My 2023 Forecast & Final Posts for 2022

Weekly Real Estate Market Update with Leigh Martinuzzi MPG

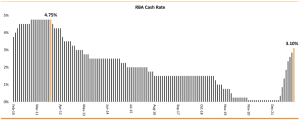

Here is my forecast, or perhaps thoughts, for the Australian property market in 2023 and how it will affect us locally on the Sunshine Coast. I believe the RBA will struggle to find the balance between controlling inflation without lifting the cash rate too high, which could cause an economic downturn. We do know that there will be further rate rises in the new year. Looking back over the past ten years, we can see how higher interest rates affect the property market. In 2011 and 2012, the property markets across Australia were very slow-moving and there were many more distressed sales happening. We haven’t reached that yet, however, if the cash rate rises to 4% and above, we could be in for a rocky 2023.

It is likely that we will see the cash rate rise to 4% in the first half of 2023. This will naturally mean a slower market but perhaps not a “market crash”. We will see fewer active buyers in the marketplace, which means time on the market will continue to be extended. However, I don’t believe we will see prices drop too much further. Sellers will hold firm to their expectations, and if they cannot get a satisfactory price, they will likely choose not to sell. The thing is, that despite the cash rate has risen from 0.1% to 3.1%, and prices on the Sunshine Coast are down -7.1%, the markets across Australia are holding firm (see below).

Scenario one, the property market will slow for the first half of 2023. Consumer spending and consequently, inflation, will also slow. This will allow for the RBA to pause the cash rate, which will likely hover around that 4% mark. After which, if they are confident that inflation is calm, they may even start to ease back on cash rate rises for the latter half of 2023. This could welcome an improvement in buyer confidence and market activity. This would be the most plausible, and for many, the most pleasing outcome for next year.

In scenario two, the cash rate rises to about 4% and yet the economy doesn’t slow, and consumer spending remains up. In this situation, we could have inflation rise even higher. In this scenario, the RBA would react, like they have done this year, and raise the cash rate rapidly. If this happens, and we see a cash rate rise above 4%, we will see ourselves heading into a pretty severe market downturn and likely a massive recession. Not what anyone wants. Based on current trends and some historic data, this is not as likely to happen.

I think for those looking to sell, one needs to remain conservative with their price expectations. It is easy to look at strong past sales to base your price expectations on, however, if those sales occurred in the booming market of 2021 and early 2022, it’s less likely they’ll be achievable moving forward. Look for property sales in your area in the recent 3 to 6 months and remain conservative. Find a pricing strategy that aims to attract strong interest in the chance that you find that one premium buyer. I think time on the market will be pushed out yet will remain better than average. For the local markets of Palmwoods and Woombye, expect anywhere between 30 and 60 days. Property presentation will remain key in 2023. Those homes that present well and require little to no work will still achieve great prices and quick turnaround.

On one final point, CoreLogic reported this week that the spring market has seen a downturn in the number of properties listed for sale. Over the past decade, we have seen an average 21% uplift in the number of homes for sale from winter to spring. In the three months to November, the total new listings were 118,734, down from the three months to August recorded at 121,859. Based on this alone, I think we might see a spike in new listings that come to the market early in 2023. This will mean more choices for buyers and more competition for sellers.

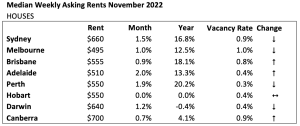

That’s the sales side of 2023, now let’s turn briefly look at the rental market. Rental Markets End Strong for 2022! As of the end of November 2022, the asking rents for houses and units end strong. Brisbane’s rental gains we up 18.8% for the year while asking prices for unit rentals in Sydney were up 25%. I expect demand for rental properties to remain strong in 2023 which may push up rental fees further.

This is my last post for the year 2022. I would like to take this opportunity to thank all of you for tuning in and I really hope the information I’ve provided has been useful. I wish you and your families a safe and Merry Christmas.

AUCTION CLEARANCE RATES – WEEK ENDING 21ST OF AUGUST 2022

- Queensland – 29% (292/1201)

- NSW – 52% (1174/1505)

- Victoria – 55% (1233/1201)

- ACT – 52% (126/108)

- South Australia – 57% (162/363)

- Tasmania – NA (0/168)

- Western Australia – 9% (11/755)

- Northern Territory – 50% (2/31)

*(Auctions/Private Sales)

REVIEW(S) OF THE WEEK

Highly Recommend Leigh

We were very satisfied dealing with Leigh whilst purchasing our home, he was always very responsive and helpful and always kept open lines of communication throughout the process – invaluable when doing something as stressful as purchasing a house! – Buyer