Brisbane Tops Melbourne, Rising Rentals & RBA’s February Outlook

Weekly Real Estate Market Update with Leigh Martinuzzi MPG

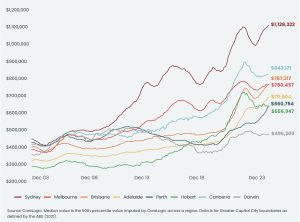

This week’s property market update brings some interesting shifts, especially in the comparison between Brisbane and Melbourne. The spotlight is on Brisbane as its housing market has surpassed Melbourne in the median dwelling value ranks, and Eliza Owens from CoreLogic has shed light on the reasons behind this. The key insight is that Melbourne has a heavier reliance on the unit market compared to Brisbane, where detached housing values play a more dominant role. This distinction naturally affects the overall dwelling value ranking, with Brisbane holding a median value of $787,217, slightly edging out Melbourne at $780,457. The disparity is also evident in the pandemic’s impact on property prices, with Brisbane experiencing a remarkable upswing of 50.2%, while Melbourne saw a more moderate 11% increase.

Migration patterns have played a significant role in shaping these trends. Extended lockdowns in Melbourne and other factors have prompted a decline in population, with Victoria experiencing a loss of 20,000 residents in the year leading up to March 2022. In contrast, Queensland has gained 51,500 residents during the same period.

Shifting gears to the rental market, it’s worth noting that rental fees have outpaced property values three times in the past decade, with notable spikes in 2023, 2022, and 2018. This indicates a growing challenge in housing affordability, with increasing demand pushing more individuals into the rental market. CoreLogic’s estimate of 488,898 national sales in 2023, a moderate 2.8% decrease from 2022, is noteworthy. Despite this national average, specific markets, such as Adelaide, Sydney, and Perth, may be experiencing growth due to a combination of affordability and demand.

The average time to sell a house nationally has slightly increased to 29 days, while regional markets in Australia sit at an average of 41 days. Palmwoods and Woombye on the Sunshine Coast, for example, are hovering around 40 days. Vendor discounting has reduced from 4.5% to approximately 3.5% in the December quarter last year, indicating that sellers are holding firm on their pricing expectations in a market characterised by strong demand and undersupply.

Turning attention to the cash rate, the upcoming RBA meeting on February 6th is generating speculation. While economic growth has slowed since the last rate rise, there is uncertainty about future moves. NAB has adjusted its forecast to a hold, aligning with the other big three banks, all of which are anticipating one or more rate cuts. CBA even predicts a cut as early as September, with all four banks suggesting at least one cut by the fourth quarter of 2024. Buyers seem to be holding back, possibly waiting for a more favourable lending rate, creating an atmosphere where the market may heat up as the year progresses. For those considering entering the market, the suggestion is to act sooner rather than later to avoid increased competition and potential market fervour towards the end of 2024.