Tipping Point: The Impact of the 13th Rate Rise

Weekly Real Estate Market Update with Leigh Martinuzzi MPG

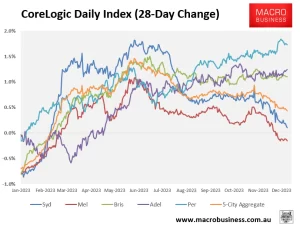

The recent spate of interest rate hikes, culminating in the 13th rise, has undeniably left the real estate market feeling the strain. Tom Panos aptly noted that the Reserve Bank of Australia’s (RBA) move has indeed “tipped the bucket,” and I wholeheartedly concur. This final rate increase appears to be the tipping point, impacting the market significantly. Despite record-high auction numbers, clearance rates have dipped below 67%, signalling a broader trend of softening property prices in most capital cities, except Adelaide.

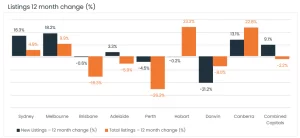

The steepest declines are observable in Melbourne and Sydney, although Sydney has experienced a notable rebound in property prices this year. However, this resurgence is not consistent across the board. Brisbane, for instance, has seen a softening of property prices, but the overall market performance remains robust. The surge in new listings hasn’t translated to a surplus of supply over demand in Brisbane, as opposed to the situations in Sydney and Melbourne where improved supply levels, coupled with the 13th cash rate rise, have led to a drop in demand and consequent price softening.

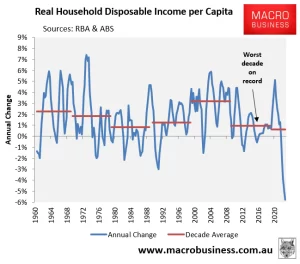

A recent report from Macrobusiness sheds light on the worsening situation of Australian household disposable income. Real household disposable income per capita has plummeted by -5.8% over the year, reflecting a troubling trend. The growth of disposable income was meager last decade, averaging just 0.96% per year, and this decade appears to be shaping up even worse, with an average growth rate of just 0.62% per year. Against the backdrop of the estimated income needed to afford a house in Sydney, which stands at $300,000, it’s no surprise that homeowners find themselves with less money to spend.

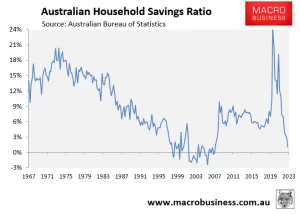

Record-high rental fees, coupled with a lack of commensurate wage increases, have created a financial squeeze on Australian households. Household savings have dipped to levels reminiscent of 2007, just before the last global financial crisis. Rising interest rates, rental fees, and service cost increases have contributed to a notable increase in household debt to servicing costs.

While this paints a rather grim picture, it’s essential to keep in mind that the supply situation is still insufficient to meet long-term demand. ANZ-Roy Morgan’s recent report on consumer confidence, which remained virtually unchanged, provides a glimmer of hope. Additionally, with the holiday season in full swing, buyer activity and property transactions are typically subdued. Despite the surge in listing numbers, especially in Sydney, the Sunshine Coast and Brisbane still face a scarcity of available homes.

Looking ahead, I can’t help but wonder if the RBA may have overreacted with the last cash rate rise. As we approach the new year, there might be a delayed reaction to reverse the cash rate, as the pent-up buyer demand grows. This demand is expected to intensify, particularly with record-high immigration numbers projected to continue. If the RBA softens the cash rate and this accumulated demand materializes, a slight property bubble could be on the horizon, possibly in the second half of 2024.s.