A Promising Outlook Amid Challenges

Market Update with Leigh Martinuzzi MPG

The current state of the national real estate market is a topic that’s on the minds of many. As a real estate agent with my finger on the pulse, I’m here to provide you with the latest insights into this dynamic landscape.

The national median house price is currently at a robust $1,063,071, showing a promising 0.7% increase in August. While house price growth has softened somewhat in recent months, there are encouraging signs for an active spring selling season. Despite concerns about homeowners facing unmanageable mortgages, there’s a growing confidence in demand, especially with the noticeable shortage of quality properties available for sale. Nationally, property prices have risen by 3.8% since the August quarter of 2022, coming within 0.9% of the peak seen in April 2022. It’s anticipated that we will surpass thispeak in the upcoming Septemberquarter, setting new records for property prices across most of Australia.

Turning our focus to the Sunshine Coast, median house prices are holding steady, likely due to the scarcity of available properties for sale. In larger regional areas and markets offering more affordable housing compared to capital cities, demand is soaring, leading to higher than average price growth. However, in the mid and high-end market segments, prices have softened over the past year. While some experts, like Heron Todd White, suggest that the Sunshine Coast is entering a declining market phase, I hold a different view. If we witness a surge in new listings during the spring season, it could create more room for buyers to negotiate fairer prices. In particular, demand for land has slowed due to rising build costs and extended build timeframes. This has led to a slight drop in land prices. On the east side of the M1, land prices for 250 to 400m2 blocks typically range from $300,000 to $400,000, while on the hinterland side, larger blocks of 600m2 and above can be found in the $400,000 to $600,000 range.

Property shortages continue to be a common theme in the current market. Buyers must act swiftly when presented with a promising opportunity, as demand for quality homes remains high. An interesting development to note is the increasing prevalence of off-market sales, suggesting that there simply aren’t enough appealing options for buyers looking to enter the market at this time.

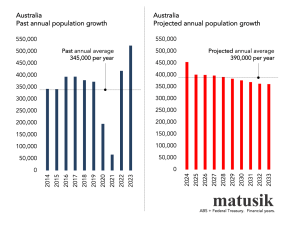

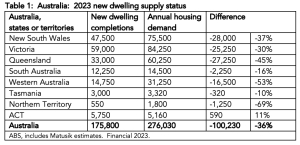

A few charts provided by Matusik offer insights into the future of housing demand. The federal government’s promise to build 240,000 houses annually between 2024 and 2029, along with financial incentives for states, aims to address the rental crisis and housing affordability. However, this year, we’ve seen just over 175,000 new dwelling completions, while demand for housing stands at 276,000 dwellings, leaving a substantial gap of almost 100,000 new homes (a 36% shortfall). This ambitious goal may prove insufficient in tackling Australia’s housing challenges and could potentially exacerbate existing market inequalities.

In conclusion, the Australian real estate market is in a state of flux, with pockets of both promise and challenge. While some areas experience price softening, others continue to see remarkable growth. The supply-demand imbalance remains a key driver, and government initiatives, while ambitious, may fall short of addressing the nation’s housing issues. As we head into the spring season, it’s essential for buyers and sellers alike to stay informed and make decisions that align with their individual circumstances. Anything I can assist you with please get in touch.