Why the Australian Property Market Won’t Crash Despite the Headlines

By Leigh Martinuzzi MPG – eXp | Luxury

The Australian property market has always been a magnet for sensational headlines, with predictions of dramatic crashes often dominating the narrative. But while the media may focus on short-term fluctuations, the bigger picture tells a very different story. As we step into 2025, it’s clear that the fundamentals of the Australian property market remain strong, and a crash is highly unlikely.

Here’s why the market is far more resilient than the doom-and-gloom headlines suggest.

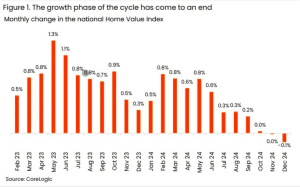

December’s Decline in Context

Yes, December saw a slight decline in property values—CoreLogic data shows a modest 0.1% dip nationally, the first monthly fall in nearly two years. But let’s put this into perspective. This decline was primarily driven by Melbourne (-0.2%) and Sydney (0.0%), while other markets such as Perth, Adelaide, and Brisbane continued to show strength.

On a year-on-year basis, national property values rose by 4.9%, adding approximately $38,000 to the median home value. Regional areas and lifestyle destinations, like the Sunshine Coast, have also experienced substantial growth. Media outlets often magnify short-term declines, but the broader view highlights a property market that remains robust and resilient.

Resilience in Regional and Lifestyle Markets

Lifestyle markets like the Sunshine Coast have consistently outperformed due to their unique appeal and limited supply. Over the past year, the Sunshine Coast recorded a remarkable 7.8% growth in property values. Looking at the longer-term picture, the region’s lifestyle and infrastructure developments have cemented its position as one of the country’s most sought-after destinations.

Nationally, Perth, Adelaide, and Brisbane have led the charge in 2024, with Perth recording a staggering 21% growth year-on-year and Brisbane not far behind at 8.3%. Regional markets also demonstrated resilience, with many areas benefiting from increased migration and demand for affordable, lifestyle-focused housing.

Supply and Demand Dynamics

One of the biggest reasons Australia’s property market won’t crash is the persistent imbalance between supply and demand. With population growth surging—thanks to record levels of migration—and construction rates failing to keep up, the demand for housing continues to outstrip supply.

CoreLogic and other experts have highlighted the ongoing housing shortage, with Australia needing to build around 300,000 new homes annually just to meet current demand. However, building approvals remain significantly below this level, and high construction costs are further slowing the delivery of new homes. This ensures that property values are underpinned by structural scarcity, even in softer market conditions.

The Luxury Market and Shifting Buyer Preferences

The luxury property market also tells an interesting story. While this segment can be more volatile, demand for high-end homes has remained strong in lifestyle destinations like the Sunshine Coast. The region’s top 5% of homes have seen a staggering 55% growth in value since 2019, reflecting the ongoing appeal of premium properties.

At the same time, affordability challenges are pushing many buyers towards more attainable options such as townhouses and units. These property types offer a solution for buyers looking to enter the market without stretching their budgets to breaking point.

The Role of Interest Rates and Borrowing

The Reserve Bank of Australia’s decision to hold the cash rate steady at 4.35% in December 2024 offers some breathing room for borrowers. Speculation about potential rate cuts in 2025 has already sparked interest, with many expecting one or two reductions by mid-year. While these cuts will improve borrowing capacity, they won’t completely solve affordability issues.

CoreLogic estimates that a 1% rate cut could expand the affordability range for middle-income households from $500,000 to $580,000. However, with the national median house price sitting at $800,000, the gap remains significant. Buyers who act early in the year may find themselves in a better position before increased demand from rate cuts intensifies competition.

Final Thoughts

Despite the media’s tendency to amplify short-term negatives, the broader view of Australia’s property market is one of resilience and stability. Whether it’s the strong year-on-year growth of 4.9%, the ongoing appeal of lifestyle markets like the Sunshine Coast, or the structural scarcity of housing supply, there are plenty of reasons to feel confident about the market’s future.

For those considering buying or selling, the key is to focus on your own goals and circumstances rather than trying to time the market. The Sunshine Coast remains a standout destination, offering opportunities for homeowners and investors alike.

As always, I’m here to help you navigate these trends and make informed decisions. Reach out to the team at Martinuzzi Property Group to discuss your property goals for 2025.

Stay optimistic and stay informed—because the Australian property market isn’t crashing anytime soon.