Christmas Festive Season Market Update

Weekly Real Estate Market Update with Leigh Martinuzzi

As we head into December, property prices are still on a downward trajectory. The year has proven a tough year for many property owners and buyers with the onset of a rapid increase in the cash rate. Since April, we’ve seen a rise of 2.75%, with an expectation that the RBA will continue to push up the cash rate leading into 2023. The next RBA meeting is on the 6th of December, with many suggesting a further rate rise of 0.25% will occur. Rising interest rates will continue to affect buyer sentiment, borrowing capacity, the ability to make reasonable offers, and price expectations of those selling. It is often challenging to navigate through periods of uncertainty; however, the market will stabilise and find its feet, and things will start moving along somewhat more comfortably in 2023.

The RBA governor Tim Lowe apologised this week for announcing back in late 2020 and throughout 2023 that there wouldn’t be a cash rate rise until 2024 or later. On this news, many people took this advice and bought the property. Now, months later, those holding an average mortgage of $500,000 have seen their repayments rise about $800 per month. Further rises in the interest rates leading into 2023 may put more people under mortgage stress in the months ahead. On the economic front, unemployment is at a record low of 3.4%, and we have seen a slight increase in wages across Australia. This may help offset potential mortgage stress. We also expect, once inflation is pulled back in, that the RBA will ease back on cash rate rises, making finances more manageable for many.

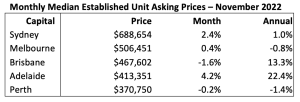

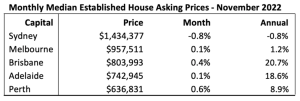

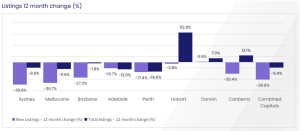

While prices are down nationally over the last month by -1.1% and -5.2% over the last year, the median asking prices for new properties listed over the month of November are up. In Brisbane, asking prices are up 0.4% despite a -1.9% decline in property prices recorded. Prices are reported down in the Brisbane-Gold Coast markets by -7.3% and on the Sunshine Coast by -7.1%. We are still seeing a shortage of homes for sale, indicating that it still may be considered a “sellers” market (see chart below). On top of that, time to sell is still hovering on average around 30 days and vendor discounting is down about 2-3% on their asking prices. Historically, this is still positive.

As we approach December and head on through the festive season into the new year, many sellers do wonder whether it’s a good time to sell. Most put off selling now until well into the new year, with the Autumn months being quite attractive. However, while the coming months may see slightly less activity, it can be a great time to sell. It’s often better to sell in isolation than in competition! With many homeowners choosing to wait, those who do decide to sell now may be better able to attract the best buyers. It’s also a great time to prepare your property for the market, with an early launch in January or February.

AUCTION CLEARANCE RATES – WEEK ENDING 21ST OF AUGUST 2022

- Queensland – 32% (305/1167)

- NSW – 54% (1142/1403)

- Victoria – 55% (1017/1181)

- ACT – 58% (127/81)

- South Australia – 63% (135/318)

- Tasmania – NA (1/150)

- Western Australia – 25% (12/657)

- Northern Territory – 60% (5/18)

*(Auctions/Private Sales)

REVIEW(S) OF THE WEEK

Tough times to sell

My house couldn’t have gone on the market at a worse time, but Leigh and his team managed to get a better result than expected. – Seller