Why Lower-Priced Homes Are Leading the Market Surge: Sunshine Coast Property Market Update

By Leigh Martinuzzi | Martinuzzi Property Group – eXp Australia

The year is off to a strong start, and while many are easing back into routines, the property market is already showing some clear trends. As we digest the latest quarterly data, one thing stands out: the market’s momentum is coming from the bottom up. Lower-priced properties are outperforming, and national forces are converging to reshape where and how people buy.

Let’s take a look at what’s happening nationally and what it means here on the Sunshine Coast.

Lower-Priced Homes Take the Lead

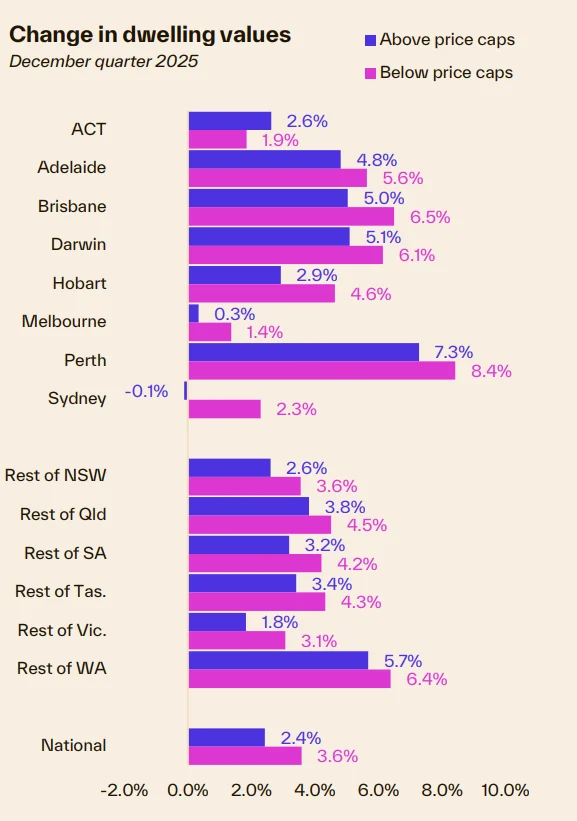

New data from Cotality shows that homes priced under the government’s expanded Home Guarantee Scheme caps rose 50% faster than higher-priced homes in the December quarter (3.6% vs 2.4% nationally). This is no accident. High interest rates and serviceability hurdles haven’t killed buyer demand-they’ve just redirected it. Buyers and investors alike are concentrating their activity into more affordable homes.

In fact, investor demand is back with a bang. They made up 41% of mortgage demand in Q3 2025, driving investor credit growth at its fastest pace since 2015. Investors are now competing directly with first-home buyers in the same entry-level price brackets, intensifying demand at the lower end of the market-precisely where supply is tightest.

Across nearly every capital city and regional market (except the ACT), properties below the price cap outperformed those above. On the Sunshine Coast, where many homes fall under these thresholds, this means we’re likely to see ongoing price pressure on more affordable stock.

National Market Wrap – 2025 in Review

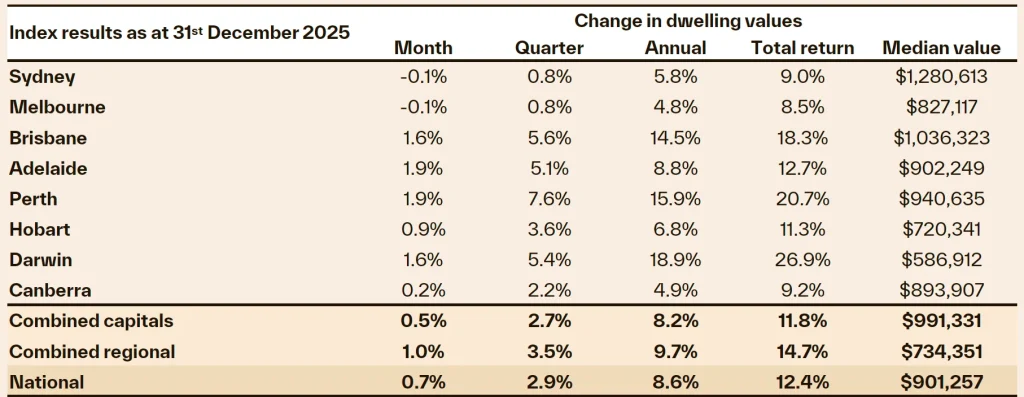

Cotality’s Home Value Index ended 2025 up 8.6% nationally, lifting the median dwelling value to $901,257. December’s 0.7% rise marked the smallest monthly gain in five months, though that’s a seasonal pattern rather than a signal of slowing.

Here are the median dwelling values by city at the end of 2025:

- Brisbane: $1,036,323 (14.5% annual growth)

- Sydney: $1,280,613 (5.8%)

- Melbourne: $827,117 (4.8%)

- Adelaide: $902,249 (8.8%)

- Perth: $940,635 (15.9%)

- Darwin: $586,912 (18.9%)

- Hobart: $720,341 (6.8%)

- Canberra: $893,907 (4.9%)

Regional areas, including ours, outpaced the capitals again with combined regional markets rising 9.7% in 2025 compared to 8.2% for the combined capitals.

What It Means for Buyers, Sellers, and Investors

In this environment, speed isn’t everything. As PRD’s chief economist Dr Diaswati Mardiasmo noted this week, “Caution, not speed, will define property success in 2026.” Buyers and investors are being urged to take a strategic view, balancing long-term growth prospects with risk management, particularly as interest rates remain uncertain.

For investors, the smart money is moving into multi-generational housing, build-to-rent models, and affordable two-bedroom units, especially in areas with future infrastructure and strong rental demand. Existing homes are also becoming more attractive due to high construction costs and slower new supply.

For sellers, now is a good time to assess whether your property falls into the high-demand brackets. Homes that are affordable, well-located, and low-maintenance are hotly contested.

Sunshine Coast Spotlight

Locally, we continue to benefit from structural demand drivers: high migration, relative affordability compared to Brisbane and Sydney, and lifestyle appeal. Stock levels remain tight, and buyer competition is most intense under $900,000.

We’re seeing increased investor activity in the Coast’s duplexes and entry-level homes, while upsizers continue to seek homes with space for multi-generational living. Properties near schools, hospitals, and transport are particularly desirable.

Local News and Council Updates

Council is progressing with several key infrastructure projects in 2026, including continued upgrades to the Sunshine Coast Public University Hospital precinct and preliminary works for the new Maroochydore City Centre expansion.

Population forecasts remain strong, and with limited new housing supply in the pipeline, these infrastructure improvements are likely to further support property values across the region.

Final Thoughts

The market is moving, but it’s not moving evenly. Lower-priced homes and strategic property types are leading the charge. Whether you’re looking to buy, sell, or invest in 2026, having a clear plan and good advice will make all the difference.

If you’d like help navigating the market whether you’re buying, selling, or just planning ahead, feel free to reach out.

Request Your Free Market Appraisal Today! 👉 Click here to book your appraisal

SUBSCRIBE to stay updated with all latest property insights and news 👉 Click Here to Subscribe

The Sunshine Coast Seller’s Guide to Choosing the Right Agent 👉 Get Your Free Guide Here

Preparing for Settlement: A Seller’s Guide to a Smooth Handover 👉 Download the Guide Here