The 8th Cash Rate Rise for 2022

Weekly Real Estate Market Update with Leigh Martinuzzi MPG

The RBA announced a further 0.25% cash rate increase this week as they continue to try to rain in rising inflation. This brings the current cash rate to 3.15% which will be passed on by all banks with increased interest rates. For those that hold a mortgage, now would be a great time to speak to your broker about having your current rates reviewed. My brother just did this and has saved $1,000 per annum in reduced repayments, and I’ve done it myself and saved just under $900. If you’d like your rates reassessed give me a call. We’d love to help you with this.

As we close the year, it seems the property markets may finish out the year better than expected. Since the first cash rate rise in May, many thought that there would be a significant downturn in property prices, and yes prices are lower and buyer sentiment too, however, there certainly hasn’t been a massive crash. Inflation is slowing and the current CPI figure is sitting at 6.9% for the year, lower than most predictions. I was surprised that the RBA decided to raise the cash rate this month, as I thought they’d give people a little breather while also encouraging festive season spending. To be clear, they are on a mission to stop spending, yet people keep spending. Unemployment is at all-time lows and wages are slightly up. In the USA, it looks as though they’ve avoided a market crash with all indications that the market will be sailing into 2023 with confidence.

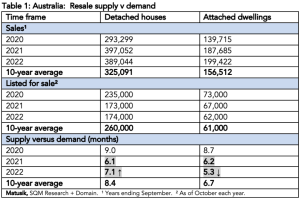

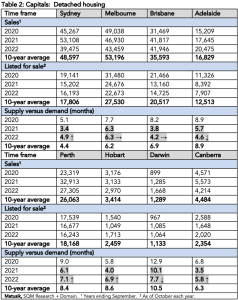

In Australia, we will likely see a rocky start in 2023 before we near some level of certainty and stability by mid-year. Of course, there could be multiple scenarios playing out. I will touch on this more next week. Supply and demand will always determine house prices, and right now we can see that the supply of A-grade properties is down, and these properties are still achieving great prices as if they’ve had not to price correction at all. People are happy to pay a premium for premium value! On top of this building, approvals are falling across the country, with detached housing down -113% year on year. With immigration on the rise and continuing population growth, it is likely we will see demand outweigh supply. This will obviously help maintain property prices. Again, prices may drop if owners are forced to sell, which will be highly dependant on inflation and how high the RBA raises the cash rate.

Have a look at the charts below provided by Matusik. He highlights that although the supply of detached dwellings is currently up, the attached dwelling supply is down, and both are historically below average. He further suggests that this is likely to continue into 2023. This could mean we experience a softer landing for the current property price decline.

Is it a good time to sell over December and January?

As Christmas fast approaches, many of us start winding down and thinking less about work and more about the holidays and festive season ahead. In real estate, it’s much the same, most people that own a property put off selling until the new year. The question I’ve been asked probably the most this week is, “is it a good time to sell over December and January?” My answer is yes! The simple reason is that many future property sellers hold off from selling until March or April, which means that selling during the quieter months of the festive season has less competition. And of course, there are always buyers, those people who’ve just sold and are ready to buy their next home and will be actively looking over the Christmas period with additional time of work. Less choice for buyers creates a little more urgency and balance in the negotiations between buyers and sellers. If you are thinking of selling, then perhaps it would be timely for us to speak about our “List Now, Launch Later” initiative to help get you ready for sale.

AUCTION CLEARANCE RATES – WEEK ENDING 21ST OF AUGUST 2022

- Queensland – 32% (306/1238)

- NSW – 54% (1087/1491)

- Victoria – 55% (1017/1181)

- ACT – 61% (116/98)

- South Australia – 60% (154/338)

- Tasmania – 100% (1/175)

- Western Australia – 45% (11/759)

- Northern Territory – 50% (4/37)

*(Auctions/Private Sales)

REVIEW(S) OF THE WEEK

Highly Recommend Leigh

I found Leigh to be easily approachable, professional, friendly, and genuine. Leigh kept us up to date the whole time with the sale of our house. He found the right buyer in a short amount of time which we were very grateful for. If you’re looking to sell contact Leigh, a very easy and friendly agent to do business with, highly recommended, Thank you Leigh. – Seller