Rate Rise Slows Confidence but Sunshine Coast Prices Stay Strong

By Leigh Martinuzzi | Martinuzzi Property Group – eXp Australia

The first few weeks of 2026 have offered an interesting contrast between sentiment and reality. The Reserve Bank of Australia lifted the cash rate back to 3.85% in an effort to cool inflation, and while that has softened confidence, it has not softened prices. Across the country and here on the Sunshine Coast, strong migration, low supply and a resilient labour market continue to steady property values.

Let’s unpack the latest developments and how they are influencing the Sunshine Coast market.

National Insights: What Has Happened in the Last 7 to 14 Days

The RBA’s decision was driven by stubborn inflation. The price level has increased 20 to 25% over recent years and underlying inflation remains above target at 3.3%. Housing continues to contribute the most to inflation, with higher rents, insurance premiums, utilities and construction costs feeding into overall living costs.

Rental conditions remain extremely challenging across the country. Cotality reports:

- National rents are up 43.9% in five years

- Wage growth over the same period is only 17.5%

- Tenants now spend 33.4% of income on rent

- Vacancy rates remain critically low at 1.7%

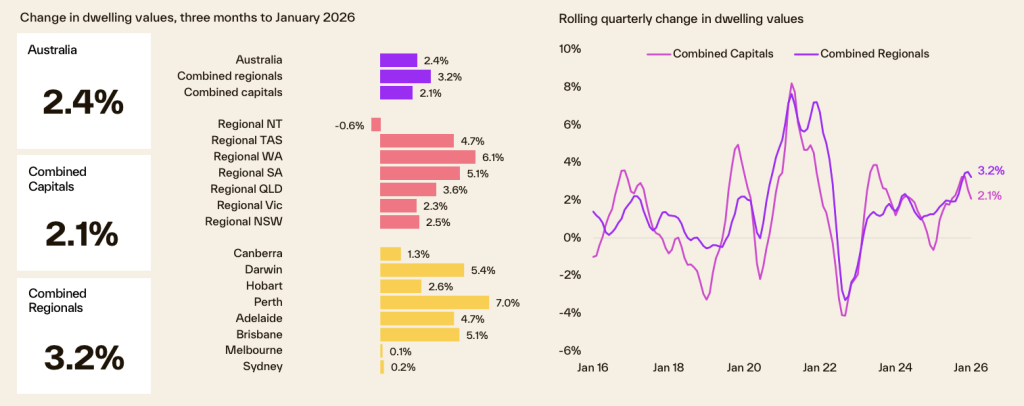

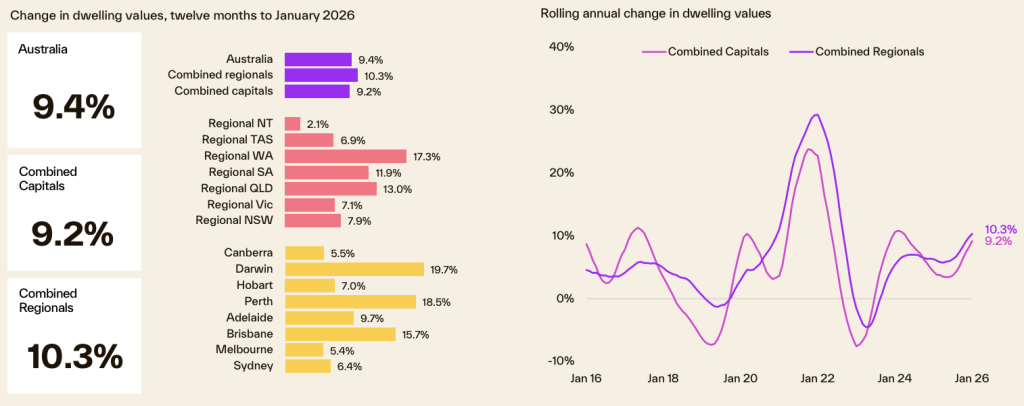

Home values have remained resilient. Over the past three months, dwelling values increased 2.4% nationally and are up 9.4% over the year. Regional markets continue to outperform capital cities, rising 10.3% annually. Homes are selling faster too, with a median 26 days on market and discounting levels near record lows. Investor activity also remains strong.

Investor lending now accounts for 41% of new borrowing, and total mortgage commitments hit 98 billion dollars last quarter. While borrowing power has reduced by around 18,000 dollars for a median household, buyers are adjusting rather than stepping out of the market.

Monthly Housing Chart Pack: February Overview

The February Cotality Monthly Housing Chart Pack provides detailed insights into quarterly and annual growth across Australia’s capital city and regional markets.

National Value Growth

- National dwelling values up 2.4% for the quarter

- Annual growth at 9.4%

- Combined regional markets up 10.3%

- Housing total return at 13.3%, outperforming equities at 7.4%

Quarterly and Annual Growth by Market

These visuals replace the need for written growth figures and clearly show the strength of markets like Brisbane, Perth, Darwin and Regional Queensland.

