The Property Market Keeps Pace – Weekly Real Estate Update with Leigh Martinuzzi

Just over a week into October and the property market continues to keep pace. Brisbane, Sydney, and Melbourne have all recorded positive gains so far this month of 0.8%, 0.7%, and 0.5% respectively. Auction clearance rates over the past week remained high with signs that buyer demand is still outstripping supply. With NSW opening this week and talks of easing restrictions in Victoria it will be interesting to see how busy the Spring selling session becomes. New property listings will likely increase as will buyer demand in all areas across Australia. We expect the number of sellers interstate who are looking to make their move to Queensland will continue to rise over the next few months.

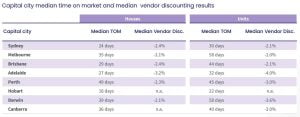

Buyers are out in force and the property market is finding it hard to keep up with demand. This is reducing overall time on the market (see chart below) and will continue to assist with strong prices being achieved. There are strong signs that property values will continue to climb until affordability reaches its tipping point. Look out Sunny Coast, there is more room for house price gains yet!

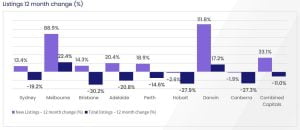

Having a look at the charts below you can see that although more properties are being put up for sale there is still a huge shortage of total properties for sale compared to this time 12 months ago. On top of this, buyer demand continues to climb which is up nationally by 50% this year. In most suburbs on the Sunshine Coasts, we’ve seen demand increase anywhere from 20% to above 50% with Buderim one of the most sort after areas for property in Australia and Palmwoods now in higher demand than ever before.

The Australian Prudential Regulation Authority APRA has announced new rules for banks this past week which have them increase the borrowing assessment rate by 3% above the loan product. This will hopefully reduce the risk of financial instability for those that might be considered more vulnerable should interest rates suddenly rise, although this is said to be unlikely for another few years. I believe that this will have very little impact on many buyers who are well-off or financially stable.

Lending is still relatively affordable and property values have risen phenomenally this year taking the total value of property in Australia from 8 trillion dollars 5 months ago to now over 9 trillion dollars. This gives many current property owners greater borrowing capacity and equity to tap into. If you want to borrow 1 million dollars and have the deposit to support the loan you only need to be able to afford $28,000 per year in repayments. Perhaps this is a good enough reason why APRA is concerned because if interest rates rise or the economy crashes, many homeowners might be quickly put under mortgage stress and even forced into selling.

If we can assist you with your property needs, now or in the future, please give us a call. We’re here to help!

Auction Results State by State. Week ending Sun 10th Oct.

- Queensland – =87% (143/1436)

- NSW – 89% (522/1390)

- Victoria – 87% (835/1547)

- ACT – 99% (87/37)

- South Australia – 93% (107/340)

- Tasmania – 100% (8/187)

- Western Australia – 100% (3/657)

- Northern Territory – 100% (4/29)

*(Auctions/Private Sales)