Property Price Predictions 2022

by Leigh Martinuzzi

What will help keep property prices strong in 2022 and beyond? As always, the supply vs demand ratio is a paramount consideration. If demand continues as it has done in the past year to outweigh supply, then naturally, one will expect property prices to stay buoyant and even continue to rise. Many property experts predict this is what we can expect to happen this year and perhaps beyond. Of course, there are other factors to consider but let’s first look at the supply and demand ratio.

With a national shortage of homes available to purchase and buyer demand still at unprecedented levels, prices stay firm and so far in 2022 remain in positive territory. At the end of January 23rd, 2022 property prices were recorded to have risen a further 0.8% across the combined capital cities. However, those areas that are experiencing higher than average demand and an all-time low in properties for sale are seeing property prices continue to rise above 2% and above week on week. Property listings in the greater Brisbane area are 40% below the 5-year average. The Sunshine Coast is one of those areas seeing stock shortages and huge buyer demand with some experts suggesting we could see a further 18% growth in dwelling prices in 2022 on top of a 33% climb in 2021.

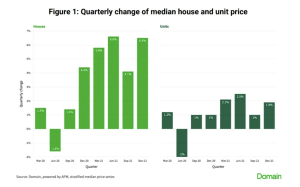

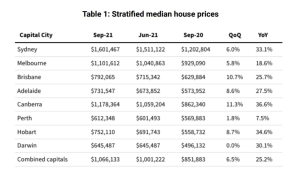

In the December quarter of 2021 national dwelling prices grew 6.5%. The new national median house price drove above $1M last year. Looking at the figures so far in 2022 I would expect we’d see a national growth rate of approximately 3% for the first 3 months of the year. This will depend on how well the start of the selling year kicks back into gear. Usually, come February and into March, we see property listings and associated sales go through the roof. The impeding factor this year is of course the economic and social uncertainty in the Omicron variant may cause. However, I feel the initial disruption and slow-down caused by the Omicron outbreak may be near an end. It certainly hasn’t stopped sales, with many buyers still out and about and many sales results still well above what’s expected.

Affordability is one of the key reasons for slowing demand however is it enough to cause a halt to price growth? Already in 2022, we’ve seen several properties sell well above prices achieved last year for comparable sales. For those properties that present really good value, I estimate we’ve seen a further 5 to 10% growth in the last 3 months. With the median house prices reported on Sunshine Coast to sit somewhere in the vicinity of $810,000 to $875,000, one would expect relative affordability to be at a stretch for many buyers.

While the unemployment rate nationally fell to a low of 4.2%, the lowest since August 2008, wages haven’t caught up. This will make it harder for many to save a suitable deposit to buy a home or be able to maintain mortgage repayments without putting themselves in mortgage stress. A tightening labour market and a potential raising of wages are causing more concerns for further increasing inflation. Based on this reasoning, Westpac expects the RBA to raise the cash rate by August 2022. However, the Omicron situation may put many out of work or in temporary suspension, which may cause strain on these predictions. With international borders opening, we can expect increased demand for houses and units in both the sales and rental markets. Naturally putting further strain on an already tight market.

Some forecasters are suggesting we will see prices continue to rise until 2026. Using historic data and charts they suggest we are in the second half of an 18-year property market cycle which may be more volatile than what we’ve experienced in the previous 7 to 8 years. It may also be a more lucrative growth period in the history of real estate markets across Australia and internationally. Land is the premium asset in question. With pricing affordability worsening in the housing sector, we can expect to see higher growth rates in the unit sector in 2022. As the high level of buyer, competition fades buyers will show more diligence in their purchasing decisions which I expect will mean A-grade properties and those that present really well and offer great value will receive the most attention and most favourable outcomes.