A Few Things to Consider in A Softening Market

Weekly Real Estate Market Update with Leigh Martinuzzi MPG

House prices continue to decline over the month of August; however, it has been an improvement from the dwelling price decreases observed in July. Brisbane has recorded a -0.5% decline in values over the month of August yet, year-on-year prices are still up 25.5%. Auction clearance rates last week were low at 26%, with many properties getting passed in or withdrawn from the market. A sign that consumer sentiment in Queensland is still down. In Sydney, they’ve seen an improvement in sales and activity. For August they recorded a decline in property prices of -0.6%, which is better than July’s drop of -2.7%. Buyer activity has improved in our southern states, which should have a flow-on effect for us here on the Sunshine Coast over the coming months.

Massive price gains throughout 2021 and into 2022 saw property affordability getting well out of reach for many. With historically low-interest rates, people could justify, or should I say, afford to service higher mortgage repayments. However, we have now had four cash rate rises since May and a prediction of a few more to come, although historically still low, these interest rate rises coupled with increasing inflation is restricting many buyers from purchasing. Talking affordability, in Sydney right now the portion of your income required to service a new mortgage is 51.3%, and on top of that, it would take on average 14.1 years to save for a 20% deposit. Prices simple cannot keep rising, which is why we are now experiencing a correction in property values. This doesn’t necessarily mean there will be a major crash, with some headlines suggesting prices drop by 30% or $150,000, but rather, that prices cannot continue to climb. During the pandemic, house prices went up 26% with regional markets reporting growth of 42%. A slight adjustment of 5% or so will unlikely be noticed by homeowners who are selling in the current market.

Here are a few things to consider whether you a looking to buy or sell right now.

Property Values Are Declining.

The good news is that property prices have dropped slightly. Pleasing news at least for buyers, but perhaps not so pleasing for sellers. However, considering the average homeowner lives in their home for an average of 8 years, if you were selling now, it is likely you would be making significant gains. The latest property boom occurred in the last couple of years in which property prices rose the most. Selling now means you will still be walking away with money in your pocket unless, of course, you bought in the booming market. Buying now means you will have lower purchasing costs like stamp duty. You will also have more properties to choose from with less competition which means greater buying power, something that certainly wasn’t present during the booming market. On the flip side, if you purchase today and prices decline further, you may be in for a slight loss, keeping in mind that you are probably going to be there for at least 8 years, so any adjustments in prices now won’t be noticed by then. On the other hand, prices may climb again. If you buy today, you may be better off than buying during spring. We’ve seen property sales gain momentum fairly quickly after a slowdown which may just happen again in the coming months.

Mortgage rates are rising.

One advantage of applying for a loan now is that lenders are offering competitive interest rates on variable home loans. This generally happens in a softening market. We can see the loan differentiation gap between new loans and existing loans widen as banks compete to gain new customers. Advantage new home buyers. For those buyers out there waiting for prices to fall some more, you might be worse off if interest rates continue to rise, which they likely will. For a $500,000 loan and an interest rate of 2.41% over 30 years, repayments are approximately $1950 per month. Assuming the market drops 5% and the loan amount is now $475,000, but interest rates go up 3.05%, which they are likely to do in the next six months, repayments would now be $2050 per month. The real advantage of rising interest rates is that it’s helping to stabilise runaway property prices.

A few other things to consider.

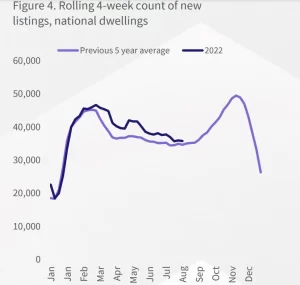

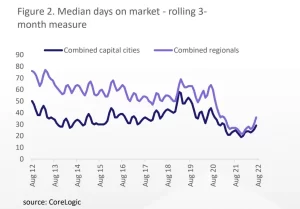

Properties are now taking longer to sell. This gives buyers more time to make their purchase decision and to carry out their due diligence. It also helps buyers in negotiations and for those who are serious about making a move tend to be more negotiable on price. Property reductions are almost 1% higher from this time last year, with vendors now discounting by an average of 3.8%. If you sell now for a reduced price, it is likely that you will buy back in for a reduced price, everything is relative. The other thing to keep in mind for buyers is that during a softening market where there is a lot of uncertainty, property owners become less motivated to sell, meaning less choice. Unless you must sell, why would you for a reduced price? Property prices and listings move together. New listings are now falling closer to the 5-year average with less homes coming up for sale. Total property listings higher, mainly because they aren’t selling as quickly as they were. We will likely see a spike in new listings hit the market as people rush to cash in on the super gains, however, that boat has now sailed. You can still nab a great price right now but don’t expect to attract a price higher than where the market peaked in April. On a final note, for those renting right now may be your time to purchase. There is still a significant rental shortage and it’s likely that rental fees will be rising further when renewing your lease.

That’s about it from me this week. For any property advice or service that I can assist you with please get in touch.

AUCTION CLEARANCE RATES – WEEK ENDING 21st OF AUGUST 2022

- Queensland – 26% (247/1097)

- NSW – 48% (939/1343)

- Victoria – 59% (812/1110)

- ACT – 62% (81/80)

- South Australia – 70% (114/305)

- Tasmania – 100% (1/132)

- Western Australia – 44% (9/652)

- Northern Territory – 17% (6/29)

*(Auctions/Private Sales)

REVIEW OF THE WEEK

Highly Recommended

Leigh was very professional and diligent in selling our property in an extremely timely manner with the best possible outcome. Constant communication at all times (Even after normal people’s working hours) with progress updates and document signing. I would recommend Leigh and his team based on the two business transactions now completed. – Woombye Seller