Spring Surge Ahead: Property Market Trends and Insights for August 2024

Weekly Real Estate Market Update with Leigh Martinuzzi MPG

As we move further into August, the Australian property market is showing signs of change, setting the stage for a busy spring season. According to PropTrack Data, listings in July were up 12% compared to last year, reflecting growing seller confidence. While some markets saw more significant growth, the Sunshine Coast experienced only a slight increase in new listings. The region still faces an undersupply of properties, struggling to keep up with the ongoing demand. Though August saw a slowdown in new listings, experts predict a surge in market activity this spring, with both buyers and sellers coming forward in greater numbers.

The anticipated spring boost is already visible in the auction space. CoreLogic recently reported a 71.4% auction clearance rate—the highest since late July—with auction numbers rising. Last week, 2,052 homes went under the hammer, led by Sydney and Melbourne, which saw 807 and 889 auctions, respectively. I anticipate a busy market on the Sunshine Coast by October and November, with increased activity beginning as early as September. Strong buyer demand may motivate many homeowners to take advantage of this heightened interest.

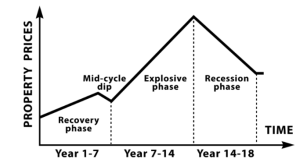

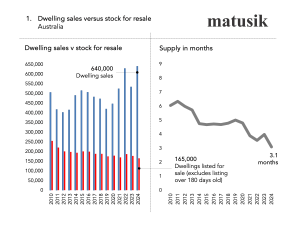

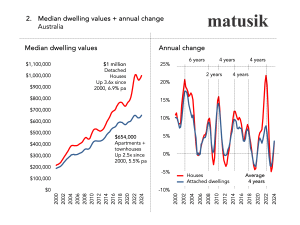

One of the most insightful reports this week came from Matusik, highlighting how supply and demand drive market trends. Since 2000, Australian house prices have risen 3.6 times, with apartments increasing 2.5 times. The property cycle appears to be shortening; once a 7-year pattern between peaks and troughs, it now spans just four years. Matusik’s charts show how population growth, limited supply, and rising demand continue to drive prices up. A recent API poll revealed that 70% of experts expect prices to keep climbing over the next 12 months, with 52% predicting growth in regional areas.

~

If the previous peak was in 2022, we might expect the next peak by 2026, followed by a market downturn. As previously discussed, Fred Harrison’s 18-year property cycle suggests we’re in the final years of the explosive phase before entering a recision phase. Managing this next stage will largely depend on debt levels and mortgage management, with the RBA’s cash rate decisions playing a critical role.

Currently, about a third of homeowners are experiencing mortgage stress, and within the next 12 months, 1 in 7 may need to sell to reduce financial strain. I believe property prices will continue to rise, albeit more slowly than in recent years. Higher mortgage costs and living expenses will challenge buyers’ willingness to pay more, though interstate and non-local buyers with greater purchasing power will continue to influence the market.

For sellers looking to attract these buyers, presentation is key. Remarkable home presentation, combined with a strategic marketing campaign, will be crucial. Embracing new technology, video content, and digital media can help homeowners connect with the best buyers and achieve optimal outcomes.

As we approach spring, it’s clear that market dynamics are evolving. Whether you’re buying or selling, staying informed and adapting to these changes is essential. If you have any questions or need guidance, I’m here to help you navigate these market shifts.

At MPG, we’re here to help you live more fully, have more meaning and find more joy on your next property journey.