Have We Hit a PEAK in Housing Values?

Weekly Real Estate Market Update with Leigh Martinuzzi MPG

Tim Lawless from CoreLogic defines a “peak” market as one that has had a consistent trend in negative monthly movements. Looking at the data across the capital city markets in Australia, most areas have traveled through peak growth rates with a slowing trend in dwelling price increase however, it is not yet evident that our markets have peaked. Of course, this varies across markets in Australia. So, what can we expect of Australia’s property markets in 2022?

Below is a snapshot view of the peak and current reduced rate of growth in most cities around Australia. Brisbane, regional Queensland, and Adelaide are the only expectations where the growth rate in housing values seems to be avoiding a slowdown. In March of 2021, Brisbane and Adelaide reported a dwelling growth rate of 2.4% and 1.5% respectively. In December they’ve seen a peak rate of 2.9% and 2.6% respectively. And although January is a slower market in general so far Brisbane prices have increased by 2.2% and Adelaide prices by 1.9%. See the information below to compare the growth rates across the rest of the country (provided by CoreLogic).

- Sydney’smonthly growth rate peaked at 3.7% in March and has since reduced to 0.3%

- Melbourne’s monthly growth rate peaked at 2.4% in March, reducing to -0.1% in December (the first monthly decline since Oct 2020)

- Perth’s monthly growth rate peaked at 2.7% in February. After recording only a single month of decline (-0.1% in Oct 2021) the monthly rate of growth has reaccelerated to reach 0.4% in December

- Hobart’s monthly growth rate peaked at 3.3% in March and dropped to 1.0% in December

- Darwin moved through a peak rate of monthly growth in April at 2.7% (0.6% in December)

- Canberra moved through a monthly peak in March at 2.8% (0.9% in December)

A few reasons that may explain why the markets in Queensland and South Australia remain buoyant are due to a positive demographical shift, relative affordability compared to other Australian markets and a consistent lack of property availability. Tim Lawless expects that we may see Sydney and Melbourne hit their peak later this year. These markets have already passed their peak growth rate and the other market across Australia will likely follow. Typically, when we see a slowing growth rate, we can expect a correction phase to follow and sometimes prices can fall suddenly and sharply but that’s not always the case.

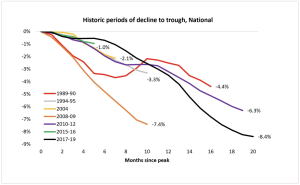

Several factors that will determine how the market will move include, rising interest rates, tightening credit availability, economic conditions, affordability constraints, slowing auction clearance rates, and shifting vendor metrics such as time on market and vendor discounting. Early signs of many of these factors are already being witnessed. CoreLogic provided a chart below that highlights historic periods of market declines. You can see some have fallen sharply over a short period of 3 to 4 months before hitting a trough in about 8 months while others took 20 months to hit the bottom of the market.

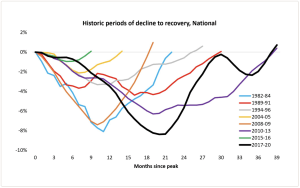

The other charts they’ve provided were the historic periods of decline to recovery. It appears that the time of a declining market is reflected in the time it takes for recovery. For example, the time it takes a market to decline from peak to trough, it takes roughly the same time to rebound to another peak. I think we will see a longer period of a slowing market before a rapid decline to a trough. On all accounts, we may not see the bottom of the market until 2023 and perhaps well into the year. The Southeast Queensland market and here on the Sunshine Coast I believe will be more resilient due to the aforementioned factors which will help keep the market stable.

Auction Results State by State (Preliminary). Week ending Sun 9th of Jan 2022.

- Queensland – =80% (20/1392)

- NSW – 96% (26/1083)

- Victoria – 81% (37/1141)

- ACT – 100% (6/41)

- South Australia – 100% (5/350)

- Tasmania – NA (0/195)

- Western Australia – NA (1/781)

- Northern Territory – NA (0/29)

*(Auctions/Private Sales)

Review of the Week

Positive and Reassuring

My wife and I first met Leigh on the day of the open house for 51 Cheviot Road. He was able to answer all questions and was very direct with responses (something that is appreciated when you’re house hunting). We were fortunate enough that our offer was preferred and thus it led to going under contract. Alyssa and I endured with the banks to obtain our finance and during this time Leigh was nothing positive and reassuring to the buyers which eventually led to us formally purchasing and moving into the property In Summary the team at Martinuzzi Property Group (MPG) were great communicators and great to work with! – Palmwoods Buyer

Highly Recommend

Leigh and Kez could not have made our purchase any simpler. They were really accommodating and friendly to deal with. Very community orientated and had local knowledge of the Palmwood’s area. Would not hesitate to recommend them. – Palmwoods Seller