Navigating the Year Ahead

MPG’s Weekly Real Estate Market Update – January 4, 2024

Happy New Year. Happy 2024.

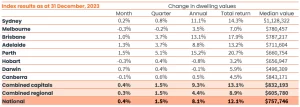

It’s time to reflect on the highs and lows of the Australian real estate market and peer into the crystal ball for what 2024 might have in store. In the realm of numbers, the CoreLogic National Home Price Index sets the stage with a remarkable 8.1% rise in Australian home prices throughout 2023. To provide some perspective, the index took a roller-coaster ride, soaring by an impressive 24.5% in 2021, only to dip by -4.9% in 2022. Meanwhile, Proptrack offers a more conservative figure, reporting a still-healthy 5.52% increase in 2023. It’s safe to say, the property arena is on the rebound.

Looking ahead, it’s a mixed bag of challenges and opportunities. Property shortages persist, fuelled by dwindling new housing approvals and a reluctance among homeowners to part ways with their abodes. The allure of the market, however, remains strong. We may see a potential surge in investment properties hitting the market, as returns wane. Additionally, some homeowners might opt to sell due to mortgage stress. Yet, the scales tip in favour of sellers, thanks to an enduring supply-demand imbalance.

What’s orchestrating these market movements? I believe that The Reserve Bank of Australia (RBA) will lower the cash rate at some point this year, offering a potential tailwind for property prices. Coupled with anticipated government incentives, this might just be the boost new homebuyers need and a lifeline for those grappling with financial stress. A new report by ANZ highlights that currently on average 46.5% of household income is required to service new mortgages, and for renters, 31% is required to cover rental fees.

Despite a softer December market, optimism prevails, with a projected early rebound this year—sooner than the usual ebb and flow. Notably, regional areas are holding their own, experiencing a 4.4% increase in the property price index for 2024. This, however, pales in comparison to the more vibrant 9.3% surge witnessed in our bustling capital cities.

While Sydney and Melbourne markets soften, they’re not without silver linings. A surge in new listings has empowered buyers with choice and negotiating leverage. However, in some areas, a slight decline in competitiveness may extend the time properties spend on the market.

Addressing the elephant in the room—housing affordability. The government’s ambitious plan to build 1.2 million new homes by 2029 seems to be facing scepticism, as historical data paints a challenging picture. In 2017 just over 230,000 dwelling completions were reached, and last year close to 164,000. One report suggests that this year we will see less than 100,000 dwelling approvals. Zoning law changes and private sector involvement are touted as potential saviours, but rising building costs cast shadows on the feasibility of these solutions. One radical solution on the table involves revisiting migration numbers. According to a housing affordability report from ANZ, the median dwelling value to income has risen by a staggering 7.5%. With the cost of goods and services on the rise, many are left with dwindling disposable income.

As we surf the waves of the Australian real estate market in 2024, uncertainty is the only constant. Keep your eyes on the horizon for RBA decisions and government initiatives—they just might be the rudders steering this ship. If you missed my December Quarterly market wrap and thoughts on the year ahead, dive into the insights here.