Understanding Land Tax in QLD: What Home Owners Need to Know

By Leigh Martinuzzi | Martinuzzi Property Group – eXp Australia

Whether you’re a homeowner, investor, or building a property portfolio on the Sunshine Coast, land tax is becoming increasingly important as property values continue to rise. Many Sunshine Coast owners who were once comfortably under the threshold are now finding themselves liable simply due to increased land valuations across suburbs like Palmwoods, Buderim, Woombye, Noosa, and Maroochydore, and more.

This guide breaks down exactly who pays land tax in Queensland, who is exempt, how it’s calculated, what recent reforms mean for you, and how different ownership scenarios play out for Sunshine Coast property owners.

Who Pays Land Tax in Queensland?

In Queensland, you may be required to pay land tax if the total taxable value of all land you own in the state (excluding exemptions) exceeds:

- $600,000 for individuals

- Or $350,000 for companies, trusts, and absentee owners

These thresholds apply to your combined landholdings across Queensland, which means land located anywhere in the state will be included.

Many Sunshine Coast owners find themselves crossing the threshold not because they’ve acquired new property, but because land values have surged. For example, a Palmview block that once valued at $250,000 may now sit above $400,000. Add a rental in Nambour or Maroochydore, and you may suddenly fall into land tax territory.

Who Is Exempt From Land Tax in Queensland?

Not all land is taxable. Exemptions reduce your land tax liability and stop certain land from being counted toward your total taxable value.

The most common exemptions include:

- Your principal place of residence

- Primary production land, common on Sunshine Coast acreage in Palmwoods, Woombye, Yandina, and the Glass House Mountains

- Land used for charitable, community, or aged care purposes

- Subdivider concessions for developers holding unsold lots

Your family home is typically exempt, but any investment property or vacant land will contribute to your taxable total unless another exemption applies. Remember: exemptions are not automatic so you must apply through the Queensland Revenue Office.

How Is Land Tax Calculated in Queensland?

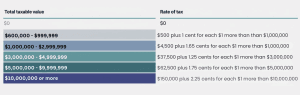

Land tax is based on the unimproved land value of all taxable land you own in Queensland as at midnight on 30 June each year. Once your total taxable value exceeds the relevant threshold, the Queensland Revenue Office applies a progressive tax scale.

Here is a visual guide showing how general land tax is calculated:

For a quick estimate tailored to your exact landholdings, you can also use the official Queensland Revenue Office Land Tax Calculator HERE.

When Do You Pay Land Tax in Queensland?

Land tax assessments are based on whatever land you own at midnight on 30 June each financial year. The Queensland Revenue Office issues notices shortly afterwards, and payment is due by the date specified on your assessment. If you sell a property close to 30 June, you may still be liable for that year’s land tax unless your contract contains specific adjustment clauses.

Recent Land Tax Reforms in Queensland

There have been few major structural changes in the past year, but some developments still matter for Sunshine Coast owners. A proposal to include interstate landholdings in Queensland land tax calculations was paused, but it’s something investors keep an eye on as the conversation continues in government circles.

The bigger issue affecting Sunshine Coast owners is the steady increase in land valuations. Suburbs like Palmwoods, Buderim, Maroochydore, Noosa, Woombye, and Caloundra have seen strong growth, which directly impacts your land tax liability even if nothing else has changed. Additionally, trust and company structures which have a lower threshold of $350,000 are receiving heightened scrutiny, catching many owners by surprise.

How Land Tax Impacts Sunshine Coast Property Owners

Here is how it plays out in practice:

- Single Property Owner – An owner with one investment property valued at $500,000. Because this amount is below the $600,000 threshold, no land tax applies.

- Two Properties Combined – An owner with two taxable properties worth $400,000 and $350,000. The combined value of $750,000 exceeds the threshold.

- Land tax payable is:

- $500 + 1 cent per $1 over $600,000

- $150,000 × $0.01 = $1,500

- Total land tax = $2,000

- Large Portfolio Owner – An owner holds several properties totalling $3 million in taxable land value. Since the value exceeds the threshold, the applicable bracket applies:

- $37,500 plus 1.25 cents for each $1 over $3 million

- Trust or Company Owner – With a lower threshold of $350,000, tax is triggered earlier. For example, if a trust holds two properties valued at a combined $750,000, land tax payable is $8,250, compared to $1,500 for an individual with the same holdings.

What’s Next For You?

If you own multiple properties or hold land via a trust or company, it’s especially important to review your land tax position each financial year and seek professional advice where needed.

When you’re ready to begin or grow your property portfolio in Queensland, make sure to connect with us. We specialize in assisting new investors and have access to property databases and valuation tools to help guide your investment decisions. We also have in-depth knowledge of the Queensland market and can organize for a skilled property manager to oversee the day-to-day management of your property. This takes the pressure off you as a landlord, allowing you to concentrate on expanding your portfolio.

Be sure to approach your investments with tax efficiency in mind by organizing all your documentation from the start. This includes knowing which expenses are deductible, staying on top of your tax responsibilities, and properly reporting all rental income in your annual return.

👉 Get in touch with us today and and let’s give you fantastic results that you deserve.

Request Your Free Market Appraisal Today!

Click here to book your appraisal

SUBSCRIBE to stay up to date with all the latest property insights and news.

Click Here to Subscribe

The Sunshine Coast Seller’s Guide to Choosing the Right Agent

Get Your Free Guide Here

Just Listed Your Home? Here’s What Happens Next (And How to Get Ready for a Great Result)

Download the Guide Here