Sunshine Coast Prices Down 7.1% – 2023 Forecast

Real Estate Market Update with Leigh Martinuzzi MPG

In CoreLogic’s recent regional market update, they’ve highlighted, that in the last quarter, property prices on the Sunshine Coast have declined by -7.1%. On the average sale price in Palmwoods of $900,000, we may see prices drop by roughly $64,000. In my experience, homes that have been priced with realistic expectations, i.e., based on recent comparable property sales over the last 12 months, buyer offers are coming in around 5% to 10% below these expectations. This is of course a very general observation, as every property differs. However, that is the current trend we are seeing as the market turns in the buyers’ favour. It is important to keep in mind that prices have risen more than 40 to 50% in most areas of the coast, including our Hinterland destinations.

Nationally, prices are reported down 6% since the peak back in March this year. On average across Australia, the median house price rose $320,000 during the covid period. Many houses in our local markets have risen by anywhere between $300,000 to $500,000 since the beginning of the pandemic in 2022. An adjustment of $60,000 may not be frowned upon. Now, looking ahead to 2023, the forecasts are very uncertain. Matusik has forecast a fall in median house prices over the year ending March 2023 of 8%. With further cash rate rises expected as the RBA continues to tackle rising inflation, we would expect buyer confidence and borrowing capacity to worsen, meaning property prices on the Sunshine Coast may lower further in the months ahead. Since the first cash rate rises back in May 2022, we’ve seen mortgage rates rise from around 3.5% to 6.2%. For an average home loan of $500,000, repayments have gone up already by $800 per month.

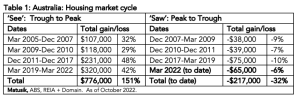

Now, let’s look at the history of price booms and subsequent falls (see chart below). While the headlines are claiming price falls of 20% and above, history tells a different story. Over the past two decades, most price booms over anything between 30% and 50% have been followed by a correction of about 5 to 10%. In the current stagnating market so far prices are only down by 6%. I would expect we will experience another 12 months of a stabilising market before prices do what they’ve always done and rise again.

On the local listing front, we’ve seen a surge in the number of homes for sale. Many owners choose the spring market to make their move. And while buyer sentiment is down, buyer numbers are still positive. In the past week, we have welcomed five written offers on properties we have for sale. Byers is still keen to put pen to paper for the right property. And while sellers must be a little more open to negotiation, we can usually find the happy middle. I expect buyer numbers to remain active over the Christmas period as many people are travelling, dreaming of a new move, or spending time planning for the year ahead.

AUCTION CLEARANCE RATES – WEEK ENDING 21ST OF AUGUST 2022

- Queensland – 36% (276/1135)

- NSW – 57% (1000/1543)

- Victoria – 55% (1022/1123)

- ACT – 50% (123/90)

- South Australia – 5% (137/333)

- Tasmania – NA (0/163)

- Western Australia – 21% (24/662)

- Northern Territory – 40% (5/35)

*(Auctions/Private Sales)

REVIEW(S) OF THE WEEK

Highly recommend

Leigh was very approachable and professional in helping me purchase my property. Great communicator and very accommodating. I highly recommend Leigh for any real estate needs. – Buyer