How Far Will Prices Need to Fall to Reach Pre-COVID Levels?

Weekly Real Estate Market Update with Leigh Martinuzzi MPG

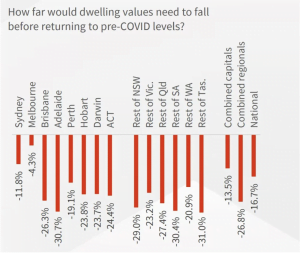

After analysing the market charts this week, I feel there are a few things to share and consider. Firstly, Sydney has now seen double-digit declines in property prices since it peaked in February. Sydney has recorded a 10.1% decline in values, however, they are still in the positive territory since the onset of the pandemic. Prices in Sydney will need to fall a further 11.8% to return to pre-covid levels. While this is unlikely, it may be possible as the global economies struggle with inflation. At home, most efforts from our government are focused on increasing interest rates to help reduce spending. And it seems to be working. Price declines in Brisbane and the Sunshine Coast have been less volatile, which boils down to overall affordability. Arguably Sydney is the most expensive city to live in and usually the most susceptible to rising interest rates, and therefore, they have been experiencing larger drops, as property markets across Australia correct themselves.

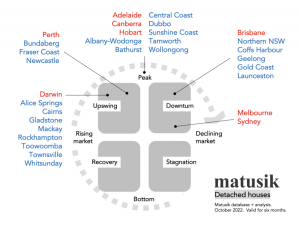

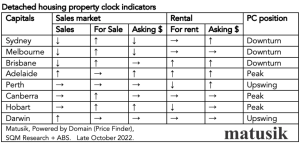

Looking at Brisbane and the Sunshine Coast, we’ve seen less severe declines, with Brisbane recording a 6.1% drop in prices since its peak in June 2022. Noting here that we lag behind the sydney market cycles by about four months, seeing that Sydney’s market peaked in February and then Brisbane in June. So, while the rate of decline is easing in Sydney, we may not have seen the worst of it yet here in Queensland. In Brisbane, and the Sunshine Coast, we would need to see a further drop in prices of 27% and above to see property prices return to pre-covid levels. I feel this will be highly unlikely as most property owners would rather hold on to their property and ride out this part of the housing cycle than sell for less. The chart below provided by Matusik highlights the current property clock.

The good news is that there are still active buyers in the marketplace. Naturally, we will find our bargain hunters, but from experience on our end, we haven’t seen such sales happen. Last weekend, out of two recently listed properties, we received four written offers. Buyers don’t seem to be as urgent or enthusiastic with their first offers, with efforts to protect themselves from further rising interest rates, however, offers are coming in well above pre-covid levels, which for many sellers should be pleasing news. It looks as though we will see further interest rate rises and I expect a slower start to the year in 2023. If it were me, I’d be trying to do my best to secure a sale this side of Christmas as the uncertainty of our economic stability leading into 2023 appears shaky.

Assessing Borrowing Capacity

How is your borrowing capacity tested in a market with rising interest rates? Late last year, 2021, APRA, a governing body of the financial services industry, increased the loan ‘serviceability buffer’ from 2.5% to 3%. With variable interest rates currently sitting in the vicinity of 4% to 5%, this means they will test your borrowing capacity at a rate of about 7% to 8%. That rate varies for interest only and investment property loans. So if you are looking to borrow $500,000 your repayments will be assessed to cover approximately $40,000 in annual repayments compared to actual repayments of around $30,000. This is aimed to help avoid families and individuals from going into mortgage stress in a market with rising interest rates and a rising cost of living.

If you need to speak with a financial broker about a new or existing loan, please let us connect you. We work with one of the leading brokers here on the Sunshine Coast who are happy to provide you with no-obligation advice and services.

AUCTION CLEARANCE RATES – WEEK ENDING 21ST OF AUGUST 2022

- Queensland – 34% (252/1187)

- NSW – 56% (799/1493)

- Victoria – 59% (1203/1159)

- ACT – 58% (83/86)

- South Australia – 68% (125/335)

- Tasmania – NA (0/136)

- Western Australia – 13% (8/666)

- Northern Territory – 100% (2/36)

*(Auctions/Private Sales)

REVIEW OF THE WEEK

Outstanding service

Leigh achieved a great result for us, very happy with the service and professionalism! – Seller

Friendly, collaborative, and seamless experience

We arrived late for the inspection, but Leigh was willing to hang around for us to have a proper look. Glad he did as we ended up buying that property! Always willing to share knowledge on the area and guidance around the process. Leigh was always friendly and remained in constant communication as it became clear we were going to put an offer in. From that point on Leigh made sure the whole experience was simple and he made it incredibly easy for us to make a considered decision but with no pressure. – Buyer