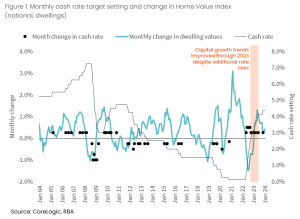

Interest Rates and House Values

Real Estate Market Update with Leigh Martinuzzi MPG

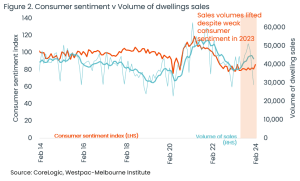

This week, I want to share two insightful charts. The first, provided by Westpac-Melbourne Institute, tracks consumer sentiment, reflecting how households perceive current economic conditions, personal finances, and demand for major household items. The second chart illustrates the relationship between interest rates and housing values.

Let’s start with the interest rate to house values chart. It’s fascinating to observe that despite multiple rate hikes by the RBA, the national price index fell by 7.5% (according to CoreLogic) after the initial rate rise. Traditionally, we’d expect prices to fall when interest rates rise and vice versa. However, last year, despite several more rate hikes, property prices began to climb and reached a new national record in November 2023. This unexpected trend can be attributed to the housing shortage we experienced and the record immigration and population growth during the same period.

On the consumer sentiment front, there’s a slight improvement noted at the start of 2024. This could be attributed to expectations of the RBA holding rates and potential future easing. According to CoreLogic, there are early signs of heating up again in the property market across Australia, particularly evident in the improved level of auction clearance rates experienced in Sydney over the last couple of weeks. If the RBA eases the cash rate back later this year, we might see a significant uplift in activity, given lower rates coupled with stock shortages and high population growth should only mean prices remain strong or rise further.

In other news, Quarter 4 inflation rates were reported at 4.1%, slightly below market expectations of 4.3%. While this shows moderation in most sectors, it remains above the RBA’s target range of 2 to 3%. Slowing inflation is reflected in other economic indicators, such as a slight increase in the unemployment rate, a dip in retail spending, and record-high consumer credit, signaling improved buyer confidence in the property market amidst certain global economic instabilities.

Finally, let’s talk about the growing gap between house and unit prices. A recent report by CoreLogic highlights the disparity in price growth, with detached dwellings experiencing significant increases since the pandemic compared to more modest gains in unit values. Since the pandemic until January this year, house prices increased by 33.9% or by $239,000, whereas unit values rose by 11.2% or $65,235. Partly, this divergence reflects a shift in preferences towards more spacious living arrangements away from inner-city apartments, driven by the pandemic-induced desire for more space and lifestyle benefits. However, it’s always been the Australian dream to own your own house and plot of land.