Property Booms Are More Supersized Than Downturns!

Weekly Real Estate Market Update with Leigh Martinuzzi MPG

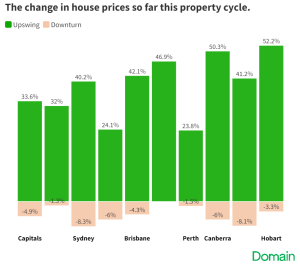

The boom that saw the median house price in Australia bound over $1M was sure to come to an end, and it did! Property prices in Australia came to a peak in March 2022, when prices simply became unaffordable and consequent interest rate rises meant borrowing capacity was reduced considerably. Capital city prices peaked as early as December 2021 with most peaking in March 2022 and Adelaide later, September 2022. With the median house price of $1,066 in Australia and Sydney house prices rising as much as $1100 per day, the market needed to find a correction. Historically, however, property booms have been much greater than subsequent downturns.

When each capital city market peaked

| Capital City | Price peak achieved |

| Sydney | Mar-22 |

| Melbourne | Dec-21 |

| Brisbane | Mar-22 |

| Adelaide | Sep-22 |

| Canberra | Dec-21 |

| Perth | Jun-22 |

| Hobart | Mar-22 |

| Darwin | Dec-13 |

Source: Domain House Price Report, Q3.

The Australian cash rate was at historic lows sitting at 0.1%. We hadn’t seen a rise in 12 years and then, low and behold, inflation gets out of hand and the RBA steps in, albeit a tad late. We see interest rates rise the fastest we’ve seen in decades. For the household servicing a loan of $750,000, with interest rates around 2% suddenly jumping to 5% we see repayments on a typical 30-year loan rise from $2772 per month to $4026 a month. This is sure to have an impact on spending within the average household, not to mention the rising costs of fuel, food and childcare, to name a few. And for those looking to purchase, property prices remain high and with each rate they see their borrowing capacity reduce. Borrowing power is 25% less than it was this time last year and prices haven’t backflipped that greatly.

Check out the chart below that highlights where property prices are now compared to the early 2020 trough. Nationally prices have fallen -4.9% since the peak in March, however, are still up approximately 27% since the start of the boom. In dollar amounts, this is a fall of $53,000 since the peak yet still up $218,000 since the pandemic trough. Chief of research and economics at Domain, Dr Powell, states that the average property cycle upswing spans 2.75 years, with an average 32.7% rise from peak to trough, while on average downturns last 0.75 years with an average fall of 3%. We can expect to see prices continue to correct early this year however I feel we’ve passed the worse of the cash rate rises and therefore can expect a slight rebound and a new property cycle beginning later this year.

| City | Now compared to pandemic trough | Price difference |

| Sydney | 29% | $326,101 |

| Melbourne | 17% | $147,163 |

| Canberra | 41% | $320,092 |

| Brisbane | 36% | $215,160 |

| Adelaide | 47% | $253,732 |

| Perth | 22% | $116,123 |

Is 2023 a good year to buy a property? Some would say, “absolutely not!” Their reasoning is the cash rate and future interest rate rises remain uncertain. Property investors would tell you that there is no “best” or “worst” time to buy property. With the right plan and financial strategy in place, 2023 might be an ideal time for many to buy. We expect to see many investors return to the property market this year seeking good opportunities. In 2022 we witnessed the fastest tightening of the cash rate in 30 years. We knew there would be a coming correction to the 2020/2021 boom market. Now we are nine months in from the peak prices of March 2022, we can expect to see consumer confidence return and property transactions begin to increase. The first six months of the year will be a slow burn with the second half of the year likely the start of a new cycle. Seek good financial advice and make 2023 your year to buy property.

AUCTION CLEARANCE RATES

- Queensland – 32% (148/997)

- NSW – 55% (84/1074)

- Victoria – 61% (76/833)

- ACT – 64% (14/65)

- South Australia – 60% (62/303)

- Tasmania – NA (0/158)

- Western Australia – NA (2/648)

- Northern Territory – 25% (4/20)

*(Auctions/Private Sales)

REVIEW(S) OF THE WEEK

Good Bloke

Lovely bloke and easy to deal with, really great at keeping you in the loop with what’s going on. – Seller