The Australian Real Estate Market On the Rebound

Weekly Real Estate Market Update with Leigh Martinuzzi MPG

The Australian real estate market is making headlines once again, as housing prices reached a remarkable milestone, surging to a staggering $10 trillion by the end of August 2023. This resurgence marks a return to the peak levels last seen in June 2022. Please enjoy this week’s market update.

Despite facing a peak-to-trough decline of approximately -9.1%, the Australian housing market has displayed remarkable resilience. Since March 2023, property values have bounced back, showing a 4.9% increase. We are now merely 4.6% away from the peak levels in property prices recorded in April 2022.

This impressive rebound can be attributed to the sustained population growth driven by increasing migration and fewer departures. This demographic shift is not only boosting demand for housing but also intensifying competition among buyers due to the limited supply, which remains 23% below the five-year average.

Major banks have adjusted their price growth predictions, and the consensus is clear: prices are expected to continue their upward trajectory over the next year or two. This optimism stems from the persistent supply shortage, which shows no signs of abating.

However, some experts argue that the current market heat may subside if supply levels normalise. However, given the current supply-demand dynamics, this outcome seems unlikely.

The driving force behind this resurgence is primarily focused on Australia’s capital cities, with Sydney, Canberra, and Brisbane showing solid positive growth. Year-to-date data reveals that Sydney has experienced a robust 7.8% increase in property prices, and Brisbane with a 4.7% rise. Cash buyers from southern states still show eagerness to move to the Sunshine Coast, which will likely put upward pressure on competition for properties available for sale here.

Nevertheless, the property market’s outlook remains somewhat uncertain. Across our capital cities, prices are now above the previous peak in 2022 by 0.8%.

Economists suggest that we may have witnessed the peak of the cash rate, with expectations that rates will begin to ease in early 2024. Coupled with the upcoming national election, there is a likelihood that we will witness improved buyer and seller confidence in the property market unless unforeseen major events disrupt this trajectory.

For those who were waiting for a substantial drop in property prices, it appears that the ship has sailed. As renowned property expert Michael Yardney aptly states, “Property values are almost back to their previous peaks, and soon new heights will be reached.”

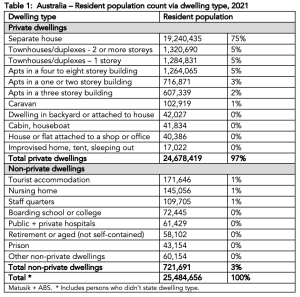

Recent insights from Matusik offer intriguing glimpses into changing housing preferences and population density. Among all Australians, a staggering 97% reside in private dwellings, with 75% opting for separate/detached housing.

The data showcases a notable increase in backyard-style homes, as well as a significant uptick in apartments and townhouses. This suggests that many individuals are choosing more compact living arrangements, driven by factors such as affordability and lifestyle choices. Nevertheless, the desire to own a house and land remains strong, often requiring relocation to suburban areas.

The Australian real estate market continues to demonstrate remarkable resilience and growth, fuelled by population growth, constrained supply, and shifting housing preferences. As the market approaches previous peak levels, opportunities and challenges abound, making it a dynamic and evolving landscape for both buyers and sellers.