September Quarterly Market Update with Leigh Martinuzzi MPG

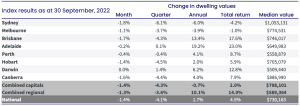

Across Australia during the first month of spring national house prices have fallen a further -1.4%. The good news is that this rate of decline now seems to be slowing. August saw prices drop by -1.6%. Keeping in mind too that during 2021 it wasn’t uncommon to see monthly price gains of 5%. This week the RBA has a further 0.25% cash rate increase as they continue to tackle rising inflation. Perhaps the initial shock of consecutive increases in interest rates has eased and buyers are better able to calculate their borrowing capacity. This could mean that we see more buyers will return to the market ready to purchase over the coming months.

Locally in Palmwoods, Woombye and the surrounding areas we’ve seen buyer demand remains lower than usual. Perhaps a combination of school holidays and colder months. Usually, spring attracts many sellers to the market however it’s been a slower start around Australia this year. I would argue that it still feels as though we haven’t seen the end of Winter yet. CoreLogic notes that new listings this spring are -12% lower than last year and -10% below the 5-year average. It seems many homeowners are happy to hold off from selling during this uncertain market. In saying that, locally, I expect we will see an influx of properties for sale over the next two months before things start to settle in time for Christmas. The total number of homes for sale at the moment is said to be 7% above this time last year, however, this is likely due to the depleted buyer numbers and the longer time it takes for properties to sell compared to this time last year.

Nationally, total sales over the September quarter are down -12.2% compared to this time last year. Locally, I believe that figure to be much higher and would think sales locally are down by about 30% this last quarter compared to last year. I feel that the rate of growth in some regional areas will start to show as we leave COVID in the past. However, for the Sunshine Coast, I believe there are some good growth opportunities in front of us. We will likely see more homes come to the market and selling times push out further. Buyer numbers will be steady and once confidence improves; more buyers will be putting pen to paper and making offers to purchase.

Beyond the click bate headlines, it seems that the economy is still rather positive. Yes, the cash rates will continue to rise but likely at a slower rate than what we’ve experienced over the last few months. This is affecting property demand and is the key reason why prices are dropping at a slow rate. Inflation has risen again in September at 7% up from 6.8% in August. This means Aussies are still spending money. Consumer spending increased in September across most sectors. And on a final note, migration is about to skyrocket with the Albanese government announcing a cap for skilled migrations this financial year of 195,000. More skilled workers, more students, and more demand for housing are expected in the not-too-distant future. Consumer spending and rising inflation will continue to put pressure on the cash rate yet I am confident we will find a happy equilibrium in the not-too-distant future.

AUCTION CLEARANCE RATES – WEEK ENDING 21ST OF AUGUST 2022

- Queensland – 36% (261/1193)

- NSW – 51% (648/1444)

- Victoria – 57% (882/1320)

- ACT – 63% (51/94)

- South Australia – 70% (82/361)

- Tasmania – 100% (1/186)

- Western Australia – 38% (13/719)

- Northern Territory – 50% (6/39)

*(Auctions/Private Sales)

REVIEW OF THE WEEK

Easy and pleasant experience

Leigh has been nothing but professional and personable from start to finish. His focus on keeping clear and open communication lines at every step of the way made us feel very comfortable with the purchase. He has been accommodating with all of the changes we’ve needed, and by far is the most proactive Agent that we interacted with on our purchasing journey. We would highly recommend Leigh for any real estate needs. – Buyer