Navigating the Peaks and Valleys – November 2023 Market Update MPG

Weekly Real Estate Market Update with MPG

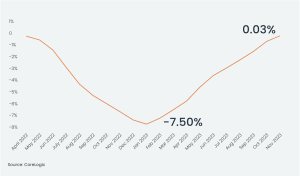

In a recent update on Australia’s real estate market, the Home Value Index (HVI) has surged to a new all-time high as of November 22, 2023, surpassing the previous record set in April 2022. Despite a temporary dip of -7.5%, house prices have rebounded impressively by 8.1%. It’s noteworthy that this HVI reflects Australia’s combined capital cities, while regional property prices are still -2.5% below their peak in May 2022. Despite multiple cash rate increases, the supply-demand imbalance persists, keeping prices resilient and, in some markets, soaring.

Despite concerns about the impact of successive cash rate hikes, property prices have rebounded rapidly, reflecting the persistent supply-demand imbalance. New property listings have increased during the spring market, but on average across Australia, they remain 16.6% below the five-year average and in some areas, this figure is a lot lower.

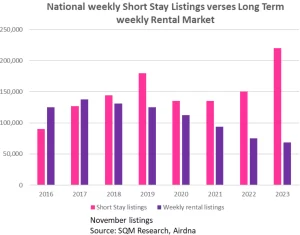

The impending immigration influx of around 500,000 people for 2022/2023 is expected to amplify demand for rentals. Rental vacancy rates have hit record lows at 0.9% nationwide, and there’s a notable shift towards properties being used for short-term rentals like Airbnb, reducing availability for long-term stays. This trend may exacerbate the rental crisis, contributing to increased homelessness and a widening equality gap.

Despite the robust property market, there has been a recent drop in interest following the latest rate hike, with Melbourne and Sydney experiencing the most significant declines. Over a 28-day period, dwelling growth prices have slowed from 0.8% to 0.5%, indicating a moderate adjustment. Consumer confidence as reported by ANZ Roy Morgan is up 2 points this past week at 76.7% yet still down 6.9 points on this time last year. Clearly, this will represent a slower turnover in the market as buyers show less urgency when buying property. However I believe this will turn around sharply sometime soon as supply worsens and demand continues to build up.

Renowned analyst Matusik predicts a 1% reduction in the cash rate by the end of the next year, signalling a possible correction from recent rate increases. Additionally, he provides intriguing statistics on Australia’s population growth, emphasizing the dynamic factors shaping the demographic landscape.

Australia’s population is growing at a dynamic pace:

- One birth every 1 minute and 42 seconds.

- One death every 2 minutes and 52 seconds.

- One person arrives to live in Australia every 42 seconds.

- One Australian resident leaves to live overseas every 2 minutes and 30 seconds.

- An overall total population increase of one person every 47 seconds.

Investment inquiries are on the rise, showing a 23% increase on average across the country. South Australia leads the way with a 29% surge, followed by Queensland (27%) and Western Australia (25%). Affordability and tax benefits are driving this interest, promising better returns on investment. For example, a $600,000 property in Queensland incurs approximately $22,000 in government fees, significantly lower than the $33,000 in Victoria.

Investors currently face a double-edged sword. While some grapple with increased mortgage repayments due to recent rate hikes and challenging tenancy laws, the scarcity of available properties suggests that rental fees are likely to continue rising. Over the last 12 months, rental fees have increased by 14.6%, with regional areas experiencing a slower rise of 1.8% compared to 0.8% in capital cities, primarily due to population increases in urban centres.