My Insights on the Current Australian Real Estate Market

Weekly Real Estate Market Update with Leigh Martinuzzi MPG

Introduction

Hello everyone, and welcome to my weekly real estate market update for Australia. Today, I’ll be sharing my personal insights and opinions on the current trends and dynamics shaping the property landscape. It’s an exciting time in the market, and I’m eager to share my observations with all of you.

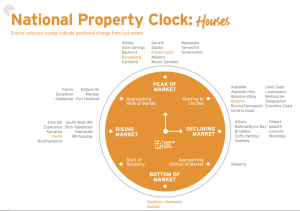

1. Price Trends and Growth

Last month, we witnessed a notable increase of 1.3% in Australian dwelling prices. However, on a year-on-year basis, prices are still slightly down at -3.2%. Despite this, there are some bright spots in certain cities. For instance, Sydney has experienced a fantastic rise of 5.9% year-to-date, and Brisbane is also showing positive momentum with a 2.8% increase.

2. Consistent Price Growth

One thing that has caught my attention is the consistent price growth over the past five months. It’s fascinating to see the market remain resilient even amidst rising interest rates and falling inflation. Interestingly, history has shown us that property prices can rise even when interest rates are on the up.

3. Fixed-Rate Mortgage Cliff and Property Prices

A concern that many in the industry are raising is the potential impact of the fixed-rate mortgage cliff on property prices. Some properties coming to the market are now not fetching the prices they were purchased for in the period between 2020 and 2022. However, properties bought pre-COVID are still experiencing substantial growth, which is reassuring for long-term investors like myself.

4. Market Strength and Future Predictions

Despite the uncertainties, I view the market as rather strong. Demand and supply issues are playing a significant role in keeping prices firm and, in some cases, even driving further increases. I’m optimistic about the market’s future, especially considering the factors supporting price growth in locations like the beautiful Sunshine Coast.

5. Migration and Lifestyle Appeal

One key factor driving price growth on the Sunshine Coast is migration. People are still drawn to the Australian lifestyle destination, and there’s a notable migrational movement happening. Some are selling in southern markets and moving north for affordability and to reduce household debt. At the same time, we’re seeing people selling on the Sunshine Coast and moving even further north. It’s all about finding the best lifestyle and financial fit.

6. Employment and Housing Demand

The Sunshine Coast’s low unemployment rate of 2.6% is a significant advantage. This rate is better than the rest of the state at 3.9% and even the national average at 3.7%. Moreover, though available listings are increasing, the total stock is still below the historic average (-18.9 year on year), indicating strong demand in the region. There are also fewer homeowners wishing to sell in an uncertain market and fewer options to purchase. The cost to sell and buy combined with the worsening affordability putting many off selling and choosing to stay put and upgrade their current abode.

7. Market Behavior and Property Presentation

From my personal experience, well-presented homes that require little to no work are attracting strong interest and selling quickly. Renovated properties in convenient lifestyle locations are fetching premium prices. Even homes in desirable areas that need some work are receiving strong offers in a short span of time.

8. Projected Growth and Interest Rates

I’m cautiously optimistic about the projected growth in the property market. It’s quite possible that we may see prices reach levels above those witnessed during the COVID-19 boom. While interest rates have risen, I believe they might ease back in 2024, which could further stimulate property prices.

9. Affordability Factor

Affordability is a critical consideration for many buyers. In the Sunshine Coast hinterland, I’ve noticed that well-presented homes priced in the $500,000 to $600,000 range are garnering significant interest. On the coast, properties in the $800,000 bracket are considered affordable for many prospective buyers.

Conclusion

As a real estate enthusiast, I find the current Australian property market both exciting and promising. Despite challenges, it continues to show resilience and growth. The interplay of migration, employment rates, interest rates, and supply and demand dynamics will continue to shape the market. I’m looking forward to witnessing how things unfold in the coming months and sharing more updates with all of you. Let’s stay optimistic and informed as we ride the waves of the ever-changing real estate landscape.