The RBA Holds Cash Rate Steady at 4.1%: A Look at Australia’s Housing Market

Weekly Real Estate Market Update with Leigh Martinuzzi MPG

In a time of economic uncertainty, the Reserve Bank of Australia (RBA) has decided to maintain the cash rate at 4.1% this week. This decision comes as great news for homeowners and mortgage holders, providing some stability amidst the ever-changing real estate landscape. Let’s delve into the latest trends in the housing market and explore how recent developments might impact the market in the coming months.

The national dwelling price index reveals a positive trend, with housing values witnessing a steady growth of 0.7% in July. This marks the 5th consecutive month of growth, indicating a robust real estate market. While the rate of growth has slowed, it is likely due to continued uncertainty surrounding potential cash rate increases. However, with the recent hold by the RBA, there is optimism that this might stimulate further growth, especially as we approach the Spring season. Nationally, housing prices are now up by 1.36% year-on-year, a sign of the resilience of the market despite challenges.

Interestingly, the slowdown in growth appears to be more pronounced in the higher-end segment of the housing market, while the middle and lower segments are showing greater resilience. This could be due to changing buyer preferences and affordability concerns. Nevertheless, the overall growth in housing values provides a positive outlook for homeowners and property investors alike.

Over the month of July, there has been some reprieve in supply issues, with listings reported to be up by 3.9% in a four-week period. Sellers seem to be attempting to pre-empt tougher conditions that may arise later in the year, choosing to sell during a period of low stock to beat the usual Spring rush. Despite this improvement, stock levels are still relatively low, with numbers down by -18.3% compared to the same time last year and -23.3% below the five-year average. This continued low supply may have implications for the market’s future dynamics.

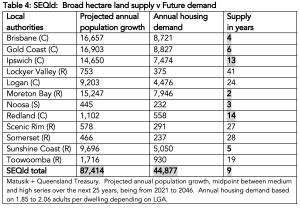

Matusik has provided some intriguing insights into housing supply forecasts, particularly in Southeast Queensland. The forecast suggests the possibility of around 390,000 new dwellings, both attached and detached, with approximately 215,000 potentially ready within the next decade. However, when compared to the population forecast of 87,000 per annum, it becomes evident that this supply might not be sufficient to meet future demand. My belief is that the current supply versus demand imbalance may lead to a shortage of housing in the region over the next decade.

Taking a closer look at the Palmwoods and Woombye markets in the Sunshine Coast hinterland, we find that both areas have experienced a decline in dwelling values over the past 6 months. Palmwoods, with a median house price of $879,000, has seen a decline of -2.6%, while Woombye, with a median house price of $847,000, has experienced a decline of -2.1%. Despite these declines, both markets show potential, with an average time to sell of 42 days in Palmwoods and 40 days in Woombye. Moreover, the number of buyers looking to purchase per listing suggests continued demand in the area.

The RBA’s decision to hold the cash rate steady at 4.1% provides some stability for homeowners and mortgage holders amidst a growing housing market. While housing values have continued to rise, there are indications of a slowdown, particularly in the higher-end segment. Supply issues remain a concern, and Matusik’s insights highlight the importance of addressing housing supply imbalances in Southeast Queensland. As we look ahead, the Palmwoods and Woombye markets on the Sunshine Coast hinterland offer potential for both buyers and sellers, despite recent declines in dwelling values.