Sunshine Coast Property Still Running Hot Despite Rising Costs and Limited Supply

By Leigh Martinuzzi | Martinuzzi Property Group – eXp Australia

It’s been another interesting week in the Sunshine Coast property market. The RBA held the official cash rate at 3.60% on Tuesday, keeping things steady for now. It’s clear the inflation story isn’t done yet. They’ve hinted that further rate cuts aren’t likely anytime soon, and the next meeting is set for 8–9 December.

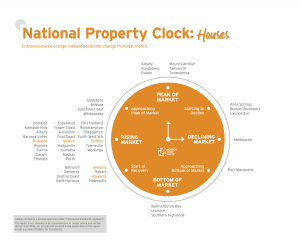

What’s fascinating is how resilient the property market continues to be, especially here in South East Queensland. Prices across the country are still climbing. The Sunshine Coast property market remains one of the most in-demand in Australia. Despite cost-of-living pressures, tight borrowing conditions and constant talk about affordability, people are still moving here in large numbers. Many are relocating from New South Wales and Victoria, chasing lifestyle, climate and opportunity.

National Pulse: Prices Still Rising Fast

Michael Yardney recently wrote that inflation is proving harder to tame because much of it is supply-side driven. Things like fuel, construction costs and the end of government subsidies are keeping prices high. He pointed out that while many expect higher inflation to pull prices down, history shows that doesn’t happen when housing supply is this tight.

Cotality’s latest data shows Australian home values are now rising at the fastest pace in more than two years. That confirms what many of us have been feeling. The market is running hot again.

Michael Matusik, in his recent “Tale of Two Cities” report, compared Melbourne’s earlier boom with what we’re now seeing in South East Queensland. He noted that while our market is performing strongly, the same kind of growth Melbourne experienced could easily cool just as fast. His message is simple. Enjoy the momentum but stay realistic. What goes up quickly can level off when affordability, interest rates or migration patterns shift.

Sunshine Coast: Demand Soars, Supply at Record Lows

Let’s talk local, because this is where it gets interesting.

You weren’t imagining it. Stock has been absolutely smashed.

Back in 2019, there were roughly 10,000 properties for sale across the Sunshine Coast according to SQM Research. During COVID, that number halved to around 5,000. By mid-2023 it had only recovered to about 6,300. Fast forward to today, and realestate.com.au shows just over 3,000 listings across the entire region. That’s less than a third of what we had before COVID, which is staggering.

It’s no wonder buyers are lining up at open homes, making strong offers and competing over quality listings. We’re achieving sale prices we’ve never seen before in some suburbs. And while the market feels mixed, with some segments running hotter than others, demand is still outpacing supply.

Even with higher living costs, rising insurance and mortgage stress, people remain motivated to buy. Many realise that waiting might cost more in the long run if prices keep rising and stock stays low.

First-Home Buyers Back in the Game and Pushing Competition Higher

Herron Todd White’s latest Month in Review also offered some valuable insights this week. Their CEO noted that government support for first-home buyers has shifted from simple grants to more hands-on involvement, such as shared equity and loan guarantees. That’s helping more people get in, but it’s also pushing up competition in the entry-level market.

Kevin Brogan from HTW pointed out that with these new schemes, buyers are now entering the market with deposits as low as two to five per cent, and with fewer income and location caps. The downside is that these buyers tend to cluster in the same affordable pockets, often older units or outer suburbs, which can drive localised price spikes and make those markets more vulnerable if things cool.

On the Sunshine Coast, the first-home buyer sweet spot technically sits around $600,000 to $800,000. But finding properties in that range today is extremely difficult. Most of the homes that sat in that bracket three, six or twelve months ago are now pushing past $900,000, even in the outer suburbs. There’s very little real choice under $800,000 now unless you’re looking further inland or at smaller units and townhouses.

Inflation, Borrowing and What Comes Next

The big question for me right now is what happens when we combine such low supply with rising prices and ongoing cost pressures. Yardney made a good point this week. Inflation today isn’t being driven by booming demand but by rising costs and supply bottlenecks. That makes it much harder for the RBA to fix with rate changes alone.

And that’s where my concern lies. When you’ve got a market this hot, driven by genuine demand and ultra-low listings, and yet households are being squeezed by higher costs, something eventually has to give.

But for now, buyers are still out in force. Many are cashed up from interstate sales or using equity to make their next move. On the Sunshine Coast, we’re still seeing multiple offers and premium prices for quality homes, especially in lifestyle pockets close to the coast.

In short, South East Queensland is still booming. The Sunshine Coast remains a standout performer, and while affordability and inflation are creating headwinds, the weight of demand is keeping this market very strong.

If you’re a seller, this remains an incredible time to list. If you’re a buyer, being prepared and decisive will give you an edge. And if you’re an investor, the fundamentals of population growth, low building levels and limited supply are all still on your side.

If you’d like help navigating this market, whether you’re buying, selling or just planning your next move, I’d love to chat.

Request Your Free Market Appraisal Today! 👉 Click here to book your appraisal

SUBSCRIBE to stay updated with all latest property insights and news 👉 Click Here to Subscribe

The Sunshine Coast Seller’s Guide to Choosing the Right Agent 👉 Get Your Free Guide Here

Preparing for Settlement: A Seller’s Guide to a Smooth Handover 👉 Download the Guide Here