Markets Holding Firm — But Sunshine Coast Needs Clever Planning Now

By Leigh Martinuzzi | Martinuzzi Property Group – eXp Australia

Recently, property commentator Michael Matusik shared some thoughts on the value of creating more close‑knit, pedestrian‑friendly cities a concept that really resonated with me. It reminded me of my time in Barcelona and other Mediterranean cities earlier this year. In those places, most daily needs are within walking distance. Life feels more connected, vibrant, and community‑driven.

Here in Australia, we’ve grown up with the “great Aussie dream” a large block, privacy, and plenty of space. That still has its appeal, but I can’t help thinking it’s time we started weaving in more walkable, community‑oriented precincts into our planning here on the Sunshine Coast. Safety, green spaces, footpaths, and thoughtful infrastructure should be the cornerstones of our neighbourhood design. If we get this right, we can enjoy the best of both worlds a home that gives us space and privacy, and a community that’s easy to connect with on foot.

While these design ideas are for the future, our current property market is also telling an important story.

National Price Growth Still Positive, But Slowing

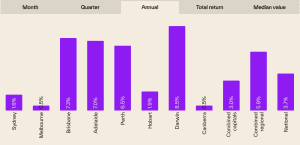

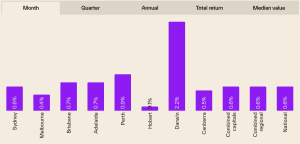

According to the latest data, national dwelling values rose by 0.6% in July, marking the sixth straight month of gains. That pushes the median Australian home value to around $844,000 up 3.7% over the past year.

The strongest monthly growth came from Darwin (+2.2%), Perth (+0.9%), and Brisbane and Adelaide (+0.7%). Hobart saw only minimal growth (+0.1%), while Melbourne trailed slightly (+0.4%).

When we zoom out to the annual change, the affordable markets continue to shine. Darwin has surged 8.5% over the past year, followed by Brisbane (+7.3%), Adelaide (+7.0%), and Perth (+6.5%). Higher‑priced Sydney is up a respectable 1.6%, while Melbourne and Canberra are both up only 0.5% over the same period.

This is a clear sign that affordability is playing a bigger role in where growth is occurring. Buyers are increasingly seeking value in lower‑priced capitals and regional areas, while high‑cost cities are seeing more subdued growth.

Why Supply Matters More Than Ever

Despite the ongoing price gains, the reality is that they’re being driven more by a shortage of available properties than by a surge in demand. If we were to suddenly see a wave of new listings whether from homeowners deciding to sell or new land releases the current growth could soften quickly.

In my opinion, if growth continues to slow, we’ll see more sellers rushing to market to lock in today’s prices before they start to turn. That, in turn, could push prices down. For now, however, demand still outweighs supply, keeping the market in relatively strong shape.

Auction Clearance Rates Stay Strong

Auction clearance rates remain an important indicator of market sentiment. At around 75% nationally, they are the highest they’ve been in more than a year. As Michael Yardney often points out, strong clearance rates generally point to ongoing price resilience. For now, that’s what the data is telling us.

Sunshine Coast: Two-Speed Market

Locally, we’re seeing a split. Lower‑priced, move‑in‑ready homes are attracting strong interest and quick sales, often with multiple buyers competing. In the prestige market, results are mixed some properties are selling quickly for premium prices, while others linger on the market, waiting for the right buyer.

Homes that are fully renovated and presented beautifully are achieving strong results. On the other hand, properties needing major renovations are proving harder to move at top dollar, with buyers factoring in the time and cost of improvements.

The lesson here is that the marketing and pricing strategy must be matched to the property and the current level of demand in its specific market segment.

Looking Ahead — The 18.6-Year Cycle

In past updates, I’ve touched on the 18.6-year property cycle a pattern identified by economists where the property market tends to move through a long-term rhythm of growth, slowdown, and recovery.

Historically, Australia’s cycles suggest that we may be in the latter stages of the current upswing, with a possible peak around 2026. If that pattern holds, we could see conditions start to soften after that point. Of course, cycles are influenced by many factors interest rates, supply, and broader economic conditions but it’s another reminder that while today’s market remains strong, change can come quickly.

Final Thoughts

The Australian property market remains resilient, but momentum is easing and affordability is beginning to bite. On the Sunshine Coast, strong demand continues but the market is segmented, and success depends on aligning presentation, pricing, and marketing to today’s buyer expectations.

At the same time, we have an opportunity to think bigger, about how our neighbourhoods are designed and how we can bring more walkable, connected, and vibrant communities to life here on the Coast.

If you’d like help navigating the market whether you’re buying, selling, or just planning ahead and feel free to reach out.

Request Your Free Market Appraisal Today!

Click here to book your appraisal

-

SUBSCRIBE to stay up to date with all the latest property insights and news.

-

The Sunshine Coast Seller’s Guide to Choosing the Right Agent

- Just Listed Your Home? Here’s What Happens Next (And How to Get Ready for a Great Result)