March Market Insights: Australian Property Continues to Surge

Weekly Market Update with Leigh Martinuzzi MPG

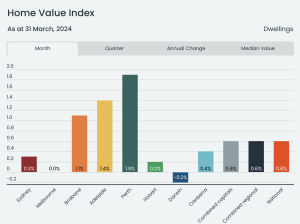

The latest data from the CoreLogic Home Value Index (HVI) reveals yet another month of robust growth in the Australian property market. In March, the HVI rose by 0.6%, marking the 14th consecutive month of dwelling price increases across the country. This sustained upward trend comes on the heels of a challenging period, with Australian property values experiencing a decline starting in April 2022, coinciding with the onset of rising interest rates.

Contrary to some earlier forecasts of significant price drops ranging from 20% to 30%, the actual decline averaged a more modest 7.5%. Since the market began its upswing, prices have rebounded impressively, surging by 10.2% or a staggering $72,000 in dollar terms.

Key markets driving this upward trajectory include Brisbane with a 1.1% increase, Adelaide with 1.4%, and Perth leading the pack with a notable 1.9% rise in property values in March. Regional areas are also holding their own, with growth rates on par with combined capital cities, recording a respectable 0.6% growth in March.

Total growth for the first quarter of 2024 stands at a solid 1.6%, showing an improvement from the previous December quarter (1.4%). Looking ahead, there are early indications of a market gaining momentum. With interest rates currently on hold and discussions of potential rate cuts by the end of the year, buyers are showing proactive behaviour by re-entering the market sooner rather than later. This strategic move aims to avoid heightened competition that may ensue should the Reserve Bank of Australia decide to lower the cash rate.

As illustrated in the chart below, various markets across Australia are experiencing different levels of growth, reflecting the dynamic nature of the property landscape. Despite economic uncertainties, the resilience of the Australian property market remains evident, driven by a combination of factors including low-interest rates, tax incentives, and improving market sentiment.

In conclusion, the outlook for the Australian property market remains optimistic, with signs of continued growth and resilience in the face of evolving economic conditions. Buyers and sellers alike should stay informed and proactive in navigating the ever-changing real estate landscape to make the most of emerging opportunities.