Inflation to Reach 7% = Further Interest Rate Hikes

Weekly Real Estate Market Update with Leigh Martinuzzi MPG

This week the RBA governor made a few comments about the rising inflation rate suggesting it will reach 7% by the end of the year, “perhaps the worst period of inflation we’ve ever seen”. Currently, inflation sits at 5.1%, and the RBA has stepped in ahead of plans to raise the cash rate to 0.85%. Only last year, they suggested that there wouldn’t be a cash rate rise until 2024, but no promises. It now looks clear that the cash rate will be lifted again in July by 50 basis points taking the cash rate to 1.35%. The RBA Governor Lowe said we can expect the cash rate to reach 2.5% at some stage, depending on how things play out.

There is a great deal of fear in the media currently with talks about the rising cost of goods, extreme inflation and of course, cash rate rises. As it relates to property owners and buyers, this is causing a great deal of anxiety and uncertainty. Having a short-term focus is important as it helps us make better decisions to deal with any unexpected changes that might occur in the not-so-distant future. Particularly important in a period of heightened uncertainty and volatility. However, as it relates to real estate, I think sometimes we need to look at the long-term picture.

Over the last 42 years, Australian property prices have grown on average by 7.98% per year. Since the start of the pandemic, property prices have risen by an average of 29% nationally. The property market is now hitting a period of stagnation, and in some areas decline. This is to be expected with inflation at a 21-year high and property prices reaching peak unaffordability. However, history teaches us that soon enough, prices rebound. In previous periods of significant rate hikes, anything from 165 basis points to 300 basis points, we’ve seen the market soon after rebound. In one or two years following the first-rate rise, prices were flat or slightly higher, and five years after, prices were on average 40% higher.

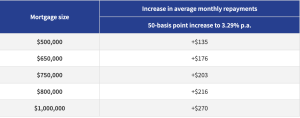

I expect this will mean for the next few years, post-boom, we will see a slowing and bottoming market before we see prices begin to rise again. What’s important right now for people who own property or looking to buy property is that they understand their worst-case scenario. Knowing what you can afford will prevent you from over capitalising. The banks already assess an individual’s borrowing capacity with a higher rate to help protect against future rising rates. Below is a chart of what a further increase in the cash rate will look like for mortgage rate repayments.

If you are seeking property advice or financial advice to help navigate this changing market, please get in touch. We’d love to help you!

AUCTION CLEARANCE RATES (PRELIMINARY). WEEK ENDING 19TH OF JUNE 2022

- Queensland – 50% (85/1292)

- NSW – 59% (389/1160)

- Victoria – 63% (675/1077)

- ACT – 62% (57/47)

- South Australia – 69% (71/323)

- Tasmania – N/A (0/141)

- Western Australia – N/A (1/700)

- Northern Territory – 75% (4/26)

*(Auctions/Private Sales)

REVIEW(S) OF THE WEEK

Best real estate agent on the Sunshine Coast !!!

“We have sold and purchased many houses over the last 10 years, and never had such a great experience with a real estate agent!!! Leigh is professional, has excellent communication skills and genuinely honest person to deal with!! His knowledge and passion for real estate shine through in his work – setting a new benchmark for other agents!! HIGHLY Recommended.” – Palmwoods Seller

Leigh has done it again!

“We had a great experience when we bought our Palmwoods home through Leigh in 2019 so there was no question that we would go back to him when we decided to sell. Leigh knows the Sunshine Coast real estate market and customer expectations better than anyone and gave us clear and honest advice on how to optimally present the house for sale. We followed Leigh’s advice to the letter and it has resulted in the best imaginable outcome with the house being sold to the first person through at a price that we were all extremely happy with. Thanks again to Leigh and his team for a fantastic result!”– Palmwodos Seller