Property Prices and Market Trends: Is a Spring Surge on the Horizon?

Weekly Real Estate Market Update with Leigh Martinuzzi MPG

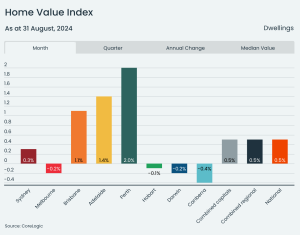

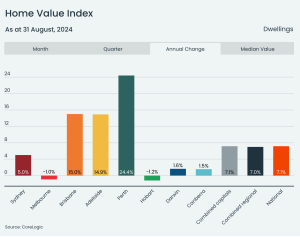

National property prices in Australia continued to rise in August, with the national home price index increasing by 0.5%. While this marks a continued growth trend, the overall pace is slowing compared to previous years. The chart below (to be included) highlights the biggest movers in price growth for August, showcasing both monthly and annual gains across different regions. Notably, Brisbane, the closest capital city to the Sunshine Coast, recorded a monthly growth of 1.1%, a quarterly increase of 2.9%, and a substantial annual rise of 15%. Brisbane’s growth is driven by factors such as population growth, infrastructure advantages, and the upcoming Olympics, but similar growth rates are also being observed on the Sunshine Coast, with most hinterland suburbs experiencing price increases between 8% and 15%.

Despite the typically slower winter season for property demand and sales, there has been a noticeable reduction in average price growth compared to the same quarter last year, falling from 3.3% to 1.7%. The current trend indicates that more affordable areas, which show higher demand due to constrained supply, are delivering the highest returns. For instance, in Brisbane, properties in the lower 25% affordability bracket saw a quarterly increase of 2.7%, while those in the upper quartile experienced only a 0.3% rise during the same period.

DOWNLOAD A COPY OF OUR SEPTEMBER MARKET MAGAZINE

Population growth is playing a critical role in shaping market dynamics, particularly in capital cities. According to data from the Australian Bureau of Statistics (ABS), overseas migration has seen a sharp decline, dropping from 165,000 in the March quarter of 2023 to 107,000 in the December quarter of the same year. This reduction, along with escalating property and rental prices, is driving a rise in multi-generational homes or shared housing arrangements as more individuals and families struggle with affordability.

Cost-of-living pressures are also reducing demand, while property sellers are likely to hold firm to their price expectations amid lower pressure to sell. For many, the challenge lies in selling and buying within the current market, where limited options and higher prices are making it difficult to justify a move unless they achieve their target selling price. This dynamic is likely to keep prices steady, with gradual but consistent increases expected through the end of the year.

Adding to this market outlook are the latest inflation figures. Annual inflation has decreased from 3.8% in the twelve months to June 2024 to 3.5% in July. The Reserve Bank of Australia (RBA) places more emphasis on underlying inflation, which remains slightly elevated, but both figures show signs of easing. Leading economist Dr Andrew Wilson pointed out that the main contributors to inflation were housing, food, beverages, alcohol, tobacco, and fuel. While it may be premature for the RBA to lower the cash rate, Australia’s big four banks have made their forecasts:

- – Commonwealth Bank of Australia (CBA): Predicts five 0.25% rate cuts starting in November 2024.

– Westpac: Forecasts four 0.25% rate cuts beginning in February 2025.

– ANZ: Anticipates three 0.25% rate cuts starting in February 2025.

– National Australia Bank (NAB): Expects five 0.25% rate cuts from May 2025.

A look at recent trends in the US property market, where momentum has significantly slowed following higher inflation figures and subsequent rate increases, suggests that Australia may follow a similar pattern, possibly six months later. While the timing of any rate cuts remains uncertain, there’s a growing belief that reductions could happen either before Christmas or early next year.

Given these market conditions, it’s crucial for potential sellers to remain aware of current trends, including demand, average time to sell, and interest rate movements, to make informed decisions. Those looking to sell in the remainder of the year should consult with local experts to understand their best options moving forward. While spring may bring a slight increase in buyer demand, an uptick in the number of homes for sale will provide buyers with more choices, making value and presentation key factors in decision-making.