2022 Property Market Insights

Weekly Real Estate Market Update with Leigh Martinuzzi MPG

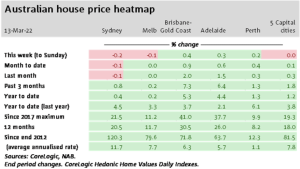

In real estate news this week, we’ve seen a further slowing of the property markets in Sydney and Melbourne both recording a slight decline in the growth rate last week of -0.2% and -0.1% respectively. Auction clearance rates across Australia also soften with CoreLogic expecting this trend to continue as property price growth continues to soften throughout 2022. In Brisbane, last week property prices rose slightly by 0.4% which was down from the previous week by 0.2%.

It is becoming more evident that this year’s property markets won’t be anything like we experienced last year. It might be due to increasing uncertainty created by some recent events causing a pause in the market such as the flood events across the east coast and the war in Ukraine. Or perhaps the impacts of inflation, talk of rising interest rates, upcoming elections and rising costs are starting to add a tad more caution to those currently looking to buy.

Dwelling values across Australia fell in February to 20.6% over the 12-month period down from January’s recorded growth of 22.4%. Of course, some markets are performing much better than others. Brisbane for the 12 months to February recorded 29.7% growth while regional NT reported a 7.1% rise in property prices over the same period.

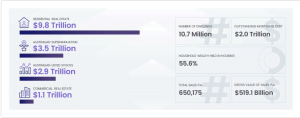

There is a noticeable trend in more new properties being listed for sale with national figures suggesting new listings are up 4.8% on this time last year. And while buyer demand has reduced slightly with CoreLogic now suggesting that for every new home listed for sale 1.2 are sold, it appears buyers are still snapping up properties that represent good value still relatively quickly. Property transactions for the month of February are 46.1% above the five-year average with an estimated 57,000 transactions having taken place. Sales transactions in the 12 months to February 2022 were an estimated 650,175 which is a rise of 37.7%.

I think this highlights that the buyer demand now is still very capable of absorbing the new properties that are coming to the market and some of the older stock too however, I imagine this will shift soon as more properties continue to be listed for sale. Property discounting remains at a record low with the average discounting rate in Australia sitting at approximately -3.2%. The time it takes to sell a property rose in February and now sitting around 30 days nationally which is up from the previous average of 21 days. With tightening, credit controls lending approvals have also slowed, dropping 4.4% from the previous month.

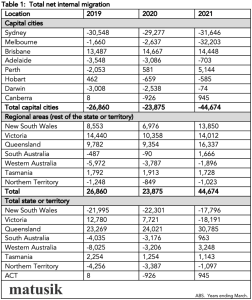

Locally, I think we will see a slowing market however it might be a few more months before we catch up. The main thought for this is that while new listings are slightly up, on the Sunshine Coast they are still well behind the five-year average. On top of this, due to the current internal migration taking place in Australia, Queensland and the Sunshine Coast has experienced significant population growth which has added more buyer demand to an already tight market (see chart below). Of course, this will change as borders open and folk start moving interstate and overseas and international visitors start migrating back to Australia’s capital cities. My advice to those thinking of selling this year is to get your property up for sale sooner rather than later.

As always, in a time in which uncertainty of the real estate markets prevails, it’s always best to seek professional expert advice. The team and I at MPG are happy to arrange a consultation with you to discuss any of your real estate needs.

With household equity having grown significantly over 2021 due to the large surge in dwelling prices across Australia I think it is safe to say that homeowners who have realised increasing equity will lead the way in the property markets across 2022. Investor activity and lending has already climbed to record heights in early 2022 with property lending at approximately $10.9 billion. Rental demand is still at an all time as many ‘would-be-buyers’ are forced to rent and worsening affordability pushes many away from purchasing. Unit demand from property investors will be back in the spotlight in 2022 as affordability represents greater value at the time and rental yields favourable as people start to move back to our capital cities for work and as international borders open.

AUCTION RESULTS STATE BY STATE (PRELIMINARY). WEEK ENDING 6TH OF MARCH

- Queensland – 80% (104/1480)

- NSW – 84% (602/1611)

- Victoria – 81% (381/1405)

- ACT – 95% (60/85)

- South Australia – 92% (884/383)

- Tasmania – 50% (2/233)

- Western Australia – 100% (2/741)

- Northern Territory – 75% (4/32)

*(Auctions/Private Sales)

REVIEW OF THE WEEK

The Rainmaker, as we nicknamed him – Leigh Martinuzzi!

Great work ethic. Communication was awesome. His knowledge and love of the Palmwoods area are reflected in his sales. Great happy disposition and always willing to assist no matter what the question may be. Our overall experience with Leigh is that he personally assisted us in moving forward and feeling quite positive and extra happy with our home sale!! We would recommend him highly!!! .- Palmwoods Seller

Professional

Leigh was professional, transparent, and great at managing the transaction between all parties. His great communication skills & shared knowledge enabled us to make an informed decision in a timely manner and secure a great home in Palmwoods.- Palmwoods Buyer