Weekly Real Estate Market Update with Leigh Martinuzzi MPG

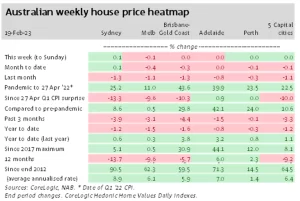

I know I’m going to sound like a broken record, but the property market is showing great resilience. Despite the recent cash rate rise, buyer numbers are up. Last weekend we had above-average numbers attend our open homes, and new enquiries are good. If you look at prices across our capital cities, you can see a strong sign that price declines are easing and growing consumer confidence. Last week Sydney noticed a slight increase in prices by 0.1%. And the auction clearance rates in Sydney were the highest they’ve been in a year. Brisbane, Adelaide, and Perth remained flat, and Melbourne saw a small drop of just -0.1%. My feeling is that over the next couple of months, we will see more buyers making confident offers and purchasing properties that represent great value.

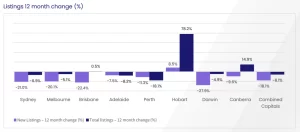

As I mentioned last week, buyers will hold back for only so long, and once the market starts moving again and buyers see properties going under contract i expect we will see a flurry of buyer activity. Have a look at the number of new listings now. Sellers are also holding back! While total listings are down to historic lows, they’ve moved up slightly, mainly due to properties now taking longer to sell. New listings on the other hand are few and far between. With improved buyer confidence, well-located, well-presented properties will be snapped up quickly. Vendors will need to have some wiggle room around their price expectations. The average discounting from the listing to the sale price now is 4.3% on average nationally.

CoreLogic’s head of research stated this week that lifestyle destinations have been some of the hardest hit by softer marketconditions and rate rises. She said, “regional areas would not be immune from softer conditions.” After CoreLogic’s regional market review, which analyses data and market trends of Australia’s 25 largest non-capital cities, Ms Owen feels that the current downward trend is one “we can expect to see playing out at least until interest rates top out.” She further suggested, “With this in mind, sellers will need to be realistic about their pricing expectations, make sure they have a quality marketing campaign behind the property and be ready to expect some negotiation from buyers. Considering some of these regional values will have only moved through a peak in the cycle more recently, it’s likely there will be a lag between buyers and sellers, and it may take some time for vendors to adjust their expectations.” On a final note, she did indicate the regional Australia is showing more resilience than capital city markets.

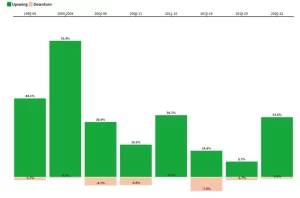

This a reminder that our property market moves in cycles. We see generational booms followed by declines, and history paints a pretty picture of this. Will prices rise again from here? Well, they always have and are usually triggered by some structural change in our economy. Next might be the Baby Boomer’s wealth transfer of close to $6.2 trillion. A figure like that would be sure to stimulate more growth. For now, we will ride out this stabilising market, and it’s just a matter of time before the housing market moves comfortably forward.

AUCTION CLEARANCE RATES

- Queensland – 44% (179/1018)

- NSW – 65% (839/1463)

- Victoria – 64% (805/1015)

- ACT – 61% (80/86)

- South Australia – 75% (72/285)

- Tasmania – NA (1/124)

- Western Australia – NA (10/592)

- Northern Territory – 80% (5/20)

*(Auctions/Private Sales)

REVIEW(S) OF THE WEEK

Highly Recommend Leigh

I found Leigh to be easily approachable, professional, friendly, and genuine. Leigh kept us up to date the whole time with the sale of our house. He found the right buyer in a short amount of time which we were very grateful for. If your looking to sell contact Leigh, a very easy and friendly agent to do business with, highly recommended, Thankyou Leigh – Seller

Highly Recommend

Leigh was very approachable and professional in helping me purchase my property. Great communicator and very accommodating. I highly recommend Leigh for any real estate needs. – Buyer