How Interest Rates & Migration Impact Australian Property

Weekly Real Estate Market Update with Leigh Martinuzzi – MPG

After riding the waves of 13 consecutive interest rate rises, the burning question on everyone’s mind is, “What’s next?” The recent surge in the cash rate has left many pondering its implications on the real estate market. If you’ve been following my journey, you know I’ve been vocal about who these rate hikes truly affect and why a broader look at policies might be in order to keep Australia’s housing supply and demand in harmony.

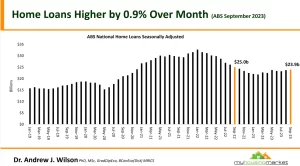

Let’s dive into the numbers. The chart below maps out the interest rate landscape over the past 13 years, with the official cash rate hitting a 12-year high. This upward trajectory is starting to squeeze first-home buyers out of the market and make investors a bit jittery. As interest rates climb, mortgage repayments become more burdensome, and borrowing capacity takes a hit. A 25 basis point rise, I’m told, roughly translates to a $50,000 reduction in borrowing capacity.

To put it in perspective, a broker shared a tale of a client whose borrowing capacity dropped from $850,000 to $550,000 in just a year. With competitive interest rates nudging 6% and an assessment buffer of 3%, meeting a mortgage assessment of around 9% is the new reality. Couple this with a national property price increase of 7%, and the purchasing power of the dollar has significantly diminished.

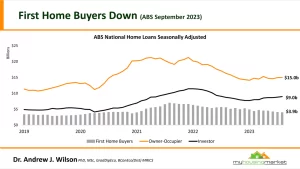

First-home buyers are feeling the squeeze, remaining in the rental pool. Given the influx of migrants (more on that in a bit), rental prices are likely to keep inching up. The charts below paint a picture of declining lending values, fewer first home buyers, and investors stepping back.

Now, who’s weathering this storm better? Homeowners, especially those with smaller mortgages and built-up equity, can still navigate the market with relative ease. But let’s not forget, we’re all in this real estate rollercoaster together.

Now, onto the topic of migration. Eliza Owen’s recent insights from CoreLogic are eye-opening. With property prices soaring 7.2% and rents climbing 6.0% year-to-date, the debates on migration policy intensify. It’s a simple equation – more people, more demand, and with housing supply struggling to keep up, affordability takes a hit.

Eliza’s five key takeaways shed light on the nuances of migration impact:

- Housing Tenure Dynamics: Temporary migrants favor rentals in the short term, impacting the rental market more immediately than property purchases.

- Temporary Migration Restrictions and the Current Surge: Post-COVID border reopenings have led to a surge in population growth and migration, creating a concentrated influx.

- Volatility in Rental Markets: Temporary migration caps provided short-term relief but resulted in a demand shock upon reopening, spiking rental prices.

- Multiple Demand-Side Factors: Reduced household sizes during the pandemic, coupled with an aging population and declining marriage rates, contribute to increased dwelling demand.

- Trade-Offs of Reducing Migration Intake: While imposing limits on migration has economic trade-offs, setting long-term migration targets could aid in planning and contribute to economic growth.

As we navigate through these challenging times, my gut tells me the RBA might pause the cash rate hikes for the rest of the year. A bit of breathing room is needed to let the effects of the past 13 hikes catch up with the economy. Keep an eye on inflation in the new year, but let’s proceed with caution and strategic thinking.

Until next week, happy real estate navigating!