Regional Australia Performance

- Regional Queensland +13.0%

- Regional Western Australia +17.3%

- Regional South Australia +11.9%

- Regional NSW +7.9%

Sales Activity and Listings

- Sales volumes up 4.1%

- Median days on market at 29 days

- Inventory levels down 17.8% from last year

- New listings remain below average

Rental Market

- Rents increased 5.4% nationally over the past year

- Vacancy remains tight at 1.7%

- Gross rental yields at 3.56% as values rise faster than rents

These figures reinforce a clear message: strong demand and constrained supply continue to drive growth, particularly in lifestyle oriented regions like Southeast Queensland.

What the RBA Wants Australians To Do Next and Where We Go From Here

The RBA has emphasised that reducing inflation requires a shift in economic behaviour. Australians are being encouraged to moderate discretionary spending, increase savings and maintain realistic wage expectations. By easing demand in a measured way, the RBA aims to slow price growth while keeping employment strong.

In the coming months, confidence may soften and activity may slow slightly. However, with supply at record lows and population growth remaining strong, prices are expected to remain steady. Affordability pressures will likely push more buyers toward units and townhomes, while investors are set to remain active thanks to tight rental conditions and solid long term fundamentals.

Two themes stand out. Low supply will continue to support values, and buyers who remain active during this quieter phase are likely to secure advantageous outcomes. The broader expectation is for moderated, not negative, price movements as the market transitions into a more balanced pace.

Implications for Buyers, Sellers and Investors

The current environment presents different strategic opportunities for each group.

For buyers, the recent rate rise has created a temporary cooling in competition. With fewer bidders in the market, there is more flexibility to negotiate, explore broader options and secure properties with more favourable terms. Buyers who are well prepared and proactive will find themselves in a stronger position than they were late last year.

Sellers remain in a favourable position due to low stock and steady demand. Homes that are presented well and priced in line with recent comparable sales attract strong early interest. Market depth remains solid, particularly in lifestyle focused suburbs where interstate migration continues to drive enquiry. High quality marketing and preparation remain essential to achieving premium results.

Investors continue to benefit from some of the best rental conditions in years. Strong population growth, limited new supply and rising rents are creating an ideal long term landscape. Many investors are targeting established units and townhomes where affordability is stronger and rental demand is consistent. The Sunshine Coast remains a standout region due to its lifestyle appeal and long term undersupply.

In summary:

- Buyers have improved negotiating leverage

- Sellers can still achieve exceptional outcomes with strong preparation

- Investors continue to benefit from tight rental markets and long term demand

Sunshine Coast Market Observations in the Past 14 Days

The Sunshine Coast market has remained remarkably steady over the past fortnight. Open homes continue to attract strong attendance and enquiry remains robust across key suburbs such as Buderim, Mountain Creek, Mooloolaba and the coastal strip. Much of the demand continues to come from lifestyle motivated relocators, downsizers and investors chasing strong rental fundamentals.

Stock levels remain well below average for this time of year, contributing to ongoing competitiveness in high demand pockets. Vacancy rates in many suburbs remain below 1%, pushing rents higher and reinforcing investor interest. While some buyers have become more cautious following the rate rise, overall momentum remains resilient.

Several factors continue to underpin market strength:

- Persistent supply shortages limiting buyer choice

- Ongoing interstate migration

- Strong lifestyle appeal driving demand

- Tight rental conditions supporting investment returns

These elements collectively help stabilise local prices even as national sentiment fluctuates.

Local Updates and Council Initiatives

Key planning and infrastructure developments across the region continue to support future growth. These include:

- Increased housing density opportunities near future transport corridors

- Expansion of schooling and community facilities

- Ongoing upgrades to southern Sunshine Coast transport networks

These improvements reinforce the Sunshine Coast’s long term liveability and desirability.

Final Thoughts

While confidence has softened following the rate rise, the underlying fundamentals driving the Sunshine Coast property market remain unchanged. Low supply, strong population growth and tight rental conditions continue to support stable prices and ongoing demand. With the right preparation and guidance, buyers, sellers and investors can all find opportunity in today’s market.

If you would like support navigating the Sunshine Coast market whether buying, selling or planning ahead, feel free to reach out.

At Martinuzzi Property Group, our focus is on helping clients stay informed, understand their options, and move forward with confidence, whether that means acting now or planning carefully for the future.

Our brand promise underpins everything we do. Honest advice. Exceptional communication. A stress free sale driven by proactive service and results that exceed expectations.

Request Your Free Market Appraisal Today! 👉 Click here to book your appraisal

SUBSCRIBE to stay updated with all latest property insights and news 👉 Click Here to Subscribe

The Sunshine Coast Seller’s Guide to Choosing the Right Agent 👉 Get Your Free Guide Here

Preparing for Settlement: A Seller’s Guide to a Smooth Handover 👉 Download the Guide Here