MPG 2023 Sunshine Coast Market Wrap: Navigating Trends for 2024

Real Estate Market Update with Leigh Martinuzzi

The Australian real estate market in 2024 defied expectations, surpassing projections of a downturn despite 13 consecutive cash rate increases since the market peak in April 2022. Initial concerns of a potential 20% to 30% decline failed to materialise. The year started cautiously, with both buyers and sellers exercising restraint. Nevertheless, Sydney experienced increased listing numbers, and buyer activity surged across various markets, including the Sunshine Coast. The 13th rate rise on Melbourne Cup day acted as a potential tipping point, affecting transaction volumes as sellers held back, anticipating the new year and another potential cash rate rise.

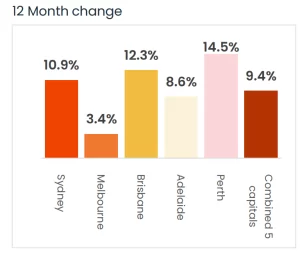

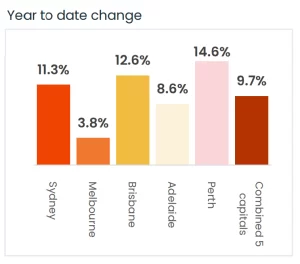

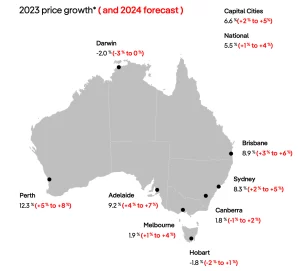

As we navigate through the charts below, it’s evident that the property markets rebounded significantly this year. Hitting a low point in January, a complete reversal occurred, with CoreLogic reporting a 9.4% increase in dwelling prices across combined capital cities over the past 12 months. Since the April 2022 peak, dwelling prices initially dipped 7.5% before making a steady climb. Regional areas are slightly trailing their May 2022 peak by about 2.5%, with the Sunshine Coast exhibiting more conservative trends—CoreLogic notes a 0.4% dip in prices over the last 12 months. While growth rates have slowed, property values remain stable, and supply issues contribute to a resilient market.

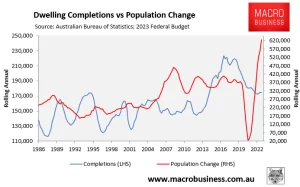

Population growth remains a key driver of demand, with over 500,000 new migrants to Australia in the year ending June 2023. The government’s migration policy, addressing an ageing population and contributing to energy transition and economic growth, anticipates a decrease to 375,000 and 250,000 migrants in the next two financial years. However, infrastructure challenges persist, particularly in housing supply and building approvals.

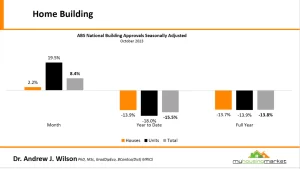

Building approvals increased by 8.4% in October, primarily driven by the more volatile unit market. Yet, the year-to-date total building approvals are down 15%, presenting a challenge for builders in the face of rising costs and interest rates. Home loan commitments rose 5.4% in October, with a 4.9% increase for the year. Owner-occupier and investor categories drove this surge, but first-home buyers faced challenges due to worsening affordability and increased living costs. The trend of urban dwellers moving to regional areas for affordability is expected to continue.

Looking ahead to 2024, a lack of housing supply, increasing demand, potential tax cuts, and a projected 1% reduction in the cash rate by the RBA suggest continued but slower housing price growth. Experts predict a 4% average increase nationwide, with Brisbane, Perth, and Adelaide leading at 8%. Brisbane’s house prices may climb 7-8%, and unit prices are expected to rise by 4-6%. On the Sunshine Coast, houses may see a 4-6% increase, and units 1-2%. Population growth will sustain demand, while the rental market approaches a tipping point.

In the coming year, three fundamental factors will shape the property market: the interplay between population growth and demand, a persistent shortage of suitable supply, and government/RBA decisions on tax incentives and the cash rate. Buyers are likely to exercise caution, while others may dive back into the market early in the year to capitalise on potential price growth. Internal migration to regional areas for affordability is expected to continue, with capital cities outperforming in housing demand. The Sunshine Coast will grapple with stock shortages, creating a challenging market for both buyers and sellers. A-grade homes will likely move quickly at above-average prices, while the average time to sell may increase in hinterland suburbs. Anticipate a surge in buyer activity in early 2024, intensifying as the year progresses, especially after potential government incentives and a cash rate easing post the financial year. That concludes my end-of-year market wrap, and I’m here to assist you on your real estate journey in 2024. Wishing you all the best for the upcoming year.