Where Will Property Prices Go Next? Australia and the Sunshine Coast Outlook

By Leigh Martinuzzi | Martinuzzi Property Group – eXp Australia

As we head deeper into spring, a question I hear almost daily is: “Leigh, what’s going to happen to Sunshine Coast property prices in 2025?”

It’s a fair question. After two years of interest rate hikes, affordability pressures, and buyers forced to make tough choices, prices in most parts of the country are still nudging higher.

On the Sunshine Coast, the story is even more interesting: steady prices, a shortage of land, and big-ticket infrastructure that is set to reshape how people live and move around here.

National Property Market Performance in 2025

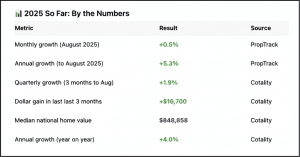

Nationally, PropTrack’s August Home Price Index showed another 0.5% rise for the month, with values now 5.3% higher than a year ago and sitting at record highs. Over the past three months alone, Cotality data shows national house values climbing 1.9%, adding around $16,700 to the median home price.

At the end of August, the national median dwelling value stood at about $848,858, up just over 4% year on year. These figures confirm that 2025 has already been a year of steady, broad-based growth, with the market warming as we head into spring.

At the same time, inflation surprised on the upside at 3.0%, higher than expected and enough to cool hopes of an imminent RBA rate cut. Consumer confidence also dipped again last week according to ANZ-Roy Morgan, reflecting households still feeling the pinch of higher living costs.

Ordinarily, you would expect that combination of high rates and weak sentiment to weigh on prices, yet the housing market continues to show resilience, largely because demand far outstrips supply.

Forecasts for 2025 and 2026

Banks and forecasters have been refreshing their views in recent weeks. NAB has become more optimistic, now predicting around 6% growth in 2025 and another 6% in 2026 across the capital cities.

Westpac remains more cautious, tipping a gain of around 3% in 2025, while Domain expects house and unit prices to continue rising through 2025 to 2026, with most capitals set to hit record highs.

Savills takes a longer view, projecting around 23% cumulative growth over the next five years, which works out at roughly 4 to 5% per annum. None of this calls for a boom, but the consensus is clear, prices are more likely to grind higher than to fall, barring a major shock.

Sunshine Coast Outlook

On the ground here on the Coast, I would agree with that outlook, modest growth, much like what we have seen this year. Where I see the real strength is in two distinct segments.

-

Lifestyle pockets: tightly held suburbs where buyers want walkability, beach or hinterland amenity, and limited new supply. These areas will continue to outperform because scarcity and lifestyle appeal simply cannot be manufactured.

-

Entry-level homes: properties under $1 million. With the Federal Government’s expanded Home Guarantee Scheme kicking in from 1st of October, more first-home buyers will be able to access properties in this range, and that is going to add fuel to an already competitive sector.

What Buyers, Sellers, and Investors Can Expect

Turnkey homes will be in hot demand. Buyers right now are showing little appetite for renovation projects, and we are already seeing time on market stretch out for homes that need substantial updating. If you have a home that is fresh, modern, and ready to move into, expect strong results. Conversely, if your property needs work, pricing it realistically will be critical to avoid it sitting stale.

Land is another fascinating part of the equation. There is a real scarcity of available blocks across the Sunshine Coast, and that will underpin values for the foreseeable future. The truth is, even sloping blocks are starting to move because options are so limited. While supply is tight, outcomes for landowners will remain solid, and any new release is likely to attract plenty of interest.

Risks to Watch

If inflation proves sticky and the RBA delays rate cuts well into 2026, borrowing power will not improve much in the short term. Confidence is fragile and could be knocked lower if unemployment rises.

On the flip side, we could also see stronger gains if cuts arrive sooner than expected or if the new buyer incentives really kick demand into gear. For now, the most likely outcome is modest growth, not a boom, not a bust.

My Final Take

While nationally growth may hover around 3 to 5%, here on the Sunshine Coast I expect the pace to be slightly stronger, somewhere in the order of 5 to 7%. Premium, move-in ready homes and anything under a million dollars will lead the charge, while renovation stock will need sharper pricing.

Landowners will remain in a strong position, and those walkable lifestyle pockets will continue to show their resilience. With major projects like the Beerwah to Birtinya rail link and The Wave connection to Maroochydore and the Airport moving closer to reality, the medium-term outlook is even brighter.

So, while the headlines may talk about affordability challenges and higher living costs, the fundamentals of our market remain strong. If you are looking to make a move, whether that is buying, selling, or investing, the next year could provide a window of opportunity before rate cuts and population growth add further pressure. Now is the time to start planning your strategy.

If you’d like help navigating the market, whether you’re buying, selling, or just planning ahead, feel free to reach out.

Request Your Free Market Appraisal Today! 👉 Click here to book your appraisal

SUBSCRIBE to stay up to date with all the latest property insights and news. 👉 Click Here to Subscribe

The Sunshine Coast Seller’s Guide to Choosing the Right Agent 👉 Get Your Free Guide Here

Preparing for Settlement: A Seller’s Guide to a Smooth Handover 👉 Download the Guide Here