Floods, War & Interest Rates!! – What does it all mean?

Weekly Real Estate Market Update with Leigh Martinuzzi

Heavy rains, a war in Ukraine, talks of early interest rate rise… what’s next?

It appears Australia’s property market is more resilient than many expect. Last week, there were slight gains in both Sydney and Melbourne of about 0.1%, while prices in Brisbane rose 0.6%, Adelaide, by 0.4%, and Perth by 0.3% over the past week. CoreLogic reports that auction clearance rates last week were just over 70% which is still positive although slightly down on the previous week. CoreLogic also said that for every new property listed for sale 1.2 properties are being sold, which is down from the figure of 1.4 more recently. Resilient, yes! However, it seems evident that the supply and demand equation is becoming more balanced and the real estate markets are changing.

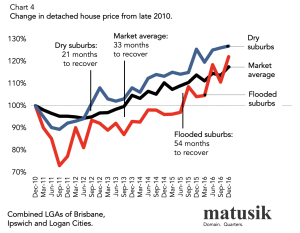

Heavy rains would naturally cause a slow down to the real estate market, particularly in those affected by the rains. It appears that the heavy rainfall is more widespread than what we experienced back in 2011 which had a massive impact on the Australian economy and the Brisbane property market. Matusik estimates that as much as $1 to $1.5 billion could be wiped off the GDP forecast for March, with a possibility we may go into a recession (two consecutive quarters of negative growth). Matusik provides chats to highlights the impact of the 2011 floods had on the Brisbane property market and how long it took for prices to rebound to pre-flood levels. The key difference is that we were in a bottom market coming into the 2011 floods, whereas now we’ve just hit the peak. The floods may bring forward the slowing markets here in the South East.

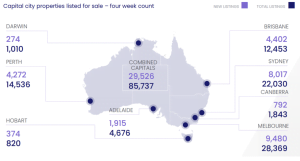

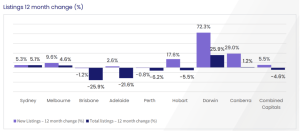

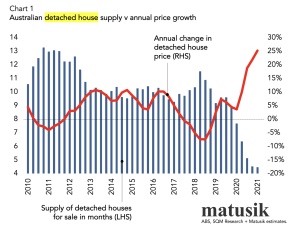

It appears the amount of property coming to the market is picking up pace however not in all areas of Australia. In some parts, like the Sunshine Coast, supply is still insufficient to keep up with the buyer demand. While there is still a noticeable shortfall in housing supply compared to the five-year averages, there is a rise in new listings coming up for sale. It is likely many areas now in Queensland have reached the peak, with some experts suggesting we will now see the property markets stagnate for the next three to five years. As COVID settles, more property owners will attempt to sell to take advantage of higher-than-normal sales prices, which will bring more balance to supply and demand. The chart below highlights the correlation between supply and property prices. As supply increases, property price growth will slow.

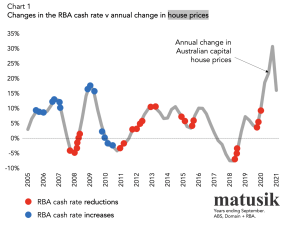

Talks of interest rate rises are bringing a bit more uncertainty to the property markets across Australia. It is a matter of time before we see a cash-rate rise, with most banks already starting to adjust their interest rates. The CBA is suggesting we will see property prices fall by up to 10% in 2023, which will mean we will see stricter lending criteria moving forward. The other major banks are estimating falls between 4% and 8% over 2023. The majority of the interest rate rises will occur in 2023 and 2024, however, Matusik suggests that we can expect to see the cash-rate rise by the end of 2022 by 0.15% taking it to 0.25% and 3% over the next two to three years.

History shows us that a cash-rate adjustment will have a direct impact on housing values (see chart below). The floods will, without doubt, affect the property market vibe. We will continue to see rising inflation. We are already seeing fuel prices rise to $2 per litre and above. Building costs are already causing havoc in the building industry and this is likely to worsen over the coming years and cause a slowing rate of building approvals. I am not sure if there are too many cards up our sleeves to help keep the market afloat as most have already been used. Household wealth is certainly one attribute of the current economy that I think may help soften the blow.

AUCTION RESULTS STATE BY STATE (PRELIMINARY). WEEK ENDING 6TH OF MARCH

- Queensland – 88% (92/1535)

- NSW – 90% (575/1651)

- Victoria – 85% (914/1615)

- ACT – 87% (98/76)

- South Australia – 95% (112/471)

- Tasmania – 100% (1/244)

- Western Australia – NA (1/802)

- Northern Territory – NA (0/35)

*(Auctions/Private Sales)

Review of the Week

Great communicator

“I highly recommend Leigh. I’ve never had such consistent and positive communication with an agent before. Leigh would call me regularly to update me on any progress with our campaign – even if there wasn’t an update, he’d call to say that. It was a breath of fresh air to know that the same of my house was a priority and in good hands.” – Palmwoods Seller

Fantastic Communication

“Throughout the purchase process, Leigh demonstrated great knowledge of the current and local property market. Communication was fantastic.” – Palmwoods Buyer