Property Market Cycles – Where Are We Heading?

By Leigh Martinuzzi MPG

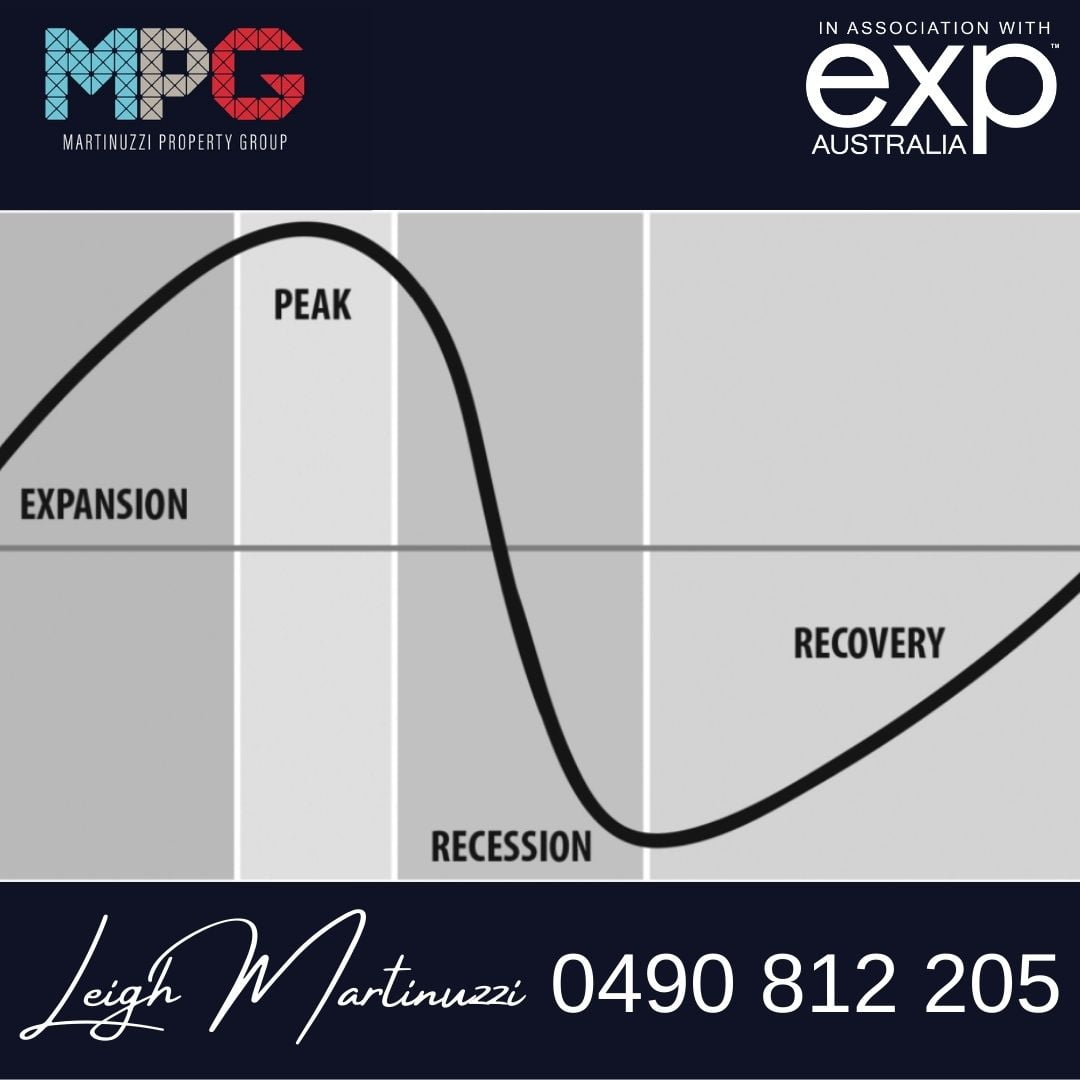

An acquaintance of mine shared some interesting property market statistics with me this week. I understand he has been following the property cycles for many years and spent many hours researching such trends. Based on some US data from the 1800s to now, history highlights that property markets move in 18.2-year cycles. That is a sequence of seven years up, four down or sideways, and then another seven up. He shared this information with me after I asked him whether he thought now was a good time to buy a property or would it be best to hold. Considering the recent boom we’ve experienced in the last 18 months or so, I am a little uncertain as to what will happen next.

His feelings are that we’ve ended the seven-year up and now heading into four years of downward growth. I am not as convinced there will be a dramatic downward trend, perhaps just slightly, and I say this for several reasons. Firstly, the costs of goods are putting a lot of constraints on the building industry, with many companies having to close their doors. For many, the cost of doing business is simply not profitable. This may mean fewer new house builds coming to the markets over the next few years, which will equate to less supply. At the same time, I am not sure buyer demand will fall that significantly.

Australia’s population will approach 29 million people by the end of the decade and nearer 40 million people by mid-century. We are doing to need more housing to accommodate the expanding population. At the same time, the number of people per household has decreased and that means more dwellings are required. This may change in the years to come, as younger people choose to live at home longer or partner up with friends to purchase shared housing. As property affordability worsens, I expect this type of living arrangement will be a growing trend. I think the way we Australians like to live may not change, yet, the dream of owning our own property might.

The next problem we face is worsening housing affordability. Over the last year on the Sunshine Coast, house prices have grown on average by 30% or more. Meanwhile, wages certainly haven’t grown as much. My friend from above shares his first house purchase was $22,000 in 1976, which was roughly three times his yearly wage. In comparison, he said, the average house is approximately $700,000 today with an average income of about $70,000 per annum. That is ten times your yearly income. Naturally, one can expect buyer demand to drop on this basis. And rising interest rates will make it harder for those buyers looking to purchase their first home.

Of course, the government will create policies in attempt to initiate buyer demand, particularly in those buyer segments that who may find it more difficult to save a deposit for their first home or fund mortgage repayments. What we may see is a two-tier property market. Those in higher-paid professions will still be able to purchase many properties, while many working-class Australians may not be able to pay as much for their homes, if at all.

As inflation rises globally and we see more shortages of commodities, I think in times of such uncertainty people will hold on to tangible assets of value, i.e. property. I feel that we will see those who can afford to buy property will seek to buy more and those who own will be less inclined to sell in fear they may be left with less. This will put tightening constraints on the current supply of property on the market for purchase.

In summary, I am partially on the fence. I do feel that we will see the heat fall back and prices will fluctuate over the next few years although I am less inclined to think we will see a massive drop in prices. As I wrote last week, I think A-grade properties, or those that present well and have good value, will still attract premium buyers, and sell in reasonable times. Consumer confidence will depict the state of the markets moving forward. If they feel confident in the future of prices, they will be more inclined to buy, if they feel the markets are about to go bust, perhaps they will hold off. My advice to you about where the property market is heading is to do your own research before making any rushed decisions.