New Listings Fall in December & Asking Prices Rise

Written by Leigh Martinuzzi

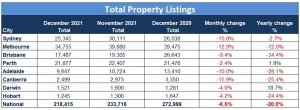

In December, we saw new property listings fall across the nation by 29.5%. In November, many property owners rushed to list their homes for sale, which is typically a busy time of the year. As people take leave the desire to sell often falls in December and January. Nationally new listings were up 2.4% year-on-year however total listings have fallen 20% since this time last year. Vendors will be less inclined to lower their asking prices while there remains a shortage of properties available for sale and buyer demand remains high.

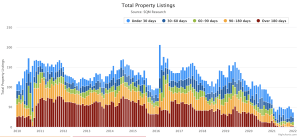

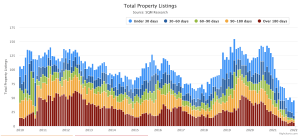

The charts below highlight the percentage changes in total listings and new versus old listings from November to December and over the past 12 months. What is noticed is that properties that have been listed for over 180 days, which is a long time in the current market, have fallen by 6.8% from November to December and 49.5% over the past year. As property availability dries up we would expect some of the homes that have been sitting dormant on the market for a while to start selling up.

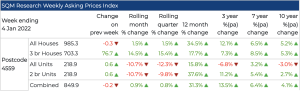

In our capital cities vendor asking prices have risen 1.9% across the past 4 weeks to the 4th of January. Firstly, this is a sign that homeowners are still expecting rising prices in the foreseeable future. Secondly, it highlights to me that although much of the heat has been taken from the market it is still very much a seller’s market. Increases in dwelling values in many areas are softening, Sydney and Melbourne, yet in other areas, like Southeast Queensland, they remain fairly strong. Of course, there is a difference between asking prices and actual sold prices.

What I notice looking at this chart is that in those areas that have seen a small percentage decline in total listings and a larger increase in new listings, asking prices haven’t spiked as much. Take for example Perth, year-on-year Perth has had an increase in total listings by 1.9% while new listings sky-rocketed by 15.5%, and yet asking prices only rose by 0.1%. High price expectations in this market will likely lead to a longer selling timeframe. On the other hand, in those markets in which total and new listings fell more significantly, we have seen higher asking prices. Year-on-year Brisbane saw a decline in total listings of 34.4% and 10% for new listings coming up for sale. Asking prices here have risen in December by 4.2%. Vendors in Brisbane and in Queensland still seem to have the upper hand… but for how much longer?

Locally, I’ve taken some screenshots of total listings available for sale of the past 10 years for Palmwoods and Woombye. Year on year total listings in Palmwoods and Woombye fell by 65% and 52% respectively. I’ve seen a few more listings come up for sale in the past few weeks however with the heightened buyer demand many are still being sold up for premium prices in very quick timeframes. In Palmwoods, the research provided by SQM suggests that there were 28 new listings recorded in December (those listed within a 30 period) while 18 properties that were listed for over 30 days were still advertised for sale. Woombye recorded 14 new listings and 23 older advertised properties.

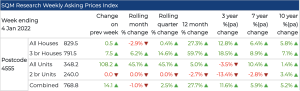

Surprisingly, the change in asking prices in Palmwoods has fallen in December by 2.9% month-on-month however remains up by 27.3% for the year. Woombye’s asking prices rose 1.5% in December and over the past year has seen a 34.5% increase.

In summary, it looks like property availability remains tight and while buyer demand is still high, we can expect prices to hold for a while longer into 2022. Unless we see a surge in new listings to start the property season in February, it is likely that property sellers will be in a positive position for potentially the first 6 months of 2022.