There Won’t Be a Significant Market Crash

Weekly Real Estate Market Update with Leigh Martinuzzi MPG

Property markets across Australia are slowing. While their enthusiasm has declined there are still many buyers on the lookout. At the same time, property sellers are still expecting top dollar in record time. The market predicts the market, and it will take both willing sellers and buyers to negotiate fairly to find a happy medium. Those who are not willing to do so will simply miss out. We can see how buyer sentiment has been reduced by looking at the auction clearance rates, which at approximately 71% was the lowest this year. The RBA’s cash-rate increase, which is two years ahead of schedule, and more to come certainly creates more hesitation among buyers to purchase.

High property prices worsening housing affordability and now higher interest rates make matters worse as buyers will be less inclined or able to pay premium prices. However, it is not all over yet. Property prices have risen a further 0.3% across Australia, and Brisbane has recorded a 0.5% growth so far in May. There is still a very low level of property availability and still plenty of buyers to absorb what does come to market. The median time for a property to be on the market has risen from just 21 days as of December 2021 to 27 days. While there may not be as much urgency, in historical terms, things are still moving fairly quickly.

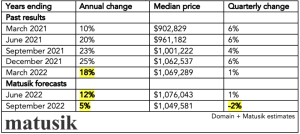

I understand that I often provide conflicting viewpoints on what’s ahead however, the future of property values may be more positive than what many may fear. Talks of a significant market crash I believe are not on the cards. I actually think that while the markets seem to be stabilising now, there may be more price increases in the year ahead and maybe even a few years ahead. Have a look at the chart below and Matusik’s predictions for the year ahead. These figures are the national averages. One would expect prices on the Sunshine Coast to be 1.5 to 2 times above these averages. That means if you bought in September 2021 your property could be worth 5% to 10% and maybe a smidgen more by September 2022. Not too bad going.

Beyond this, well no prediction on my end, however, one would expect prices to flatten out. In saying that, if our dollar losses its value and inflation is not bought under control, people will be more likely to hold on to assets like property for safekeeping. If that happens, we can expect an ever-increasing tightening of property availability which means those who want to buy will likely have to meet the seller’s expectations. So, on that note, we may see prices continue to hold firm and even increase but perhaps not as heavily as we’ve seen in the last 12-18 months.

You can see in the chart below the RBA’s updated forecast for GDP, CPI and Unemployment. With increasing interest rates and costs of goods, and more price hikes to come, more people will need to work. I think it unlikely that wages will rise as the costs of doing business will rise and most companies are unlikely to pass on wage increases for this reason. I am not sure the state of the economy is looking too bright, however, I think this will reason enough for property prices to remain good without the doom and gloom of a crash. Certainly, in our local market, property prices haven’t fallen this year, they’ve increased! And I still am seeing great prices being achieved today.

Grab a copy of the March Quarterly Newsletter here.

Auction Clearance Rates (Preliminary). Week Ending 8th of May 2022

- Queensland – 57% (111/1172)

- NSW – 82% (394/1607)

- Victoria – 82% (494/1298)

- ACT – 92% (53/91)

- South Australia – 94% (110/365)

- Tasmania – N/A (0/211)

- Western Australia – 100% (2/774)

- Northern Territory – N/A (0/18)

*(Auctions/Private Sales)

REVIEW(s) OF THE WEEK

Great service

“Leigh was a great agent, with wonderful communication and efficient service. He sold my house in a matter of days for the price he said it would sell for and the whole process was drama free and very easy. I would recommend Leigh Martinuzzi to sell anyone’s house if you want results!” – Palmwoods Seller

Home purchase in Palmwoods QLD

“Leigh and the team at MPG made purchasing our house an absolute breeze. They went out of their way to make a potentially stressful time, so much easier. Even following up after the sale was finalised just to see how we were going. Thanks so much.” – Palmwoods Buyer