Local Activity Improves as Property Australia’s Property Price Decline Eases

Weekly Real Estate Market Update with Leigh Martinuzzi MPG

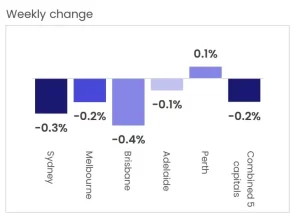

Spring is the time to sell for many homeowners across the country. The weather becomes more bearable, gardens start to bloom, and typically we see more seller and buyer activity with people seeking to make their move before Christmas. The rate of property price decline across the country continues to slow (-0.2% the previous week) as auction clearance rates improve. There are early signs of a recovering market. Michael Yardney suggests that we may even see property prices move back into positive territory as early as next year.

Locally, in Palmwoods, Woombye, and the surrounding areas, we have seen mixed responses to our advertised properties for sale. Some are attracting above-average enquiries online and more people to the open homes, while others are quiet. One of our newly listed properties for sale, after just a few days on the market, welcomed 19 buyers’ groups to its first open home. From that, we received multiple offers. Another home, that has been on the market for about six weeks, has gone under contract. Both buyers and sellers are very pleased with the result. While there are more properties on the market for sale, new listings are still lower than normal. The time it takes to sell will continue to be pushed out, however, for those A-grade properties that present good value, we’d expect to see them sell quickly. I believe there is still less supply than there is demand for property, and as we move toward Christmas, homeowners will have a good opportunity to sell.

With inflation expected to peak soon, the RBA is now nearing the level they expect the cash rate needs to be at to help soften economic growth. Their target range of 2.5-3.5% is close to the current cash rate of 2.6%. Buyers are now starting to feel a little more confident about the rising interest rates and coming back into the market to purchase. Seller price expectations will need to be adjusted as while prices are still at record highs, they are no longer rising. On top of that, with the increased interest rates, borrowing capacity will be reduced, meaning offers will be slightly more conservative. With dwelling approvals being lowered and international migration coming back into play, we may just see demand for housing rise. I actually think the trend moving forward will be that homeowners stay in their current place of residency for longer periods of time, and this will naturally lower supply levels across the country.

Brief National Rental Status Update

The rental markets have continued to tighten across Australia in the 3rd Quarter of 2022. However, the rate of rental growth is starting to ease, and rental yields are improving. Rental growth slowed in the September quarter, rising 2.3%, down from the June quarter of 2.9%. This growth is record-high, reporting a year-on-year increase of 10%. Vacancy rates tightened in the September quarter to just 1.1%. The number of advertised properties for rent is -35.4% below the five-year average. Capital cities are reporting higher rental growth compared to regional areas, 2.7% compared to 1.3%. As house prices lower across the country (down -4.1% for the September quarter), and rental incomes remain at an all-time high, naturally, rental yields have improved. Ms Ezzy from CoreLogic reported that rental yields improved in the September quarter to 3.57%, which is sitting below the decade average of 4.24%. With new tenancy laws in place and lower yields, there are some investors that are selling their investment properties. Also, while the market is in a period of flux, we expect fewer investors will be looking to purchase right now. This will of course reduce the amount of available housing available for rent which we expect will continue to tighten the rental market.

AUCTION CLEARANCE RATES – WEEK ENDING 21ST OF AUGUST 2022

- Queensland – 36% (201/1079)

- NSW – 51% (864/1094)

- Victoria – 59% (778/1082)

- ACT – 67% (117/91)

- South Australia – 70% (82/361)

- Tasmania – NA (0/165)

- Western Australia – 25% (8/635)

- Northern Territory – 20% (5/33)

*(Auctions/Private Sales)

REVIEW OF THE WEEK

Very positive experience working with Leigh on selling my property!

Very professional and committed to selling my property from the start Leigh took care of everything for me it was stress-free. Such a pleasure to work with such a fantastic realtor! Extremely responsive Leigh did a wonderful job. Good advice was given to me throughout the sale of my property which was a huge help. Extensive knowledge as a realtor. – Seller