we may anticipate a similar pattern, with prices soaring in the initial phase before stabilising. Nevertheless, these projections operate within a broader context influenced by various factors, including geopolitical events, health crises, natural calamities, and the day-to-day fluctuations in economic indicators. Despite these variables, I remain optimistic about the future trajectory of property prices, foreseeing continued favourability for sellers in the coming years as supply struggles to meet escalating demand. While periods of stagnation may punctuate the market landscape, intermittent phases of heightened activity are also anticipated. Overall, I believe we are poised for several prosperous years ahead, characterised by a steady ascent in prices, with a potential realignment expected around 2026 or 2027.