Sunshine Coast Property Update:

Rising Listings & Future Regional QLD Trends Explained

Weekly Real Estate Market Update with Leigh Martinuzzi MPG

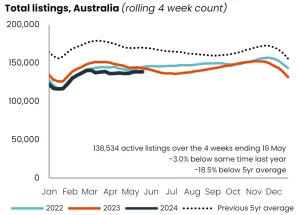

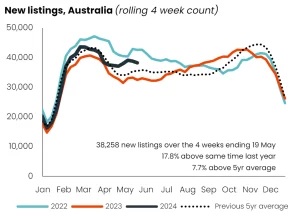

Seller activity seems to be on the mend. Over the past four weeks, new listings coming to the market in most states and capital cities across Australia have been on the rise. We’ve seen new listings up 18% since this time last year and 7.7% above the five-year average. While total listing stock is still below usual, -3% below last year and still -19% below the five-year average, it seems vendor activity is up. Buyer activity is still positive, even though things are moving a little slower, there appear to be enough confident and active buyers out there to absorb the increase in new listings. At least at this stage!

This news comes from data provided by CoreLogic, highlighting that just over 38,000 new homes have been advertised for sale over the last four weeks. The trends for higher listings per state are varied. Melbourne, regional Victoria, and Tasmania have seen a significant spike in listing numbers, corresponding to softer market conditions compared to other states. In these areas, buyers have more negotiating power than sellers at present. However, WA, SA, and Queensland are seeing advertised stock levels still down -34% below the previous five-year averages.

On the Sunshine Coast and here in the hinterland, I’ve observed more listings hitting the market in the last four weeks. However, this isn’t unusual for this time of the year in the lead-up to winter. What I am seeing, though, is that properties are sitting longer on the market before being put under contract. This is pushing up total listing numbers. Despite this, there is still not a lot available to purchase, with less than two pages of listings on Realestate.com.au.

So, what is causing the sudden surge in listing numbers other than it being somewhat of a seasonal time to sell? The surge in new listings could be attributed to many factors, although I believe financial pressures on individuals and families could be the primary reason for more homeowners deciding to sell right now. This would alleviate the pressures from rising interest rates and the cost of living. Some might be trying to downscale the financial risks of a further rate rise later this year that has been discussed recently in the media. Personally, I don’t think this will happen— Watch my recent opinion on this here.

Regional Queensland is showing much higher levels of lower stock levels compared to many other areas. This is likely due to relative affordability and changing demographics due to the pandemic. This trend will likely continue over the next decade as more people move towards regional areas due to affordability. I think this if managed well could lead to a great deal of healthy, positive growth for some of our regional towns.