The Winter Selling Season is Upon Us

Weekly Real Estate Market Update with Leigh Martinuzzi MPG

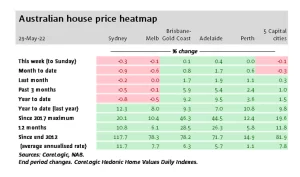

Australian dwelling prices across our capital cities for May are down 0.3% which is largely thanks to the likes of Sydney and Melbourne. In Brisbane, we have seen growth slow to 0.8% in May and locally here on the Sunshine Coast the effects have also been noticed. Despite a record number of properties flooding the market last week with many choosing auctions as the preferred sale method, auction clearance rates were lower at 67.3%. This is down from 71.4% last week and 82.2% this time last year. Auction clearance rates are a good indication of the supply versus demand ratios. A lowering auction clearance rate would indicate buyers have more to choose from.

It appears that the number of new listings coming to the market is certainly giving buyers more choices. In our capital cities in the last 4 weeks, there were 27,184 new listings up for sale bringing the total listing count to 87,390. However, I would think there is still a fair bit of room to move before we start seeing buyers having full control of the market. What is evident is that buyers are being more selective about their purchases and are happy to sit and wait for the right home to come up. And while a surge in new listings is more noticed in our capital cities here on the Sunshine Coast there is still a shortage with many buyers indicating that there are simply not enough properties to look at. This may change in the coming weeks before we see a slight slowdown mid-Winter.

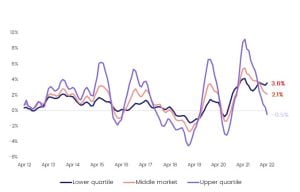

If these trends continue, we are likely to see a bigger drop in dwelling prices across Australia. I for one don’t think we will see a massive downturn and I think we will see a slight surge of activity come to the end of June and into July. CoreLogic has identified that prices in the upper quartile or premium sector, have slowed while prices/activity in the middle and lower quartile have remained positive (see chart below). This is a typical trend, as historically the premium property market usually leads the upswing and leads the downswing. The higher end of the market is generally more sensitive to credit conditions or interest rises as often more debt is tied in this group of people.

In the lower and middle markets, in locations where prices remain affordable in comparison to our inner-city markets, I believe buyer demand will remain relatively firm. And this is the case for the Sunshine Coast. There will still be plenty of buyers looking to purchase a home here and at the same time, I expect property owners will hold tight, as what better options do they have. The other point to note is that with rising building costs, and less construction happening on the Coast, buyers will be pushed toward existing dwellings, and this will likely keep prices steady. Yes, the market has slowed however there are still firm prices being offered on those homes for sale. That being the case, this isn’t a time for sellers to be raising their price expectations but rather to meet the market with realistic expectations based on recent comparable sales.

Auction Clearance Rates (Preliminary). Week Ending 29th of May 2022

- Queensland – 61% (130/1332)

- NSW – 82% (532/1489)

- Victoria – 79% (807/1300)

- ACT – 85% (72/81)

- South Australia – 87% (109/341)

- Tasmania – 100% (8/192)

- Western Australia – 100% (4/723)

- Northern Territory – N/A (0/27)

*(Auctions/Private Sales)

REVIEW(s) OF THE WEEK

Excellent!!

“Knowledgeable, great communication, friendly, great team. Leigh is a great guy and my elderly parents got on well with him.” – Palmwoods Seller

13 Blackall Range Road sale

“Leigh Great bloke Very helpful and professional would recommend Leigh his company to anyone who is wanting to sell their property.” – Woombye Seller