How Far Will Interest Rates Rise? + 2022 Property Price Forecast

Weekly Real Estate Market Update with Leigh Martinuzzi MPG

The RBA is committed to keeping inflation in the 2% to 3% range and at the moment it’s well above this. According to the RBA Governor Phillip Lowe, their goal is to lift the cash rate to 2.5% by the end of 2022. Some forecasts expect the cash rate will go as high as 3.5% by December. Although the current cash rate of 1.35% is having a significant impact on consumer sentiment it appears the RBA is still struggling to slow rising inflation. Since the first-rate hike in May Sydney prices have declined by -3.8% and Melbourne prices by -2.6%, and Brisbane prices, which were still very much in the positive territory, are now waining. However, it appears inflation may be more the culprit for the sharp decline in buyer demand and confidence than rising interest rates.

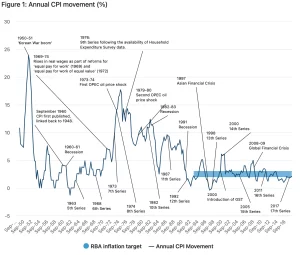

Last week we looked at a 70-year history of inflation in Australia. The costs of goods are on a run-away mission right now however we’ve experienced such rapid inflation periods before and in most instances the property market begins to stabilise once the initial shock and period of adjustment have been noticed. According to CoreLogic, the consumer sentiment index sits at 83.8 which is down a further -20% since December last year. Now, this number means very little to me, however, apparently, anything under 100 is low and indicates a sensitive and overall pessimistic consumer attitude. Consumer sentiment has been this low as recent as the GFC and also during periods in the 80s and 90s. Noting that the cash rate in January 1990 was at 17% which is much lower than what we’ve got now. On all accounts, consumers are pulling back on spending and we’re certainly seeing this in our local property market with a noticeably reduced number of active buyers.

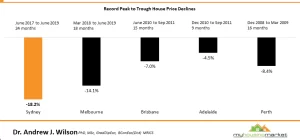

I would have thought the recent interest rate rises have had enough of an impact on consumer spending particularly in the property sector however it’s not the interest rates that are most concerning but rising inflation and until this is under control the cash rate will continue to rise. The August forecast a couple of months ago was said to be a rise of 0.25% however some are now saying they will bump the cash rate up by a further 50 basis points or even 75 basis points. Many economists are forecasting property prices to drop by 10%, 15% and some even suggesting falls of 30%. Historically this would set new records in Australia. An article by Michael Yarndey shared a chart that highlighted record property price falls from peak to trough across our capital cities (see below). It seems less likely that we will see property prices fall so dramatically. I suppose time will tell.

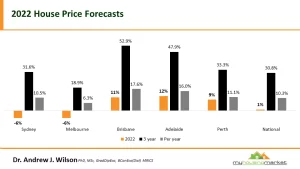

One of Australia’s leading housing economists shares his forecast for property prices in 2022 (see chart below). There are many pros and cons to the current state of the economy and the future outlook for the property market. Fear of rising interest rates and rising inflation top the list for waning consumer confidence. Building costs are also sky-high having risen 22.% last year and all expectations suggest they will rise even further. Property affordability issues are now an obstacle for many looking to purchase a home. On the flip side, there are still fewer good properties available for sale. Household savings are at an all-time high which will provide good insulation for a period against rising costs. Australia’s unemployment is strong and there seems to be some movement with wage increases now too. International immigration is also back on track which will no doubt increase demand for property in our capital cities which I expect will have a flow-on effect on outer markets and regional areas. The Sunshine Coast is also on the hot list of places to live in Australia which may insulate us from massive price decreases. No longer are we in the booming market of 2021 however the longer-term outlook is not all doom and gloom.

AUCTION CLEARANCE RATES – WEEK ENDING 24th OF JULY 2022

- Queensland – 46% (113/1078)

- NSW – 52% (305/1267)

- Victoria – 55% (390/1063)

- ACT – 57% (58/91)

- South Australia – 66% (72/327)

- Tasmania – NA (0/148)

- Western Australia – 66% (3/639)

- Northern Territory – 33% (3/30)

*(Auctions/Private Sales)

REVIEW OF THE WEEK

Great͏ communication & friendly service

“From start to settlement was a smooth process. Leigh͏ was great throughout our home buying experience. He was very knowledgeable about the home we were purchasing & the general area. Shelley and I highly recommend Leigh. If you are thinking of purchasing or selling in the area make sure you give Leigh a call first.” – Palmwoods Buyer