Real Estate Market Update with Leigh Martinuzzi MPG

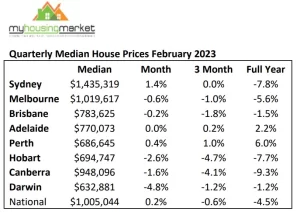

Nationally prices have risen 0.2% over the month of February, largely driven by an increase in consumer confidence in Sydney, where prices jumped 1.4% in February. As seen in the chart below, Sydney’s results have helped skew the national figure, as most capital cities are still showing slight declines in February and annually, prices are down -4.3%. Regardless this is a good sign of a housing market that is perhaps on the mend. There are always two sides to the coin, and right now, the market could go either way.

On the one hand, there are signs that the worst of inflation and the impact of the rising cash rate rises are behind us. Locally, we’ve seen many buyers in the marketplace, and for the right properties, great sale outcomes are still being achieved. Buyer sentiment is still low however it seems to be on the mend. The economy overall is performing well, with low unemployment rates and in some sectors wage increases. The RBA doesn’t want to bring on a recession, and while there are likely a few more rate rises to come, some experts are suggesting that the RBA may ease back on the cash rate as early as the end of 2023. Easing interest rates would likely stimulate the economy and the housing market.

We have also seen new property listings at record lows, down -14.8% on the five-year average. This is helping bring balance to the lower buyer demand bought on by the rapid rate rise we’ve experienced. Immigration is likely to stimulate higher demand this year, and with less to choose from, a bumb in buyer demand might push buyers to pay asking prices or close to them. National unit prices are slightly up too, by 0.1%. Brisbane has seen unit prices hike by 1.7% in the last quarter, driven up by increased demand due to the 2032 Olympics.

While new property listings are low now, this could all change very quickly as we head into the autumn selling season. Increased listings could be driven by a number of factors. Firstly, those homeowners who have held off selling over the last six months not wanting to hold back any longer. And secondly, many sellers will decide to sell now to avoid the risk of further price declines in the coming 12 months. This will increase competition for those selling and give more negotiation to buyers. And while buyer sentiment at the moment seems to be slightly improving, further cash rate rises could dampen this. Buyers are concerned about how a further 2% increase in interest rate might impact their monthly bank balance, and rightly so. This year there is also the end of fixed-rate mortgages for many homeowners.

The fixed-rate honeymoon period ends for many borrowers this year. According to the RBA, approximately 35% of all outstanding house debt is on a fixed basis. Of that, about 23% are due to expire or be refinanced this year. Those that fixed their rate in April 2021 at 1.98% would likely roll over to a variable rate at about 5.48%. This is taking into account a couple more rate rises in March and April of 50 basis points. For the average loan size of $538,936, this equates to a bit over $1,000 in additional monthly mortgage repayments. It will be a painful adjustment for many homeowners that are coming off a fixed-rate loan this year. Will it cause many distressed sales? Hard to know as the impact of such change will take a while to see. In short, disposable income will reduce and likely reduce household spending and which should further slow inflation.

Lots of variables to be considered. One thing I know is that we cannot predict the future. We can make assumptions based on current data and historic trends, but this is not always certain. Personally, I think we can make the best decisions with what information we have at hand and previous experience. Leaving things to chance when buyers or selling, perhaps not always ideal. Heads or tails?

AUCTION CLEARANCE RATES

- Queensland – 44% (241/1186)

- NSW – 62% (183/1494)

- Victoria – 64% (1175/1134)

- ACT – 54% (135/98)

- South Australia – 77% (108/320)

- Tasmania – NA (2/131)

- Western Australia – 10% (10/658)

- Northern Territory – 67% (3/35)

*(Auctions/Private Sales)

REVIEW(S) OF THE WEEK

HIGHLY RECOMMEND LEIGH

I found Leigh to be easily approachable, professional, friendly, and genuine. Leigh kept us up to date the whole time with the sale of our house. He found the right buyer in a short amount of time which we were very grateful for. If your looking to sell contact Leigh, a very easy and friendly agent to do business with, highly recommended, Thankyou Leigh – Seller